Electricity markets in the EU

What are the electricity markets? How many are there? And how are they organised in Europe? Learn the basics and dig deeper with this article.

In this article, we give a brief overview of how electricity markets are organised in Europe. We do so by answering three questions. First, why do we have so many electricity markets? Second, what electricity markets are there, and how do they work? And third, what does the future hold?

If you would like to dig deeper, our FSR online training on the Evolution of Electricity Markets in Europe might be what you are looking for!

Why do we have so many electricity markets?

Electricity can be considered a commodity, just as copper, oil and grain are. However, electricity markets differ substantially from other commodity markets. This is due to the physical characteristics of electricity:

- Time: large volumes of electricity cannot be stored economically (yet). Therefore, electricity has a different value over time.

- Location: electricity flows cannot be controlled easily and efficiently, and transmission components must be operated under safe flow limits. If not, there is a risk of cascading failures and blackouts. Therefore, electricity has a different value over space.

- Flexibility: demand and generation must match each other at all times; otherwise, there is a risk of blackout. However, demand and the availability of renewable energy resources can vary sharply over time, while some power stations can only change output slowly and can take many hours to start up. Also, power stations can fail suddenly. Therefore, the ability to change the generation/consumption of electricity at short notice has a value.

These three unique physical characteristics explain why there is not just one electricity market. Electricity is not only energy in MWh; transmission capacity and flexibility are scarce resources and should be priced accordingly. Therefore, electricity (energy, transmission capacity, flexibility) is exchanged in several markets until the actual delivery in real-time. Please note that while in the EU electricity markets have been deregulated, other regulatory models can be in place in other parts of the world.

What electricity markets are there, and how do they work?

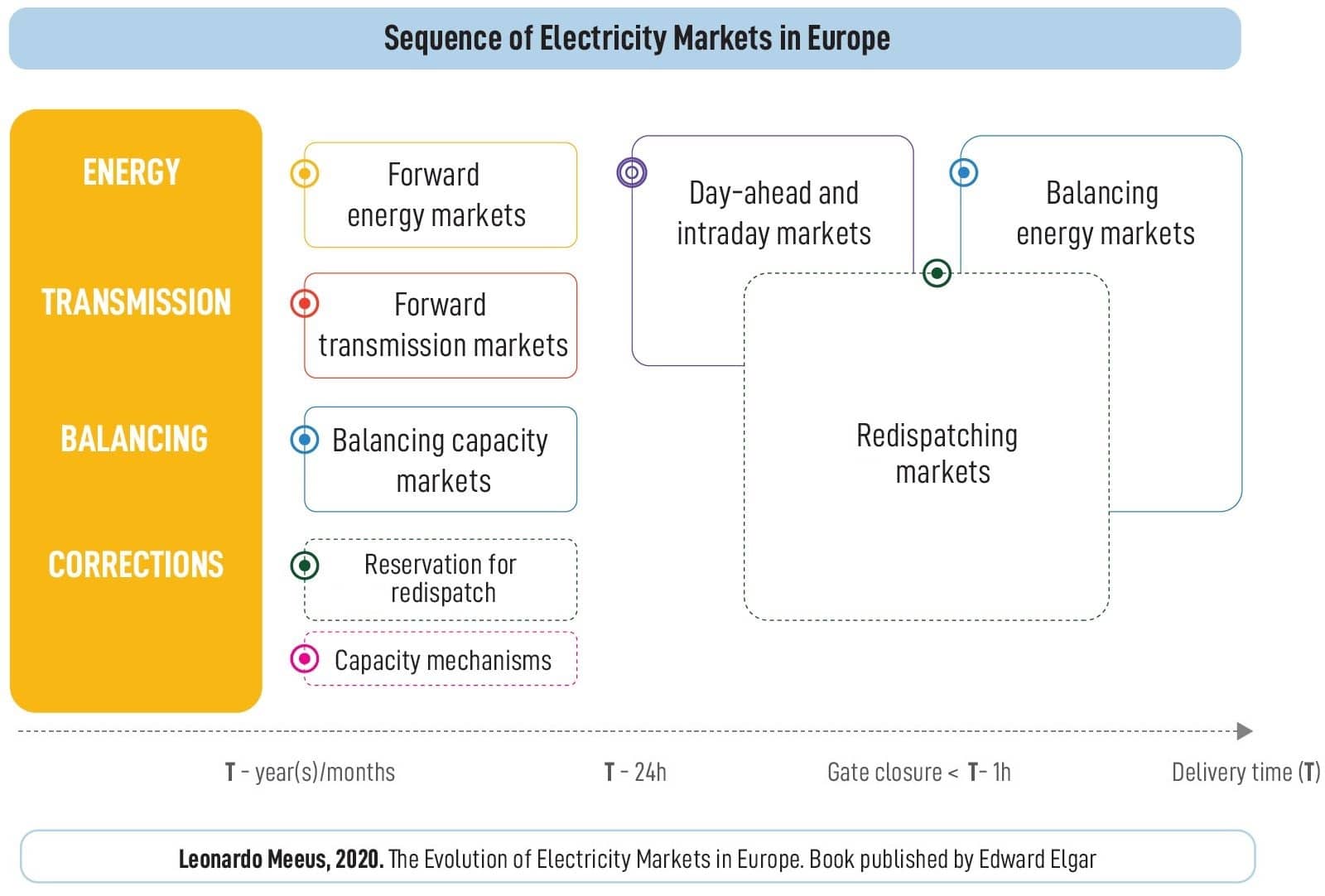

The figure below shows a schematic overview of the electricity markets that currently exist in the EU. We group the markets in four clusters and address these clusters one by one in the following subsections. Per cluster, we also state which European regulations, in the form of network codes and guidelines, govern these markets.

Long-term markets (forward energy markets, forward transmission markets and capacity mechanisms)

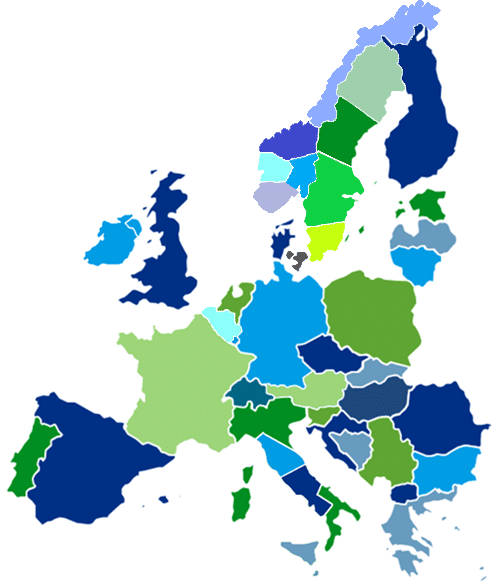

Forward energy markets start from more or less four years up to one month before delivery. A financial exchange organises trade using standardised products, or market parties can make bilateral over the counter (OTC) deals. The negotiated energy prices are denominated per bidding zone, which in most cases overlap with national borders. The market considers a bidding zone as a copper plate. The figure below shows the current bidding zone configuration in Europe. If a market party wants to hedge prices across bidding zones, long-term cross-zonal transmission rights need to be acquired separately on the Joint Allocation Office (JAO) platform. The platform is a joint service company of TSOs. The Forward Capacity Allocation Guideline (FCA GL) regulates the allocation and calculation rules for cross-zonal transmission rights.

Besides forward energy and forward transmission markets, in the longer-term timeframe, Member States can decide to set up a capacity mechanism if deemed needed for adequacy reasons. Capacity mechanisms exist in many forms and are often organised by the TSO. The capacity procurement takes place one to about four years before delivery.

Wholesale or spot markets (day-ahead and intraday markets)

There is no obligation for market parties to buy and sell their energy on the spot market. Spot markets are often used to adjust long-term positions closer to delivery. Importantly, although volumes traded in the wholesale markets are, in some cases, only a fraction of the final volume of generated electricity, the wholesale prices serve as the price reference in long-term contracts.

The day-ahead market consists of one pan-European auction at noon for the 24 hours of the next day. All accepted bids are paid the marginal offer. Trading is organised by one or several power exchanges (PXs) per Member State. At the time of writing, the Single Day Ahead Coupling (SDAC), allowing for efficient trade between all European bidding zones in the day-ahead timeframe, is almost finalised. After the day-ahead market is cleared, the intraday market opens. Currently, trading in the intraday market is done via continuous trading (as on a stock exchange) in some countries and via auctions in other countries. Recently, it has been decided that the future intraday European model will consist of a combination of continuous trading with three European-wide auctions at pre-defined times. The governance of PXs operating the day-ahead and intraday market, market coupling and cross-zonal intraday market design are described in the Capacity Allocation and Management Guideline (CACM GL).

Balancing markets (balancing capacity and balancing energy markets)

After trading in the intraday market closes, the balancing mechanism is in place to ensure that supply equals demand in real-time. Each TSO is responsible for the real-time balance in its control area. To do so, each TSO organises balancing markets where it procures the resources needed to balance the system. Balancing markets consist of balancing capacity markets and balancing energy markets. In balancing capacity markets, contracted Balancing Service Providers (BSPs) are paid an availability payment. Contracting is done one year ahead up to one day ahead of delivery in order to make sure that there will always be enough balancing energy available in real-time. The BSPs contracted in the balancing capacity market (as well as other BSPs without contracted balancing capacity) then offer their balancing energy in the balancing energy markets. The volume of activated energy depends on real-time imbalances. The balancing market design at the European level is prescribed in the Electricity Balancing Guideline (EB GL).

Transmission re-dispatch “markets” (Reservation for re-dispatch and re-dispatching markets)

Redispatch is needed when the market outcome (in this case the day-ahead or intraday market) results in generation and consumption schedules that would lead to a potential violation of operational limits (e.g. thermal limits, voltage ranges, etc.) of a certain network element within a bidding zone. Such a situation occurs regularly, as typically transmission network elements within a bidding zone are not considered when trading in wholesale markets. Only the physical limits of network elements between bidding zones are considered (so-called zonal pricing) [1]. Typically, re-dispatch involves increasing or decreasing the output of a generator at the ends of a potentially congested line. The Clean Energy Package prescribes to organise re-dispatching by default in a market-based manner (Electricity Regulation, Art. 13). Currently, in most EU Member States generators are still legally obliged to participate in re-dispatch, and prices are regulated, i.e. the audited costs (in case of upward activation) or foregone opportunity costs from the wholesale market (in case of downward activation) are paid to the owner of the re-dispatched resources. Some Member States have merged the balancing energy and re-dispatching markets.

What does the future hold?

Europe started the process of harmonising and integrating national electricity markets with the first Electricity Directive in 1996. Since then, we have seen a lot of progress. For example, ACER and CEER’s latest market monitoring report states that market coupling has so far rendered a benefit of approximately 1 billion euros per year to European consumers. However, we are facing important challenges, of which we briefly describe one at high-voltage levels and one at low-voltage levels in the following.

At high-voltage levels, the current bidding zone configuration is under pressure. Grid expansion could not keep up with the impressive capacities of renewables installed, and consequently, among other problems, redispatch costs are high and still rising. How to reconfigure the bidding zones is a hot debate. At low-voltage levels, distribution networks would need to be expanded in order to deal with the increasing installation of PV panels by consumers, electrification of transport (electric vehicles) and heating (heat pumps). Electrification is expected to accelerate even more, driven by the ambitions set out in the European Green Deal. Flexibility markets can be used to limit costly grid expansions at low-voltage levels. How these new flexibility markets will be integrated into the existing sequence of markets remains an open issue.

Notes

If you still have questions or doubt about the topic, do not hesitate to contact one of our academic experts:

Valerie Reif, Tim Schittekatte.

Relevant links

Online courses and training:

- Evolution of Electricity Markets in Europe

- FSR Annual Training on the Regulation of Electricity Utilities

- Executive course: Electricity Markets

- The EU Green Deal

Publications:

- New book: Meeus (2020), The Evolution of Electricity Markets in Europe

- Technical report: The EU electricity network codes (2020 ed.)

Webinars:

If you would like to dig in even deeper, our FSR online training on the Evolution of Electricity Markets in Europe might be what you are looking for!

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights