The role of market design in the (non-)choice of the technology for Energy Storage Systems

FSR Topic of the Month

REGULATION IN TIMES OF INNOVATION: REGULATING THE UNKNOWN

by Miguel Vazquez (Head of FSR Energy Innovation Area)

Some years ago, I was discussing gas market design at the FSR, where Michelle Hallack and I were involved in the discussions around the development of the Network Codes. The core idea of our analysis was relatively simple: most decisions concerning market design have to do with the allocation of flexibility. One of our favourite applications was the decision on line-pack services: on the one hand, line-pack provided time flexibility, i.e. arbitrage between different periods (for example, store gas now to consume in the future); on the other hand, it provided spatial flexibility i.e. arbitrage between different locations (for example, the entry-exit system allows players to buy in A and sell in B without extra cost).

Recently our discussion on time and spatial flexibility has reappeared within the electricity sector: Energy Storage Systems (EES) imply essentially the same situation. Analogous to our previous discussion, there are two relevant “arenas” for EES services:

- TIME flexibility: Buy and sell energy in different periods (including energy related to ancillary services)

- Spatial flexibility: Avoid the need to transport energy from one point to another, i.e. the need to use transmission and/or distribution networks

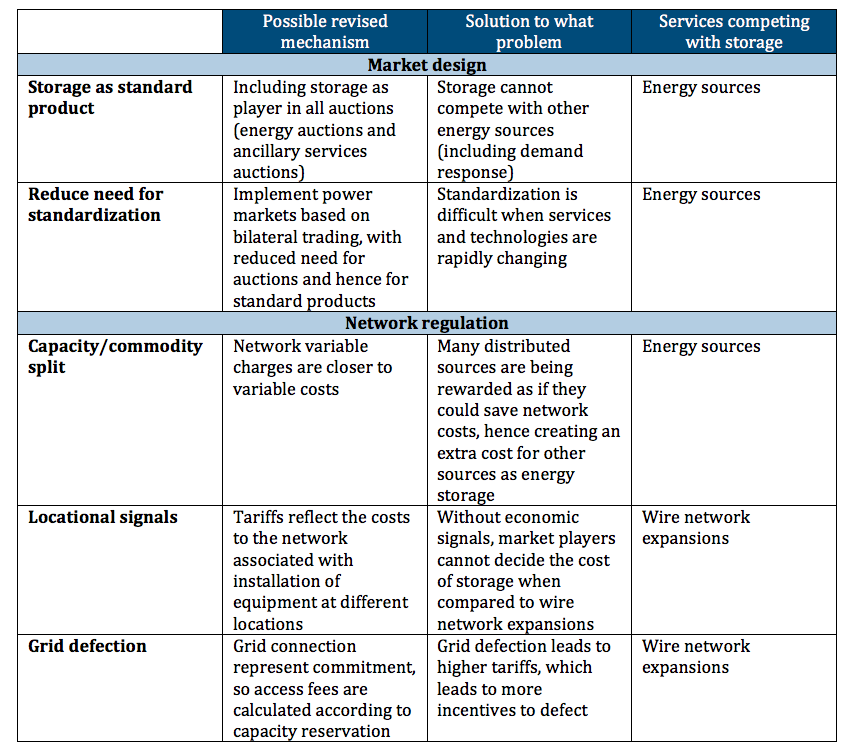

Consequently, this involves two kinds of regulatory challenges, because storage competes with different types of services: the services provided by the Market design (buying and selling energy) and services provided by network regulation (how network constraints are considered). Why is this important from a technological perspective? Not all EES offer the same kind of service. Consider Li-Ion Batteries and Fuel Cells, only the former can provide grid services in a consistent manner; but only the latter may offer significant seasonal storage, which is important for behind-the-meter applications. Consequently, systems favouring the remuneration of grid services may hamper innovation in Fuel Cells, and thus facilitating lock-in to Li-Ion technologies.

So what are the consequences of considering time and spatial flexibility as the elementary variables to consider?

Wholesale market design

Flexibility services can be sold in “competitive” wholesale markets (energy, ancillary services, etc.); hence, markets rules should allow storage services to compete in a non-discriminatory manner with other services (e.g. utility-scale storage vs. CCGTs).

As in gas markets, flexibility can be used to increase the homogeneity of the product traded (commoditization), which increases liquidity. The tendency observed in the early 2000s in the EU (the trend to switch from centralized to bilateral trading) was challenged by the combination of increased penetration of intermittent renewable generation and lack of significant storage capabilities. This motivated a more centralized trading system (e.g. market coupling) and more locational pricing (e.g. more than one price zone). Most of US markets rely on significantly centralized trading systems. This choice may be challenged, as one of its main motivations (lack of storage) may change with energy storage systems. That is, what would be the market design with more flexibility coming from storage (but also demand response)? In a situation where markets do not need to be so “instantaneous”, and hence closer to other commodities (e.g. gas), the choice between centralized vs bilateral trading become less straightforward.

Regulation of energy networks

Storage services may avoid the use of “regulated” networks; consequently, network rules should allow them to compete “fairly”. We may identify three dimensions for the challenge: I) Capacity /commodity split; II) Revision of long-term locational signals; III) Need to introduce commitments for network access.

Grid tariffs are hop-on-hop-off tariffs, based on the assumption that “users had nowhere else to go” (infinite commitments). This assumption is being challenged by the increasing potential to leave the market. Dismantling or mothballing of CCGT and self-consumption (solar, biomass) are becoming pressing issues. Energy storage systems play a major role in this regard.

- Ideally, connecting to the grid should imply a commitment to pay for many of the network costs caused. Let us consider, just as an example, a typical scheme for a private regasification facility. In it, the access fee is charged on contracted capacity, which in turn implies a commitment for a fixed period of time, e.g. 10 years. How would this contract be managed? If the demand for gas transmission is stable, then reselling in the secondary market would be feasible with no loss. If the demand for gas transmission is reduced, then players should not leave without paying the network costs incurred for them.

- Hence, the previous logic means that power markets, including retail markets, may need to charge access according to reserved capacity. From this point of view, the starting point of a tariff definition based on capacity reservation would be the definition of the network services that would be offered through contracts: different tariffs imply different services. Consequently, contracts to define different preferences for capacity reservation would need to be implemented. Those contracts would have specifications on at least: I) Location in the grid; II) Use of the system (flexibility); III) Contract duration.

Summary in the table below:

The mechanisms for arbitrage between different points in space and time is central to the definition of any market. A new layer of complexity is added when we include new technologies. Simplifications that were not relevant may become central to the market design. Moreover, those simplifications may impact the development of the technology itself. They might even create technological lock-in.

Interested in Energy Innovation?

-

Don’t miss our Webinar on 26 September 2018 | 2-3- pm CEST online:

Knowledge networks and technological frontiers: where are we, and where are we going, in bioenergy? with Jose Maria Silveira (Unicamp) and Miguel Vazquez (FSR Energy Innovation Area)

Register here

-

Check out this opportunity: Energy Innovation Academy (Call for papers and workshops in Florence)