The Mediterranean as a leader in the clean hydrogen economy: production, transmission, end-use

This is the second instalment of the Topic of the Month: Inclusive or exclusive? Green hydrogen in the international sphere

The Russian invasion of Ukraine in February of this year changed the context of energy policy in Europe and the neighbourhood regions irreversibly, with massive implications for the Mediterranean.

The escalating reduction in flows of energy products from Russia to Europe, beginning even before the invasion, pushed prices to unprecedented highs, up to 15x higher than pre-war levels[1]. Key pieces of strategic infrastructure have also become flash points of geopolitical leverage, including explosions on the Nordstream gas pipelines in September[2], as well as the control and manipulation of strategic storage[3]. Amongst other partners, the EU has turned to the wider Mediterranean region for additional energy supplies to compensate for diminished Russian deliveries[4].

Moving forward, the EU has committed to eliminating Russian fossil fuel imports[5] as well as to reaching net-zero emissions[6]. Clean gases are going to be essential for achieving these two objectives as they are versatile energy vectors, and they can be produced virtually anywhere. The Mediterranean is perfectly positioned to emerge as a leading region in this new energy economy, not only for production, but also as a transit region, and even an end user.

In this short article, I will touch on some aspects that make the region a strong candidate for prominence in this area and point to a handful of potential preconditions required for success.

What is renewable hydrogen and why do we need it?

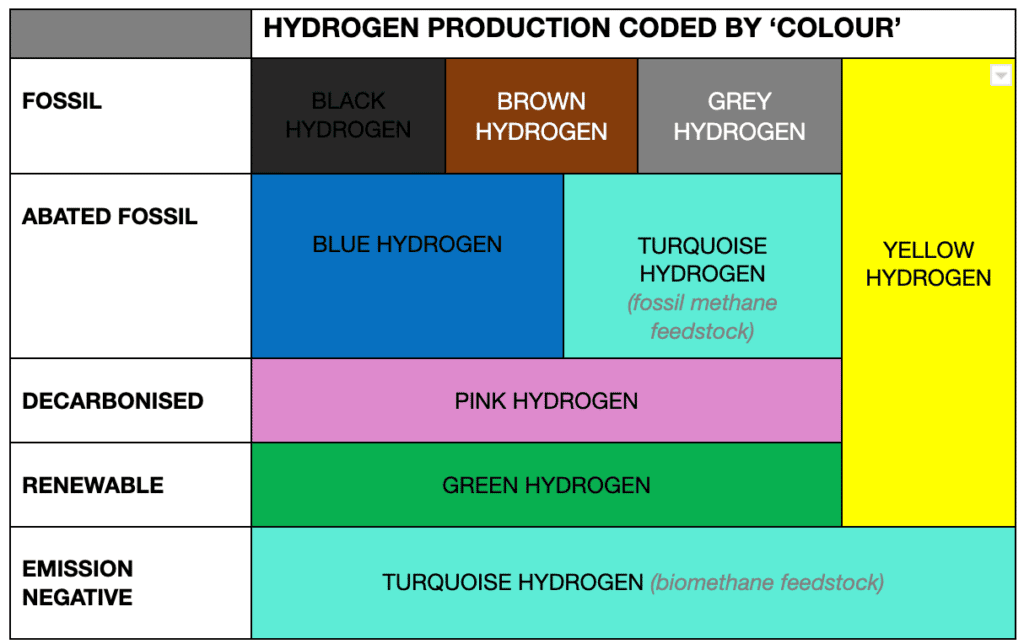

As gaseous hydrogen cannot be directly extracted, we must liberate it from other products such as methane, water, coal, or biomass. Currently, virtually all hydrogen production is of fossil origin, resulting in ~900 million tonnes of CO2 emissions per year[7]. Eliminating these emissions through clean production is key to decarbonisation of current hydrogen use, but also for widening its application into new areas, such as transportation[8]. Outlined below is a taxonomy of hydrogen production methods, ranging from the most polluting (black) to renewable (green) and even emission negative (turquoise) hydrogen.

- Black – produced by gasification of ‘black’ coal.

- Brown – produced by gasification of ‘brown’ coal.

- Grey – produced by thermochemical conversion of fossil gas, either Auto-thermal Reforming (ATR) or Steam Methane Reforming (SMR).

- Blue – produced by ATR or SMR of fossil gas, with the addition of carbon capture utilisation and storage (CCUS).

- Turquoise – produced by pyrolysis of methane (fossil or bio) driven by (renewable) electricity.

- Pink – produced by electrolysis of water, utilising electricity of nuclear origin.

- Green – produced via electrolysis of water, driven by renewable electricity.

- Yellow – produced by electrolysis of water, utilising grid electricity.

The Mediterranean in focus: Production

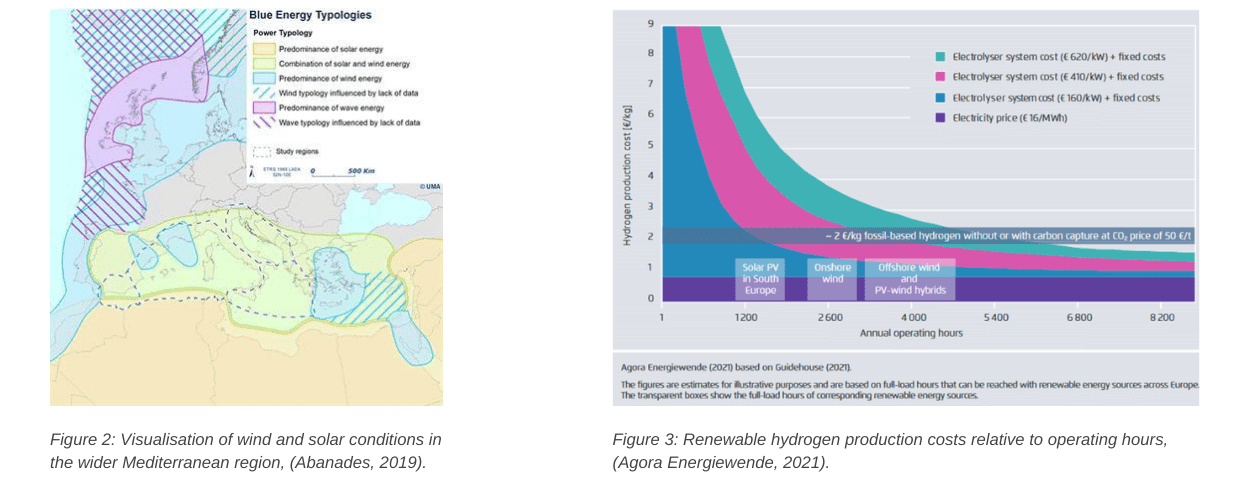

The Mediterranean should focus on renewable hydrogen production for the following three key reasons. Firstly, the physical conditions are perfect. Solar exposure is exceptional in the wider Mediterranean region, not only in terms of strength, but also daylight hours over the course of the year, whilst offshore wind speeds are consistent and relatively high. Renewable hydrogen is most cost-effective when there is a combination of strong solar and wind conditions to keep the operating hours of the electrolyser high (see Figure 3 below).[9] The Mediterranean has a competitive advantage here.

Secondly, the market is increasingly demanding renewable hydrogen specifically. This is because fossil hydrogen is becoming economically uncompetitive in Europe and the neighbouring regions due to high fossil fuel costs and increasing carbon prices in importing regions[10]. Furthermore, new applications of hydrogen[11] are primarily motivated by decarbonisation ambitions and mandatory offtake requirements[12].

Thirdly, as a clean energy vector, renewable hydrogen offers the opportunity to support the buildout of new low emission industrial value chains[13]. This is a more diverse and fruitful economic proposition relative to pure energy commodity exports which engender exposure to volatile international market prices. This could be a crucial aspect in recovering economies looking to rebuild and diversify following economic and social challenges, for example in Lebanon[14], as well as for fossil fuel exporters looking to future-proof their economies, such as Algeria, Libya, or Tunisia[15].

The Mediterranean in focus: Investing in clean infrastructure

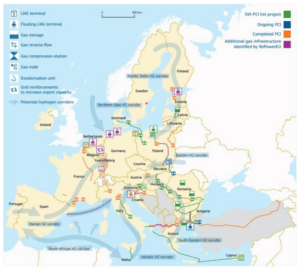

As per the EU’s ‘External Engagement Strategy’ and ‘REPpowerEU’ Plan, the EU intends to import 10’s of millions of tonnes of renewable hydrogen into the bloc over the coming years, both by ship and by pipeline[16]. Not only can the Mediterranean directly contribute to the production of these molecules, but it is also an ideal transit region for molecules coming from further afield.

Firstly, a considerable amount of imported hydrogen is likely to come from Sub Saharan Africa and the Middle East via pipeline, where companies are already signing agreements with local governments and the EU is channeling up to €300 billion funding via the ‘Global Gateway’.[17] The map below from the REPowerEU Communication shows that the Mediterranean region is home to the majority of transmission ‘corridors’ for renewable hydrogen to the EU.[18]

Much of these deliveries could utilise existing transmission connections, reducing both the cost and emissions of the infrastructural investment required to decarbonise the sector. See the map below for an illustration of pipeline connections, including key links between Tunisia, Italy, Morocco, Algeria, and Spain, as well as Israel, Turkey, Cyprus, Greece, and Albania.

The Mediterranean is also a major import destination for liquid molecules, home to 9 of the 21 LNG[19] import terminals currently in operation in the EU and its’ neighbourhood[20]. This makes particularly the Iberian Peninsula but also Greece and Italy could be highly attractive for the import of clean molecules from the rest of the world moving forward[21].

Import and transmission of molecules can generate revenue for the region through tariffs, helping to amortise existing fossil assets and in turn accelerate the phase out of fossil fuels, as well as build the foundations for environmentally and economically sustainable sectors moving forward.

The following section will offer some policy recommendations to help take advantage of these conditions.

Policy recommendations

1. Allocate public funds for derisking investment

One of the key challenges for renewable energy projects in general, but particularly for renewable hydrogen, is high upfront CAPEX[22] cost. Once installations are in place there are virtually no OPEX[23] but overcoming the initial funding barrier can be challenging. This is exacerbated with hydrogen because there is an extra technical step to transform the energy from electrons into molecules. Moreover, whilst the offtake market for renewable hydrogen remains nascent and fragmented, returns are unpredictable.

However, countries can buffer this risk by operating as a guarantor, for example using the ‘H2 Global’[24] model developed in Germany. H2 Global works as an intermediary by agreeing long-term contracts with producers (supply side) and then auctioning short-term sales contracts (demand side). Any gap in cost between the purchase cost and the supply price is covered by grant funding from the German government agency BMWK[25]. This functions somewhat like a CCfD[26], de-risking both the supply and demand side as well as removing some of the regulatory uncertainty and encouraging CAPEX investment in the process.[27] There is also fairly low exposure from the public finance perspective, as funds are only required when there is a discrepancy.

2. Establish shared priorities for the region to push through midstream, infrastructural bottlenecks

As illustrated in the analysis, there are huge opportunities to leverage existing infrastructure in the region to support climate change mitigation through participation in the renewable hydrogen economy. Whilst transmission infrastructure assets are extensive, there are key friction points that limit wider development, for example interconnection capacity between the Iberian Peninsula and France has historically been a major challenge in what could otherwise be an effective corridor from south to central and northern Europe.

Combined pressure from the European Commission, Portugal, Spain and even Germany, looks to have eventually been enough to get a project agreed, in the shape of the new ‘BarMar’28 interconnection29 which is set to come online by 2030. Although the infrastructure is physically between Spain and France, it is in the common concern of much of the western Mediterranean region and beyond. There are similar potential choke points on the horizon in different locations around the Mediterranean, for example between Greece and Turkey carrying molecules from the Middle East or agreements between industrial clusters in the south of Italy and solar farms in North Africa.

Finding a forum to agree on common objectives and strategies for the wider Mediterranean region could go a long way to amplifying prosperity and competitive advantage for all parties concerned. Moreover, the region is well positioned to benefit from EU funds for clean energy infrastructure projects, for example the CEF30 and IPCEI’s31, just as BarMar has32.

3. Take advantage of ‘technological leapfrogging’

It is important to keep in mind the diversity of the wider Mediterranean region, as the environmental, social, infrastructural, and economic conditions vary enormously from east to west and north to south. Whilst the opportunities in north Africa and southern Europe might be to leverage generation and interconnection capacity to export molecules, there is an opportunity for ‘technological leapfrogging’ energy systems in some parts of the eastern Mediterranean. This means to say, in areas where access to electricity is very low33 and energy is insecure34, or where infrastructure requires repair or regeneration, jumping immediately to renewables rather than transitioning through fossil fuels will avoid enormous amounts of emission lock-in and help guarantee, secure, affordable, and clean energy. This approach to development has wider benefits to the entire region, and that should be acknowledged and supported financially and politically.

Notes

[1] Mandruzzato, (2022). Are EU natural gas prices sensible?, EFG, Retrieved from https://www.efginternational.com/insights/2022/are-eu-natural-gas-prices-sensible.html

[2] Connoly, (2022). Size of Nord Stream blasts equal to large amount of explosive, UN told, Retrieved from https://www.theguardian.com/business/2022/sep/30/nord-stream-blasts-size-equal-to-large-amount-of-explosive-un-told

[3] Sheppard, et al., (2021). Gazprom’s low gas storage levels fuel questions over Russia’s supply to Europe, Financial Times, Retrieved from https://www.ft.com/content/576a96f7-e41d-4068-a61b-f74f2b2d3b81

[4] European Commission, (2022). Diversification of gas supply sources and routes, Retrieved from https://energy.ec.europa.eu/topics/energy-security/diversification-gas-supply-sources-and-routes_en

[5] European Commission, (2022). REPowerEU: A plan to rapidly reduce dependence on Russian fossil fuels and fast forward the green transition, Retrieved from https://ec.europa.eu/commission/presscorner/detail/en/IP_22_3131

[6] European Commission, (2022). A European Green Deal, https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en

[7] International Energy Agency, (2022). Tracking reports: Hydrogen, https://www.iea.org/reports/hydrogen

[8] Hydrogen is a versatile energy vector, which is to say that it is an effective means of transferring energy in space and time. As a result, it can be used as a feedstock to produce other products, directly combusted for heat energy, or converted into electricity. This flexibility makes it useful for a variety of applications, helping us to solve complicated decarbonisation problems that can’t always be resolved directly with renewable electricity or biogenic products. IRENA forecast that hydrogen will constitute 12% of final energy demand by 2050, up from ~2% today.

[9] Furthermore, there is significant availability of viable land in parts of north Africa and beyond that could accommodate the facilities required for large scale renewable hydrogen production.

[10] Collins, (2021). ‘Green hydrogen now cheaper to produce than grey H2 across Europe due to high fossil gas prices’, Recharge News, https://www.rechargenews.com/energy-transition/green-hydrogen-now-cheaper-to-produce-than-grey-h2-across-europe-due-to-high-fossil-gas-prices/2-1-1098104

[11] E.g. steel, transportation, cement, seasonal power storage, etc.

[12] Kneebone, (2021). Fit for 55: EU rolls out largest ever legislative package in pursuit of climate goals, Florence School of Regulation, Retrieved from https://fsr.eui.eu/fit-for-55-eu-rolls-out-largest-ever-legislative-package-in-pursuit-of-climate-goals/

[13] Kneebone, Piebalgs, (2022). Redrawing the EU’s energy relations: Getting it right with African renewable hydrogen, Florence School of Regulation, Retrieved from https://cadmus.eui.eu/bitstream/handle/1814/74890/PB_2022_50.pdf?sequence=1&isAllowed=y

[14] Cuyler, (2022). Competing Visions for Rebuilding Lebanon’s Collapsing Energy Sector, Middle East Research and Information Project, Retrieved from https://merip.org/2022/06/competing-visions-for-rebuilding-lebanons-collapsing-energy-sector/

[15] Selmi, (2022). The challenges of the energy transition in fossil-fuel-exporting countries: The case of Algeria, Retrieved from https://longreads.tni.org/the-case-of-algeria

[16] Conti, Kneebone, (2022). A first look at REPowerEU: The European Commission’s plan for energy independence from Russia, Florence School of Regulation, Retrieved from https://fsr.eui.eu/first-look-at-repowereu-eu-commission-plan-for-energy-independence-from-russia/

[17] Kneebone, Piebalgs, (2022). Redrawing the EU’s energy relations: Getting it right with African renewable hydrogen, Florence School of Regulation, Retrieved from https://cadmus.eui.eu/bitstream/handle/1814/74890/PB_2022_50.pdf?sequence=1&isAllowed=y

[18] Namely the Iberian, North African, Adriatic, and South-Eastern corridors.

[19] Liquified Natural Gas (LNG)

[20] ENTSOG, (2021). The European Natural Gas Network, Retrieved from https://www.entsog.eu/sites/default/files/2021-11/ENTSOG_CAP_2021_A0_1189x841_FULL_066_FLAT.pdf

[21] International Renewable Energy Agency, (2022). Geopolitics of the Energy Transformation: The Hydrogen Factor, Retrieved from: https://www.irena.org/publications/2022/Jan/Geopolitics-of-the-Energy-Transformation-Hydrogen

[22] Capital expenditure.

[23] Operating expenses.

[24] H2 Global, Home, Retrieved from https://www.h2-global.de/

[25] The Federal Ministry for Economic Affairs and Climate Action.

[26] Carbon contract for difference.

[27] H2 Global, Mechanism, Retrieved from https://www.h2-global.de/project/h2g-mechanism

[28] H2Med, (2022). Europe’s first major hydrogen corridor, Retrieved from: https://www.lamoncloa.gob.es/presidente/actividades/Documents/2022/091222-H2MED.pdf

[29] Sánchez Molina, (2022). EU’s first hydrogen pipeline to connect Portugal, Spain, France, Retrieved from https://www.pv-magazine.com/2022/12/12/eus-first-hydrogen-pipeline-to-connect-portugal-spain-france/

[30] Connecting Europe Facility (CEF).

[31] International Projects of Common European Interest (IPCEI).

[32] H2Med, (2022). Europe’s first major hydrogen corridor, Retrieved from: https://www.lamoncloa.gob.es/presidente/actividades/Documents/2022/091222-H2MED.pdf

[33] World Bank, (2020). Access to electricity (% of population) – Syrian Arab Republic, Retrieved from https://data.worldbank.org/indicator/EG.ELC.ACCS.ZS?locations=SY

[34] Haytayan, (2022). The Politics Behind Lebanon’s Collapsed Energy Sector, ISPI, Retrieved from https://www.ispionline.it/en/pubblicazione/politics-behind-lebanons-collapsed-energy-sector-34962