Has COP27 accelerated the development of Green Hydrogen in Africa?

This is the first instalment of the Topic of the Month: Inclusive or exclusive? Green hydrogen in the international sphere

In the first instalment of the Topic of the Month: Inclusive or exclusive? Green hydrogen in the international sphere, we look at the solutions proposed at COP27 to accelerate development in Africa and the role of renewable (green) hydrogen in this process.

The energy dilemma

As a continent, Africa contributes the least to global warming, responsible for less than 3% of the world’s energy-related carbon dioxide (CO2) emissions to date, as well as having the lowest emissions per capita of any continent (IEA, 2022). However, Africa arguably suffers some of the worst impacts of climate change, including increased frequency of extreme weather events such as drought, delayed rainy seasons, or flooding due to excessive rains. These conditions contribute to a range of social and economic problems, including food insecurity and hampered economic growth.

Despite Africa’s large coal, oil, and gas reserves, some parts of the continent still struggle with very low rates of electricity access and often very high energy prices relative to other parts of the world. Although Africa is equally rich in renewable energy sources, it lacks some of the requisite capabilities and technologies to transition from fossil sources of energy to renewable energy. Many African countries are facing a dilemma; (i) use their cheap and readily available fossil assets to address urgent energy needs, contributing to global warming in the process or (ii) take the potentially slower path to ramp up renewables, with the risk of neglecting the most pressing local energy needs in the short term.

For context, the IEA WEO for 2022 outlines that renewables are the cheapest form of installed electricity capacity virtually everywhere in Africa. However, investments in the infrastructure for renewables involve high capital expenditure, relative to fossil projects. Moreover, according to IRENA’s findings, out of the USD 2.8 trillion global investments in renewable energy in the last two decades, only 2% were made in Africa, with significant regional disparities.[1] Although fossil fuel assets also involve high capital expenditure, the infrastructure is often already installed and in operation. Therefore, the challenge faced by many African countries with fossil fuel assets is whether it makes economic sense to abandon them entirely for investments in renewables.

This is an uncomfortable situation for African political and business leaders, especially in an era when Africa seeks to embark on heavy industrialisation and development. Nevertheless, they need to find creative ways of addressing the energy dilemma. Could the many green hydrogen deals signed at COP 27 be part of the solution?

The role of renewable (green) hydrogen

Worldwide, green hydrogen, hereafter referred to as GH2, is becoming a more attractive option in the transition to a cleaner energy system. Some refer to it as the oil of the future because of its critical role in the energy transition. There is currently unprecedented political momentum surrounding hydrogen. The European Union (EU) recently announced they are targeting 20 million tons of green hydrogen consumption annually by 2030, they have launched the European Hydrogen Bank with at least €3bn seed funding to help get there. In a similar move, the US has introduced the Inflation Reduction Act, which offers a 10-year production tax credit (up to 3 USD/Kg) for “clean hydrogen” production facilities.[2]

GH2 is an energy vector and an industrial feedstock. This means it can be the basis for complex and robust economic value chains, with the potential for processing into finished products such as renewable fertilisers and chemicals. Moreover, it can decarbonise highly polluting and hard-to-abate sectors, such as for producing building materials – including cement, steel, and glass.

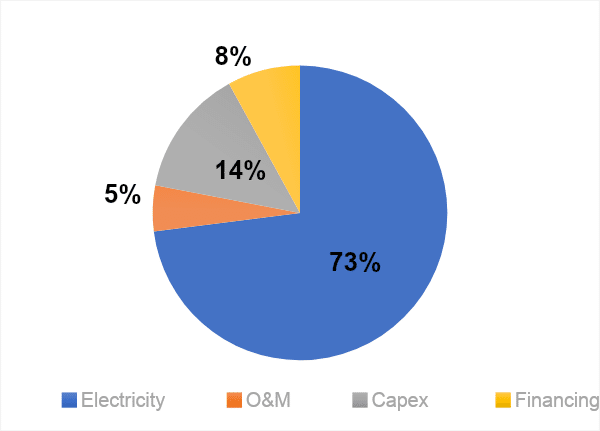

As illustrated below, the main cost component of GH2 is the electricity input. Africa has some of the cheapest and most abundant renewable electricity, as well as the space and raw materials to facilitate the industrial capacity required for these value chains. For example, South Africa has iron ore deposits and excellent renewable energy resource conditions. With declining costs for solar PV, South Africa can become a low-cost producer of GH2 and use it to produce green steel from iron ore pellets for domestic use and export. It is, therefore, potentially a great opportunity for Africa to carve out a competitive advantage in this nascent market.

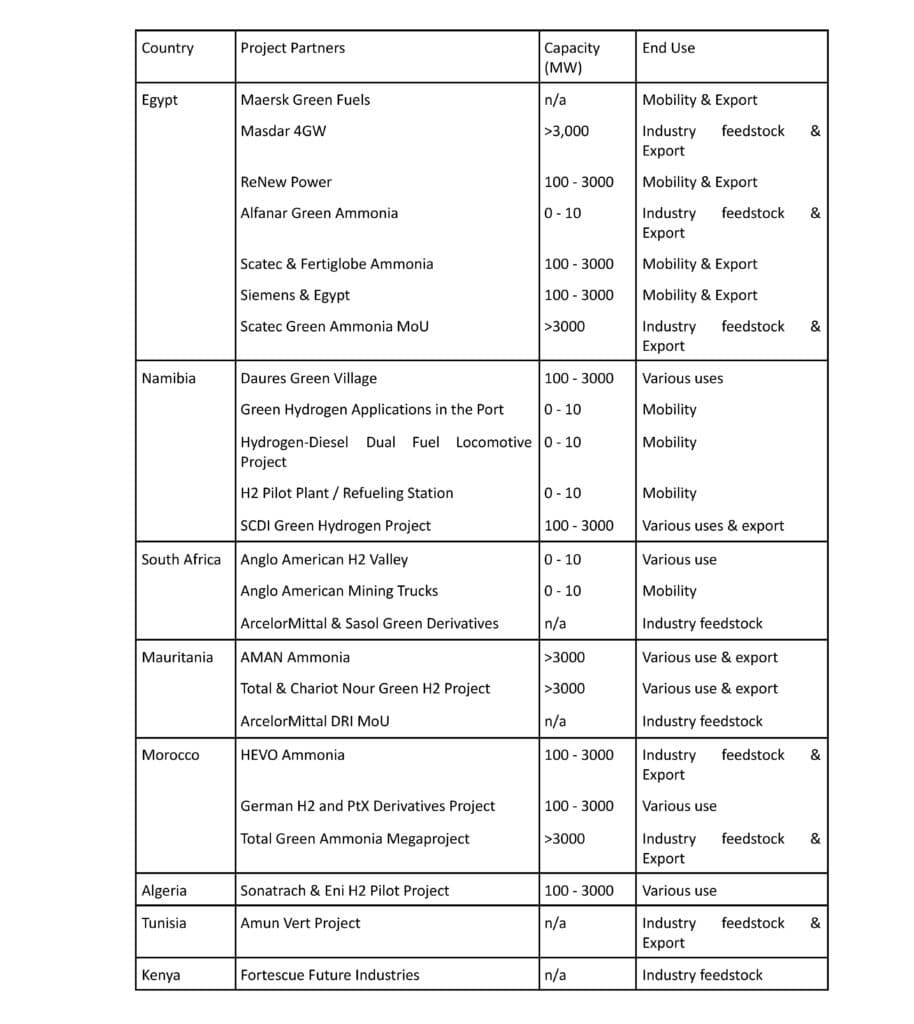

Al Gore[3] at the opening of COP 27, said: “Africa can be the renewable energy superpower. Africa has 40% of the entire world’s potential for renewables”. During the discussions at COP 27, it became evident that Africa has enormous potential for developing green hydrogen, with existing projects alone capable of supplying 10 percent of the world’s green hydrogen market. At COP 27, several GH2 project deals in Egypt, Mauritania, Morocco, Kenya, Namibia, and South Africa were discussed. Currently, at least 24 green hydrogen projects are either in the discussion stage or underway in Africa, with about 48 GW of electrolysis capacity, representing 3% of globally announced projects. The announced investment in the hydrogen value chain in Africa amounts to more than USD30bn.[4] See below for a list of projects.

By exploiting the abundant renewable resources of the continent to produce GH2, Africa can stimulate local socio-economic growth, strengthen local energy security, and help ease poverty. The development of green hydrogen in Africa can bring substantial benefits to the continent, such as the building of a green economy in African countries, the improvement and acceleration of access to energy, the creation of jobs as well as potentially improving access to energy and fresh water. The IEA notes that due to its extensive land and abundant natural resources, Africa has the potential to produce 5,000 megatonnes of GH2 a year at less than $2 per kilogram – equivalent to “the global total energy supply today.”[5]

Creating the right conditions

The right enablers must be implemented for Africa to realise its full GH2 potential. One of the most significant challenges that Africa is facing now is the cost of capital, for example the interest rates for private capital investment in renewable energy projects in Nigeria are seven times higher than in OECD countries.[6] Thus, to accelerate the green transition, there is a need to make access to capital available at a reasonable cost for GH2 projects and to overcome the barriers facing access to technologies.

Commercial factors such as the state of infrastructure in Africa and access to the demand nodes for international trade, are equally important because trade will play a crucial part in scaling up GH2 development in Africa. According to IRENA’s estimate, one-fourth of the hydrogen produced will be for international trade, half through shipping and half through pipelines.[7] Production incentives and subsidies, reducing risks through guarantor mechanisms like H2Global, and public-private partnerships will be crucial in the early stages of GH2 developments.

African governments must put the right policy and regulatory frameworks in place. There is also the need for capacity building here. Multilateral development banks and international financial institutions can play a more active role in using public finance as an investment vehicle to fund renewable energy deployment and innovation. The required technological revolution and diffusion in the energy sector will only take off with market shaping and creating policies through direct and meaningful public financing.[8] Therefore, as advocated by world leaders during COP 27, the above-mentioned financial institutions must also reconsider their business models in climate financing, accept more risks, and systematically leverage private finance for developing countries at a reasonable cost.

COP27 will be remembered for the creation of the “Loss and Damage Fund”, but it also played an important role in accelerating green hydrogen developments, something COP28 should look to build on.

Notes

[1] IRENA, (2022). Hydrogen, AVAILABLE HERE

[2] Green Hydrogen Organisation, (2022). United States: Tax credits for green hydrogen under the US Inflation Reduction Act 2022, AVAILABLE HERE

[3] An American politician, businessman, and environmentalist who served as the 45th vice president of the United States from 1993 to 2001 under President Bill Clinton.

[4] Masdar, (2022). Africa’s green energy revolution, AVAILABLE HERE

[5] IEA, (2022). WEO Special report Africa Energy Outlook, AVAILABLE HERE

[6] Al Gore, (2022). Opening of the COP27 World Leaders Summit, AVAILABLE HERE

[7] IRENA, (2022). Hydrogen, AVAILABLE HERE

[8] Mazzucato, Semieniuk, (2020). Public financing of innovation, AVAILABLE HERE