New offers are here for European consumers, why are they not choosing them?

This is the second installment of the Topic of the Month: Energising engagement

It is now 20 years since the Second Energy Package was adopted, breaking up monopolies and opening European energy markets to a diversity of suppliers. Today, European consumers have access to a range of providers and tariffs, including a growing number of sustainable ‘green’ tariffs and renewable energy-only suppliers.[1] Despite the allure of lower emissions and (often) lower bills, the level of consumer engagement[2] in the residential sector remains very low.[3]

So, why are residential energy consumers not more receptive? Does liberalisation equal competition? How should we interpret and rationalise consumers as decision makers?

Few options in the market

Low engagement is often indicative of a high level of market concentration, and the reality is that a handful of suppliers still dominate most EU energy markets. At the EU level, diversification has been steadily improving, but some markets have even become more centralised – such as Slovenia and Croatia.[4]

The European Commission have suggested[5] that improvements in the diversity of offerings in residential energy markets are typically correlated with two mutually reinforcing factors: (i) low market barriers for new suppliers, and (ii) high levels of consumer engagement. In short, liberalisation represents a necessary first step, and markets are slowly becoming more diverse in most cases, however, bottom-up pressure from an engaged and informed consumer base is required to build accountability and foster ongoing competition.

One clear and simple metric for assessing the willingness of consumers to engage is ‘switching rate’, i.e. the annual aggregation of voluntary decisions by consumers in a given energy market to switch supplier. The European Commission finds[6] that low switching rates are often related to the “common habits of consumer”, which are due either to the “legacy of several decades of public monopoly, or to the persistence of regulated prices in combination with free market offers”. Moreover, the EU considers that regulated prices are often perceived as ‘safer’, particularly by the elderly and the least educated, preventing them from switching.[7]

Understanding the consumer

It is intuitive to imagine that a more diverse and competitive market, coupled with a better informed and liberated consumer base will lead to a better alignment of priorities and products. However, Herbert Simon[8] challenged the conventional thinking on behavioural economics that consumers act in an entirely rational way, suggesting that most individual decision makers operate on a ‘primitive’ or ‘crude’ framework of rationality. Within this purview, consumers typically assess options sequentially, favouring the first satisfactory alternative rather than the overall optimum option, a pattern that is compounded by the absence of perfect information in most cases. This trend can be observed in the difference in behavioural patterns of industrial versus residential energy consumers, with industrial consumers typically more rational and therefore responsive to market changes and other concrete variables.[9]

Proximity to risk and perception of relative loss and advantage are two key drivers of human behaviour and decision making at large, often applied in the context of behavioural economics and climate change (in)action. In so far as it pertains to the case of residential energy consumers, there are two preliminary observations we can make.

Firstly, the selection of the energy supplier is a decision consumers need make only once, with relatively little subsequent visibility of the impacts, financial, environmental, or otherwise. This is different to some other decisions consumers make with greater regularity and perceptibility, such as means of transportation, food choices, waste disposal, or even daily energy consumption patterns. The difference in visibility contributes to a relative undervaluing of the less perceptible actions and outcomes versus those that are more immediate and consistent.[10]

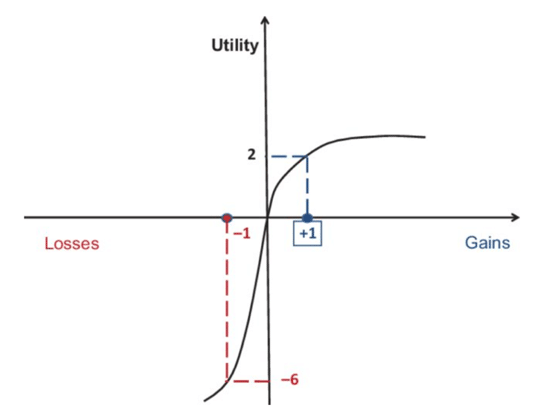

Secondly, human aversion to ‘loss’ relative to the status quo is far stronger than the desire to ‘improve’ on the status quo. This is due to neurological, social, and cultural factors including self-preservation and collectivist versus individualist perceptions of responsibility. Research suggests[11] that lower income groups are also more likely to be risk averse, further inhibiting some of the most vulnerable energy consumers from engaging with alternative suppliers and tariffs, even if they might offer a more desirable service.

Figure 1: Function indicating different utility curves for losses and gains, indicating the higher ‘stress’ of loss relative to the ‘satisfaction’ of equivalent gains (Osimani, 2013)

Aversion to loss and the proximity of outcomes versus inputs encourages entrenched behaviour. This is only exacerbated if there are unknowns associated with an information deficit or if the choice represents a high-stakes decision for the consumer, for example if they are financially insecure or physically vulnerable.[12]

Engaging the consumer with more information

Trends in low levels of consumer engagement in the residential energy sector are indicative of a gap between the availability of beneficial offerings, and the willingness of consumers to make a change. To begin bridging this gap it is important to consider where consumers are getting their information from and what sources they ‘listen to’ most.

Some of the most influential passive sources of information are advertising campaigns as well as anecdotal information or recommendations from friends and family, something which is leveraged by energy companies through referral bonus schemes, exploiting human sequential decision-making tendencies.[13] Once a consumer is motivated to engage but unsure on alternative options, energy utility comparison sites are an increasingly popular option for drawing comparisons. Although they provide a useful central data point, the commission charged by for-profit comparison sites pushes up the overall cost for consumers, as well as creating the opportunity to distort the presentation of data in favour of certain suppliers.[14] To overcome these issues, many governments both within the EU[15] and outside[16] now provide comparison and switching platforms as a public service. However, these platforms are not available in all Member States, and they are often less popular with consumers than private platforms.[17]

Further complicating the issue of switching is the fact that many residential customers are consumers of both electricity and gas. These energy products have differing levels and qualities of information available for each, as well as potentially different tariffs. One of the core initiatives of the Clean Energy Package[18] was the recasting of the Electricity Directive, with a strong focus placed on consumer empowerment. The gas sector has been lagging behind the electricity sector in this regard for many years, but the recent Hydrogen and Decarbonised Gas Market Package is looking to correct that, mirroring many of the provisions from the electricity sector that ensure consumers have access to the type and level of information necessary to make appropriate choices.[19]

In the next and final instalment of this series of the Topic of the Month, Daniele Stampatori will explore some of the options available for engaging consumers with a specific reference to the markets for system services in electricity.

[1] Green tariffs are products offered in energy markets by utilities that allow consumers to obtain their energy supply from renewable origin only. Often a portion of these supplies are covered by fossil fuels with offsets. These tariffs are more common for electricity, but also extend increasingly to the gas sector. Renewable only suppliers are energy companies that specialise in selling exclusively renewable energy services.

[2] As observed through meaningful interactions with utility companies, including switching providers, switching tariffs, installing equipment such as smart meters, changing consumption patterns (e.g., time of the day where energy is consumed, use of efficiency and energy saving measures), or participation in public initiatives regarding residential energy (e.g., subsidisation of energy efficiency installations).

[3] The European Consumer Association (BEUC), (2017). Stalling the switch: 5 barriers when consumers change energy suppliers, retrieved from: https://www.beuc.eu/publications/beuc-x-2017-106_stalling_the_switch_-_5_barriers_when_consumers_change_energy_suppliers.pdf

[4] European Union Agency for the Cooperation of Energy Regulators (ACER) Council of European Energy Regulators (CEER), (2022). Annual report on the Results of Monitoring the Internal Electricity and Gas Markets in 2021, retrieved from https://www.acer.europa.eu/Publications/MMR_2021_Energy_Retail_Consumer_Protection_Volume.pdf

[5] European Commission, Switching rates (electricity and gas), retrieved from: https://ec.europa.eu/energy/content/switching-rates-electricity-and-gas_en

[6] Council of European Energy Regulators (CEER), (2017). Retail Markets Monitoring Report, retrieved from: https://www.ceer.eu/documents/104400/6122966/Retail+Market+Monitoring+Report/56216063-66c8-0469-7aa0-9f321b196f9f

[7] European Commission, Switching rates (electricity and gas), retrieved from: https://ec.europa.eu/energy/content/switching-rates-electricity-and-gas_en

[8] Simon, (1955). A Behavioral Model of Rational Choice, retrieved from: https://www.suz.uzh.ch/dam/jcr:ffffffff-fad3-547b-ffff-fffff0bf4572/10.18-simon-55.pdf

[10] In practice this can be seen with, for example, the popularised boycotting of plastic straws and single use plastics, versus the relatively few people switching to banks with environmentally sustainable investment portfolios, despite evidence that changing bank is arguably easier and often has a considerably greater impact on ones environmental footprint. This is relevant for all consumer priorities, including price, not only environmental concerns.

[11] Inesi, M. (2010). “Power and Loss aversion.” Organizational Behavior and Human Decision Processes, 112, 58–69.

[12] See section 3.2 of this FSR deliverable for the OneNet project for details on the behavioural patterns of consumers.

[13] He, Reiner, (2018). Consumer Engagement in Energy Markets: The Role of Information and Knowledge, retrieved from: https://www.bennettinstitute.cam.ac.uk/media/uploads/files/Consumer_engagement_in_energy_markets.pdf

[14] Estimates suggest that UK consumers pay an additional £100 million per year due to commissions charged by these sites, the Norwegian government explicitly advises against their use and provides a non-for-profit alternative

[15] European Commission, (2021). Comparison tool websites run by a national authority, Retrieved from: https://ec.europa.eu/energy/topics/markets-and-consumers/energy-consumer-rights/protecting-energy-consumers/comparison-tool-websites-run-national-authority_en

[16] Australian Government, (2021). Switch to Save, Retrieved from: https://www.energy.gov.au/households/Find-the-best-energy-deal

[17] He, Reiner, (2018). Consumer Engagement in Energy Markets: The Role of Information and Knowledge, Retrieved from: https://www.bennettinstitute.cam.ac.uk/media/uploads/files/Consumer_engagement_in_energy_markets.pdf

[18] European Union, (2019). Directive (EU) 2019/944 on common rules for the internal market for electricity, Retrieved from: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32019L0944

[19] European Commission, (2023). Hydrogen and Decarbonised Gas Market Package, Retrieved from: https://energy.ec.europa.eu/topics/markets-and-consumers/market-legislation/hydrogen-and-decarbonised-gas-market-package_en

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights