Digitalisation of retail-size units: innovative services for targeted customers

FSR Topic of the Month

New business models in a changing industry

The digitalisation of retail-size units is driving the emergence of new business models in the electricity sector. Unlike the case of green generators, these new models tend to be ‘asset light’, and the offering of innovative services that target particular ‘clans’ of customers represents their essence.

The power sector ‘delivery loop’ was traditionally rather static. Retail-size customers, like households and small and medium enterprises, used to withdraw electricity from the grid according to their own will and pay a fixed tariff for each kWh to their supplier. Interaction with the rest of the system was extremely limited and the service provided to them was basically homogeneous.

The digitalisation of the electricity sector alters this situation profoundly. Digital technologies improve the availability and usability of information, thereby allowing a reduction of transaction costs and a more efficient use of resources. This gives the possibility to define and deliver customised products to attract particular groups of users. Digital technologies allow these products to be offered without the need for a significant amount of physical assets, thereby opening the door to new players next to the traditional electric utilities.

Indeed, it is possible to identify three types of actors, offering three types of services to retail-size customers.

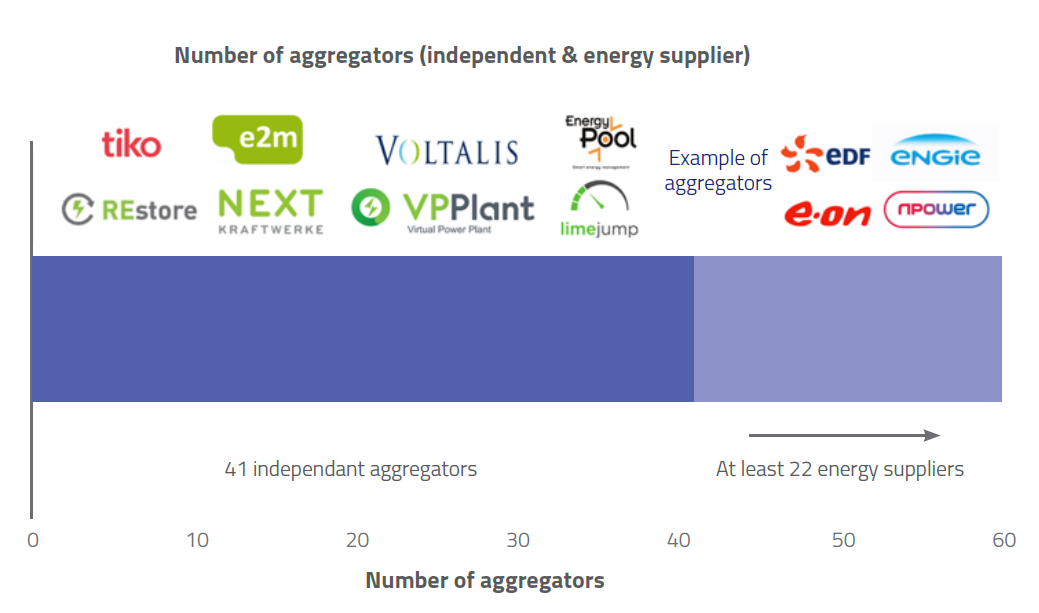

Firstly, aggregators target electricity consumers and distributed generation units that were historically excluded from direct participation in wholesale markets. Aggregators pool the resources of their customers and offer energy and/or flexibility on the wholesale energy market (day-ahead or intra-day) or in the balancing mechanisms functioning at the transmission level. Customers lose full control of their assets and receive pecuniary compensation in return. The current landscape of aggregators is quite diverse and includes several start-ups and a few more established players (see Figure 1 below). Some of them have been acquired by larger companies belonging to the electricity sector (e.g., EnerNOC bought by Enel) or not (e.g., Limejump bought by Shell). Others remain independent from any generator or electricity retailer. Next Kraftwerke, for example, currently manages 7000 units, for a total of six GW of capacity, distributed among industrial and commercial power consumers.

Secondly, ‘peer-to-peer platforms’ target consumers, prosumers and prosumagers (i.e., prosumers owning a storage unit as well) by offering them the membership to a decentralised ‘community’ of energy traders. The aggregator, which acts as a centralised platform, is here replaced by a platform for interactions within two-sided markets, where bilateral exchanges are left to the initiative of the participants to the platform and possibly automatized through algorithms such as blockchain. Some of these platforms, such as Piclo Platform, enable energy trading between consumers and generators, put in a consumer priority list, thanks to smart metering data. Others (e.g., Sonnen Community) group neighbouring consumers and enable the trade of local surpluses in renewable energy production. Some communities are independent of traditional utilities, while others are initiated by the utilities themselves (e.g., Axpo – Wüppertal Stadtwerke). Ultimately, these platforms can be open to access or restricted to a certain audience, potentially even the ‘Energy Communities’ as defined by the recently adopted EU Clean Energy Package.

Thirdly and finally, ‘smart managers of autonomous territories behind-the-meter’ do not target the consumers, prosumers or prosumagers themselves, but rather the devices inside their homes, offices and everyday life. New IT ‘managers’ are promising a professional full-time centralised management operating continuously these ‘fleets’ of smart devices. This is done by specialised knowledge of the language of these networks – the internet-of-things (IoT) – and of the software engineering needed for their optimal coordination – artificial intelligence, database management and other optimisation algorithms. A big part of this management service is to re-service this huge pool of consumer data to the consumers themselves through interactive and user-friendly interfaces. This realm consists of networks of many and diverse smart devices, located beyond the control of the traditional grid and energy authorities, such as electric vehicles, end-use appliances, storage assets and distributed generation. In fact, they could be considered as sub-nodal systems and mini-grids at the same time.

There are three main ‘candidate targets’ for these managers of ‘behind-the-meter autonomous territories’. First, there are electric vehicles, which include the last generation automotive data platforms and can freely choose where to connect (if a charging point is available close by) and what actions to perform. The behaviour of EV drivers poses further uncertainty and challenges to the daily life of system operators, making it all the more valuable to be managed. Aware of that, some companies are already envisioning the management of this virtually huge battery storage pool with the intention of offering grid services(IRENA, 2019). Second, there are “smart homes”, controlled by local sensors and interactive communicating devices. This concept is key to the realisation of “Zero Net Consumption” buildings, capable of optimising the internal generation, storage and consumption of energy. Big IT companies and automation firms, such as Siemens, are penetrating the space inside the home of clients through their own customised smart appliances and personalised customer interfaces (e.g., Amazon’s Echo). Third, a larger and more complex network composed of “smart homes” could compose “smart neighbourhoods”, or ideally even “smart cities”.

In conclusion, new players not needing large investments in physical capital are flooding the electricity sector with different types of products for different customers. Thanks to aggregators, centralised digital platforms are disrupting the trade arrangements in the existing wholesale markets. A combination of decentralised digital platforms and new algorithms disintermediating trading (e.g., blockchain) are creating previously un-existing, decentralised communities. Finally, artificial intelligence and Internet-of-Things are extending the possibility of trading up to the devices realm and unleashing new sources of value. Of course, it will take time for consumers to validate the value proposition behind these new business models and the kind of companies that will be able to prevail in this digitalised landscape remains to be seen.

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights