Unlocking industry electrification: an overview of EU policies and regulatory framework

This is the second installment of the Topic of the Month: Electrification of final uses: updates from FSR

Industry decarbonisation, including through electrification, is becoming a core priority of EU policies. Following the Draghi report on EU competitiveness and the Antwerp declaration, the European Commission’s president issued in summer 2024 her political guidelines, announcing a Clean Industrial Deal (CID), which would have included, inter alia, an Industrial Decarbonization Accelerator Act (IDAA) to “support industries in the transition”. The CID[1] was then published in February 2025, confirming a strong focus on the decarbonization of energy-intensive industries such as steel, metals and chemicals.

Electrification is one of the main decarbonization pathways for energy-intensive industries. It is estimated that up to half of the fossil consumption of the EU industry could be electrified with current technologies (McKinsey, 2020). In particular, the latter are already broadly available for low-to-medium temperature heat processes (Compass Lexecon, 2024). However, the electrification rate of the EU industry has been stagnating over the past decades, at around 33%, as shown in the first instalment of this Topic of the Month. Numerous barriers to electrification, explaining such a slow pace, were identified by the industry (see, for example, Eurelectric, 2025). This includes inadequate taxation levels (i.e., tax rates higher for electricity than for fossil fuels), high investment costs, increased and uncertain energy procurement costs, and pressure from international competition.

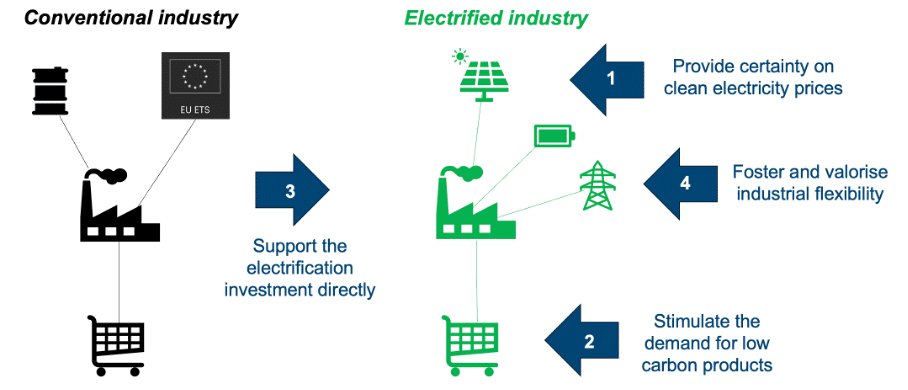

Public policies are today considered necessary to trigger and accelerate the industry electrification investments which are crucial to the energy transition. In this second instalment of the topic of the month, we highlight four areas of action and provide an overview of the policy measures at the national and EU level.

Figure 1: Stylized representation of the four policy areas to support industry electrification (source: author).

Area 1 – Provide certainty on clean electricity procurement prices

A major risk for the energy-intensive industry willing to electrify lies in the volatility and uncertainty of future electricity prices. Industrial consumers can hedge such risk by investing directly in on-site renewable production assets, or by engaging in renewable corporate power purchase agreements (PPAs). They can, in this way, benefit from both long-term electricity price stability and renewable electricity sourcing, enhancing their public image and ESG performance.

The Electricity Market Design Reform (EMDR) of 2024 aims to foster the development of markets for PPAs in the EU.[2] In particular, the reform mandates Member States to improve the accessibility to the PPA market by, for example, setting up a public guarantees scheme to reduce buyers’ default risk, or facilitating the aggregation of demand for PPAs. More recently, the CID foresees concrete actions, specifically targeting the industrial offtakers of renewable energy. A European Investment Bank pilot program should be set up in 2025 to offer financial guarantees for PPA offtakers, with a focus on small and medium size enterprises and energy-intensive industry. The Commission also plans to consider “clean flexibility instruments based on PPAs”, to support industrial PPAs, where industry commits to consume electricity with a 24/7 hourly matching[3] to the contracted clean electricity generation. As regards on-site projects or physical PPAs, speeding up permitting for industrial access to renewable energy is one of the actions planned under the IDAA.

Area 2 – Stimulate the demand for low-carbon products

Decarbonisation of industrial production is also risky if the demand for decarbonized products[4] is low or uncertain. In particular, the price of clean products often remains less competitive than that of their conventional equivalents. This issue should be gradually removed with rising EU ETS prices and the implementation of the Carbon Border Adjustment Mechanism. However, specific policies can be implemented to increase the EU demand for decarbonized products, providing increased revenue certainty for industries investing in the decarbonisation of their processes.

The CID foresees numerous initiatives to foster the demand for clean products, both through public and private procurement. The Public Procurement Framework should be revised in 2026, to enable the use of non-price criteria on sustainability, resilience and local content. Such criteria should be introduced by the IDAA. Non-price criteria can also foster private demand for clean products, when included in product legislation or codes. The Commission will assess such possibilities. Product labelling is moreover identified as an important measure, both for public and private procurement. The IDAA should additionally introduce a voluntary label on the carbon intensity of industrial products.

Area 3 – Support the electrification investments directly

Industrial electrification projects are typically capital-intensive and carry significant investment risks, as their returns depend heavily on future EU ETS and energy price developments. Indeed, changes in these prices eventually impact the relative competitiveness of the electrified industry, against competitors which did not electrify. Public support schemes can be relevant to safeguard electrification investments, as they can partly finance investment costs, and/or provide projects with revenue/competitiveness certainty through long-term operational cost support.

When implemented at the national level, large-scale support schemes must be notified to the European Commission, which then assesses whether they are compatible or not with the rules on the internal market. State aid guidelines have been issued over the years by the Commission, in order to streamline the process; support schemes that respect those guidelines are in fact automatically approved. The State Aid Guidelines for Climate, Environmental Protection, and Energy (CEEAG) provide the general framework; they allow for a broad scope of measures, including support to “electrification” (article 4.1). The Temporary Crisis and Transition Framework (TCTF), adopted in 2022, provides more specific guidelines under Article 2.6, dedicated to “decarbonisation of industrial production”. The Clean Industrial Deal State Aid Framework (CISAF), adopted in June 2025, will replace the TCTF, building on its experience.

State aid schemes targeting industrial decarbonisation have differed in terms of perimeter (i.e., the technologies covered), support type, and budget. An overview of some large-scale State aid schemes dedicated to industrial decarbonisation is provided in Table 1. The type of support has evolved over the past years, with the implementation of more complex instruments such as Carbon Contracts for Difference (CCfD). Interestingly, the draft CISAF did not specify how State aid for industry decarbonisation should be allocated. Some stakeholders have, in response, argued that operational cost support through CfDs or CCfDs is needed, and should be more explicitly mentioned in the text (see, for instance, Eurelectric, 2025, and Eurometaux, 2025). The final CISAF specifies that such forms of support should be instead approved under the CEEAG.

Table 1 – Overview of State aid measures dedicated to industry decarbonization notified by EU Member States under the CEEAG or TCTF.

| Country | Date | SA case | Legal basis | Budget (Bn€) | Support type |

| Slovakia | 10/2022 | SA.102385 | CEEAG | 1.1 | Investment grant |

| Netherlands | 07/2023 | SA.104448 | CEEAG | / | CCfD (12-15y) |

| Czech Republic | 10/2023 | SA.109055 | TCTF | 2.4 | Investment grant |

| Germany | 02/2024 | SA.104880 | CEEAG | 4 | CCfD (15y) |

| Germany | 04/2024 | SA.108729 | TCTF | 2.2 | Investment grant |

| France | 05/2024 | SA.108810 | TCTF | 4 | Investment grant |

| Italy | 07/2024 | SA.109439 | TCTF | 0.4 | Direct grant + clawback |

| Netherlands | 07/2024 | SA.112112 | TCTF | 0.75 | Direct grant + clawback (60%) |

| Austria | 09/2024 | SA.109730 | CEEAG | 2.7 | Investment grant

+ transformation grant (10y) |

| Finland | 12/2024 | SA.113721 | TCTF | 0.2 | Investment grant |

| France | 12/2024 | SA.112361 | CEEAG | 3 | CCfD with pre-defined CO2 reference price (15y) |

| Germany | 03/2025 | SA.116065 | CEEAG | 5 | CCfD (15y) |

In addition to national schemes, which do not yet cover all EU countries, a decarbonisation support scheme will be implemented at the EU level. Indeed, the CID foresees an Industrial Decarbonisation Bank, which aims at 100 billion euros in funding, derived from ETS revenues. The first pilot auction, whose Terms & Conditions were published in June 2025, has an available budget up to €1 billion. It will target mature industrial process heat electrification projects. The support will be auction-based and allocated as a fixed premium (€/tCO2 abated) over 5 years.

Area 4 – Foster and valorise industrial flexibility for better system integration

An electrified industry can, and is expected to, provide significant flexibility to the electricity system. Appropriate market integration is crucial to foster this flexibility and can offer additional revenue streams for electro-intensive industrial consumers. How to do that is part of a much broader discussion on how to remove barriers to consumers’ flexibility and pass on the right market signals (ACER, 2025). In this regard, the CID announced that guidance will be provided to Member States and retailers on how to promote remuneration of flexibility in retail contracts.

The provision of industrial flexibility could also be fostered through the policy instruments mentioned in the previous three areas. First, industrial consumers receiving support for electrification (Area 3) could be required, for example, to qualify in a capacity market, an interruptibility scheme, or other national flexibility instruments (when technically possible). Second, when industrial consumers are supported in the acquisition of renewable generation on-site or through PPAs (Area 1), a high degree of matching of generation with the industrial load can be mandated. This would incentivise the adaptation of load patterns to renewable generation, or the uptake of co-located storage.

If you are interested to know more about the role of electrification in the road to a carbon-neutral industrial sector and the policies that can contribute to achieve this goal, you may want to consider our course Getting to Net Zero.

[1] For more information on the Clean Industrial Deal, see our Cover the Basics on the topic, available at: https://fsr.eui.eu/the-eu-clean-industrial-deal/.

[2] For more information on the Electricity Market Design Reform, see our summary of the initial Commission’s proposal, available at: https://fsr.eui.eu/a-summary-of-the-proposal-for-a-reform-of-the-eu-electricity-market/.

[3] The hourly generation profile of a renewable plant generally does not match perfectly with the hourly load profile of an industrial consumer. For example, a solar PPA cannot cover the load profile of a “baseload” consumer, in particular during night hours. 24/7 hourly matching refers to more complex forms of PPAs, aggregating various technologies, such as solar and wind (potentially in various locations), as well as electrical storage. The objective of such a PPA is to provide an energy output matching more closely the industrial buyer’s load for each 24 hours of the day and each seven days of the week. While such PPAs are typically more expensive than the common single-technology PPAs, their advantage is to provide a higher degree of hedging (i.e., reduced exposure to short term markets), and a higher degree of decarbonization (i.e., clean electricity for any hour of the day). For more information, you can refer, for example, to “24/7 CFE Hedging analysis, Report for Eurelectiric” (Pexapark, 2023) , available at: https://www.eurelectric.org/wp-content/uploads/2024/06/eurelectric_pexapark_247-hedging-analysis.pdf.

[4] By decarbonized product, we refer to an industrial product whose carbon footprint has been reduced through a change in its production process. For example, decarbonized steel can be produced using an electric arc furnace with low-carbon hydrogen direct reduction, or a blast furnace with a carbon capture and storage infrastructure.