The Tunisian power system and the COVID-19 pandemic

What impact will COVID-19 pandemic have on the Tunisian power system? Find out in this opinion piece by Athir Nouicer and Asma Dhakouani.

This opinion piece on the “Tunisian power system and the COVID-19 pandemic” by Athir Nouicer and Asma Dhakouani is part of a series of articles covering the impacts of the pandemic on the energy and climate sectors. Read more here.

Foreword on the COVID-19 situation

2020 had an exceptional start with the COVID-19 pandemic spreading across the world throughout its first quarter. Consequently, many countries have decided to put their populations under lockdown. The situation is much the same in Tunisia. A curfew had been declared since March 18th, prohibiting outdoor movement from 6 pm till 6 am, and general confinement was announced on March 20th. The parliament granted the Prime Minister special powers amid the COVID-19 crisis to accelerate decisions implementation. On May 4th, the country opted for a selective lockdown to be enforced until June 14th.

Lockdowns cause significant disruption for industries and services, leading to tremendous impacts on economies. Due to the decrease of energy demand, oil prices dropped to their lowest levels; whilst US oil prices turned negative for the first time in history. The pandemic also shook power systems. With the economic slowdown, electricity demand is dropping too, and daily profiles are changing, impacting power generation upstream. Renewable energy (RE) projects have also been set off track. For example, the deployment of solar and wind farms slowed down due to the closing of industries that are part of the supply chain and the restrictions on workforces (Solar Power Europe 2020 and Wind Europe 2020).

Tunisia’s economy is no exception to the challenges posed by COVID-19, with the country facing the worst economic contraction since Tunisia’s independence in 1956. According to the National Institute of Statistics, INS (2020), in March 2020 exports decreased by 29.5% compared to March 2019, while imports were down by 27.4%. The International Monetary Fund, IMF (2020), expects a recession to set in with a 4.3% contraction in 2020.

Overview of the electricity sector in Tunisia

Over the last few years, the energy sector in Tunisia was swinging between having its own Ministry and being in the fold of the Ministry of Industry. Currently, the Ministry of Energy, Mines and Energy Transition (MEMTE) is in charge of electricity and renewable energy. It also supervises the state-owned utility that is the Tunisian Company of Electricity and Gas (STEG), which oversees power generation, electrification and gas connections. Other stakeholders in the power system include the National Agency for Energy Conservation, Independent Power Producers (IPP), Labour Union of Electricity and Gas and international donors.

The energy sector in Tunisia is heavily subsidized. Subsidies aim inter alia at protecting low-income consumers by ensuring affordable energy prices and at fostering industry development. Since 2010, subsidies have sharply increased due to (i) the decrease of national energy resources, (ii) the reduction of the rent from Algerian transit gas to Italy, (iii) the drop of the local currency value and (iv) the increase of demand. This policy became a burden on the state budget (Dhakouani et al. 2020).

Until the beginning of the 21st century, the electricity market followed a centrally managed model where the power system is owned and run by the state, represented by STEG. By 2019, power generation installed capacities were 5,742 MW for a total supplied electricity of 20,233 GWh to the nearly four million electricity customers. The electricity mix in Tunisia is little diversified with 93.4% of electricity from natural gas and 6.6% from renewable energy sources (RES), including 240 MW of wind, 77 MW solar PV and 62 MW of hydro (MEMTE 2020). Tunisia has a 99.8% electrification rate. Its electricity demand had a consistent annual increase of around 5% over the last decade (STEG 2019). Yet, since the Tunisian revolution in 2011, STEG expansion in generation capacity has slowed down by 3.5% compared to the preceding decade (World Bank 2019). This can be seen as the corollary of the economic recession and increase of the gearing ratio.

Tunisia has five interconnections with Algeria and three with Libya, for a total capacity of 1,677 MVA and 801 MVA, respectively. In general, exchanges among Maghreb countries are limited due to the instability of the North African network and the similarity of electricity demand profiles between the countries. A 600 MW interconnector with Italy, included in the third list of Projects of Common Interest, is planned for 2027 to allow bilateral electricity trade with Europe.

Thus, to cope with the increasing demand and to decarbonize its energy mix, the Tunisian Government established a framework in 2015 which allows private investments in large scale renewable energy projects with the law 2015-12. Three regimes could be applied large-scale; self-production, IPP for the local market and for exports. The national objective consists of 30% RES in electricity generation by 2030. RES deployment aims mainly at decreasing the energy dependency rate and national trade deficit as reported in Ilboursa. The last tender for 500 MW solar PV power plants, in December 2019, resulted in an LCOE of USD 0.025/kWh. Further details could be found at the MEMTE and PV magazine websites.

Short term COVID-19 impact

With this overview in mind, the following section focuses on the short-term impacts of COVID-19 and measures adopted by STEG to face the consequent technical, economic and social challenges posed by the pandemic.

1. Measures for protecting households

With the announcement of the lockdown, STEG declared guaranteed access to electricity and gas for all consumers. With less than one-third of its employees on-site, STEG must manage, in addition to gas services, the reliability of power, generation, dispatching, transmission and distribution. It also has to manage urgent interventions relating to the repair of failures and restoring electricity shutdowns.

STEG is encouraging customers to pay their bills online or using the phone app to avoid leaving their homes. The utility also announced that service will not be stopped for households due to non-payment bills during the lockdown period. The payments will be deferred by one month. Moreover, aligned with governmental decisions, STEG will postpone suing power system offenders.

2. Impact on electricity and gas demands

As in most countries under confinement, the electricity demand in Tunisia has experienced a significant reduction. As stated by STEG’s CEO on April 1st, about 60% to 65% of electricity demand comes from economic sectors, i.e. industry, services and agriculture, while the rest being residential demand. Therefore, with most businesses temporarily closed, there was a 20% reduction in overall electricity demand during April 2020 compared to the same month in 2019 despite an increase in household demand (MEMTE 2020).

The pandemic impact has varied from one sector to another. For example, transport and tourism have slowed down tremendously as most citizens are confined, hotels are shut down and air traffic is limited to repatriation and cargo. The Information and communications technology (ICT) service sector is mildly impacted since activities related to ICT can work remotely. The food industry demand has marginally reduced principally due to the absence of tourism activities. Demand from healthcare services has increased due to the particular focus on health care.

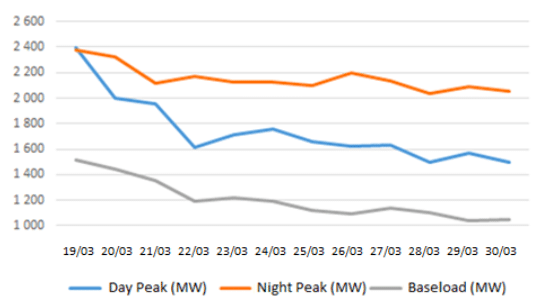

Figure 1 illustrates the load curve evolution from March 19th to March 30th. There was a significant decrease in the daily peak as commercial load reduced due to closures. The change in electricity demand profiles is also due to shifting consumers’ habits. Note that even though the 6 pm curfew started on March 18th, the evening peak declined. Moreover, the peaks and off-peaks have decreased in comparison with the same period of last year. For instance, the evening peak on April 1st in 2019 was 2,398 MW, while in 2020 it registered only 2,067 MW. Generally, in Tunisia, the spring period is the lowest energy consumption period of the year. But this year, the off-peak recorded its lowest values for decades. Unfortunately, these values reflect an unhealthy load curve with a difference between the daily off-peak and peak of around 1,000 MW. This load value represents half of the maximum load, leaving system operation in a challenging technical situation and increasing costs. Consequently, over the same period, March 19th to March 30th, the daily electricity generation dropped from 47,469 MWh to 33,263 MWh.

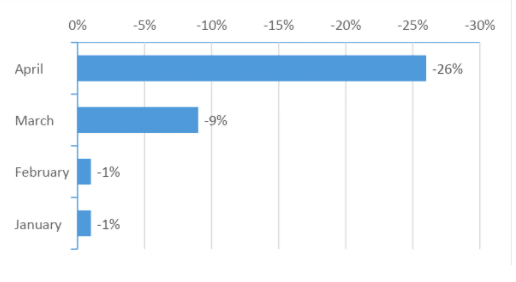

Natural gas demand was also adversely impacted as over 70% is used for power generation. Figure 2 shows a comparison between monthly natural gas demand between 2019 and 2020. In April 2020, due to the decrease in electricity demand and the shutdown of some industries, there was a 26% decrease in the natural gas demand, compared to the same period in 2019. The natural gas demand coming from the electricity sector decreased by 16% during the same period and 6% between March 2020 and March 2019 (MEMTE 2020). These conditions have allowed STEG to rely less on natural gas imports, with approximately a 34% reduction compared to the previous year. Instead, STEG has higher percentages of national natural gas, with a switch of around 20% between the domestic and Algerian natural gas. Obviously, Tunisia as an importer of fossil fuels will benefit from the reduction of consumption in this context.

3. The consequent impact on power system operations

With the decrease in electricity demand, the Tunisian utility had to shut down some baseload power plants, i.e. combined cycles. To respond to the daily load changes, open-cycle gas turbines were used as peak technologies because of their quick response. However, these technologies have a lower efficiency rate compared to baseload technologies, leading to a higher specific consumption (Dhakouani et al. 2017). STEG did not curtail any renewable generation, which forms only a small part of the generation mix.

As electricity cables are lightly loaded, there is an increase in reactive energy in the high voltage (HV) grid. STEG is trying to maintain reactive power levels low; preserving electric voltage at the required level has become an important issue. STEG needs to deal with overvoltage problems while generation units are close to their limits on reactive energy absorption and stability. Therefore, it has opted for the increment of the demand curve by increasing its electricity exports to Libya, which jointly agreed to manage the crisis. Two bordered Libyan villages are now entirely supplied by STEG as they are facing supply issues from the Libyan utility, thus becoming a win-win solidarity measure in the COVID-19 crisis.

Aside from the increase in losses in the transmission grid, as a consequence of the limitation of control workforce, STEG has to deal with commercial losses from the rise in power theft, mainly at the distribution level.

4. Oil price drop vs the strategy of applying real price for electricity supply

As Tunisia is engaged in applying real costs of supplying electricity for medium voltage (MV) customers, subsidies are being gradually reduced based on an agreed schedule. Because of the hard time that investors are having, the Government has decided to postpone tariff adjustments temporarily.

At this stage, many consumers would expect a drop in final energy prices. However, as described above, electricity is principally generated by natural gas. Since the latter’s price is indexed on oil price with a nine-month gap, the drop in natural gas prices could be expected in the fourth quarter of 2020. As Tunisia is relying on Algeria for gas supply, the MEMTE has engaged discussions with its Algerian counterpart on the review of natural gas prices.

Since STEG is a commercial company and has to avoid credit and liquidity crunch, the bill payment by final consumers is crucial for the continuity of electricity and gas services. Therefore, STEG has engaged a communicational and commercial strategy facilitating payments of dues from MV and HV customers.

Medium- to long-term impacts of COVID-19 in Tunisia

Although Tunisia did not face severe human casualties as a result of the virus, the economic and social crisis that will follow will be harsh. With the gradual relaxation of the lockdown due to a slowdown in contamination, citizens are slowly resuming economic and social activities. Yet, COVID-19 has already impacted the 2020 state budget and shifted the priorities of the Government towards health care. Funds that were allocated to different activities and investments have shrunk; this could have an impact on the power system planning.

Currently, opinions about the summer season diverge. While some economists expect a return back to a similar situation as 2019, others are pessimistic. The summer season is of particular importance as tourism is a significant contributor to the GDP amounting to 14.20% in 2019, according to a KPMG report. In both cases, meeting the electricity demand in 2020 will not be a problem. Yet, it is critical to analyze the ability of power generation to meet demand on the medium and long time horizons. Indeed, the realization of planned electricity generation projects might be impacted. For instance, project agreements and parliamentary approvals from RES projects planned to be implemented by 2022 and 2023, are to be undertaken by 2020. Decision-makers, which are already under constraints related to gearing ratios, have to figure out sustainable solutions regarding (i) the continuous development of the power system, which is considered as the backbone of the Tunisian economy and (ii) the achievement of the national strategy in terms of sustainable development, i.e. 30% of RES in power generation by 2030.

Mechanisms based on public-private partnerships and a better allocation and deployment of national resources are amongst strategy segments to be explored. Innovative technical solutions aimed at the improvement of energy dependency rates (i.e., battery storage, pumped-storage hydroelectricity, power-to-X) should be enabled.

Moreover, within a few months, natural gas prices will drop. Low oil and gas prices pose a good opportunity to reform taxation and subsidies, and consequently to apply real cost prices to power for MV customers. On the one hand, large consumers will benefit from low prices which allow them to gain extra revenues and compensate for losses from the first and second quarters of 2020. On the other hand (and on a longer horizon), consumers will get used to these new pricing mechanisms. They will adapt to market-based price dynamics and will only partially assert the need for energy subsidies. The subsidy measures that were applied should be recalled. They were created as a social measure and as a stimulator of economic activities but ended up becoming a heavy burden on the state budget and a barrier for sustainable development in recent years.

Bibliography

Dhakouani, A., F. Gardumi, E. Znouda, C. Bouden and M. Howells (2017), ‘Long-term optimization model of the Tunisian power system’, Energy, accessed here

Dhakouani, A., E. Znouda and C. Bouden (2020), ‘Impacts of Electricity Subsidies Policy on Energy Transition.’, in Dynamics of Energy, the Environment and Economy, In Press, vol. Vol. 77, Springer Nature.

INS (2020), Commerce Extérieur Aux Prix Courants, accessed here

MEMTE (2020), Conjoncture Énergétique, accessed here

Ofgem (2019), Energy Trends: UK Electricity, accessed here

STEG (2019), Intervention de Mr Moncef HARRABI Président Directeur Général de La STEG (Tunisie), accessed here

World Bank (2019), Energy Sector Improvement Project, accessed here

Acknowledgements

Contributor writer Asma DHAKOUANI is a doctor-engineer, graduated from National Engineering Schools of Gabes and Tunis in chemical & process and industrial engineering. Holder of an MBA from Southern States University in USA, Asma has a proven multi-cultural work experience since 2012 and is currently working in the Tunisian Company of Electricity and Gas. She has built capacity in energy strategy.

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights