The Green Hydrogen Economy: insights from India

This is the third instalment of the Topic of the Month: Inclusive or exclusive? Green hydrogen in the international sphere

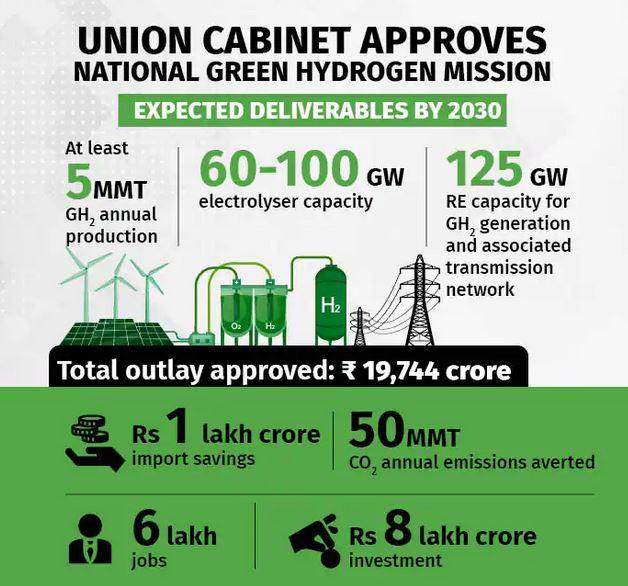

On its 75th Independence Day, Indian Prime Minister Narendra Modi announced the National Hydrogen Mission with an aim of making the country a production and export hub of green hydrogen. This mission was approved by the Union Cabinet on 4th January 2023 with an initial outlay of ₹19,744 crore ($2.3 billion), aimed at producing 5 MMT (Million Metric Tonne) per annum with an associated renewable energy capacity addition of about 125 GW by 2030.

In this article, we peek into some of the key aspects of India’s vision for green hydrogen drawn from its National Hydrogen Mission, while looking into the potential challenges for the nation in creating for itself a green hydrogen economy.

The Indian green hydrogen vision

As per International Renewable Energy Agency (IRENA), hydrogen shall make up ~6 per cent of total energy consumption by 2050 [1]. Hydrogen demand in India is expected to increase fourfold by 2050, and the steel industry and heavy-duty transportation will drive 52% of it, according to a NITI Aayog and Rocky Mountain Institute (RMI) report [2].

It is no surprise then that India has been focusing on this resource to cater to its climate ambitions. The Green Hydrogen Policy proposed by the Ministry of Power, Government of India, in February 2022 defines it as “Hydrogen produced by way of electrolysis of water using Renewable Energy; including Renewable Energy which has been banked and the Hydrogen produced from biomass” [3].

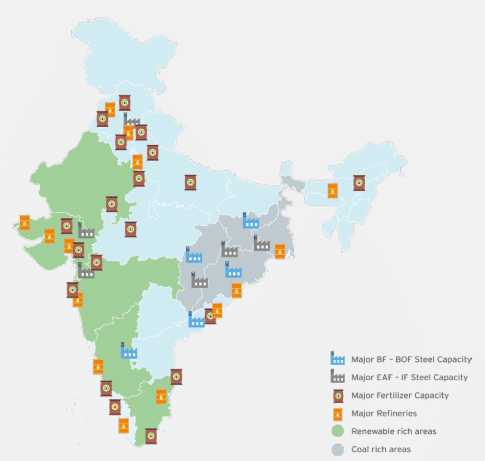

The primary envisioned uses of green hydrogen are expected to be seen in fuel-cell mobility (Hydrogen electric cars and trucks), container ships being powered by liquid ammonia made from hydrogen, “Green steel” refineries burning hydrogen as a heat source rather than coal and hydrogen-powered electricity turbines that can generate electricity at times of peak demand to help firm the electricity grid.

NITI Aayog, the government think tank, estimates that currently, India spends over $160 billion of foreign exchange every year for energy imports which are likely to double in the next 15 years. Not only can a green hydrogen economy help drastically reduce these costs, but the adoption of green hydrogen can also enable India to abate 3.6 gigatonnes of CO2 emissions cumulatively between now and 2050 [2].

Under the Strategic Interventions for Green Hydrogen Transition Programme (SIGHT), two distinct financial incentive mechanisms – targeting domestic manufacturing of electrolysers and production of Green Hydrogen – will be provided under the Mission. The Mission will also support pilot projects in emerging end-use sectors and production pathways. Regions capable of supporting large-scale production and/or utilization of Hydrogen will be identified and developed as Green Hydrogen Hubs.

Moreover, the mission mentions the development of a robust Standards and Regulations framework. Further, a public-private partnership framework for R&D (Strategic Hydrogen Innovation Partnership – SHIP) will be facilitated under the Mission; and the R&D projects will be goal-oriented, time-bound, and suitably scaled up to develop globally competitive technologies. Furthermore, a coordinated skill development programme to facilitate and meet the capacity-building requirements of the Mission will also be undertaken.

With such targets in mind, it is not surprising that the mission is being touted as means for the nation to achieve its target of becoming energy independent by 2047 and also achieve its vision of ‘Atmanirbhar Bharat’ (self-reliant India) [5]. Steps in the direction towards attaining this vision have already been taken in the form of projects like setting up of “India’s first 99.999% pure” green hydrogen plant in Assam (Northeast India) commissioned by Oil India Limited (OIL) [6].

These ambitious targets and vision are creating more enthusiasm and optimism towards the creation of a green hydrogen ecosystem in India which will not only cater to its domestic needs but will also support global decarbonization objectives, with India catering to the rising demand for green hydrogen internationally.

An ambitious vision or a farfetched dream?

While the cabinet approval for the Mission certainly creates a sense of confidence among the various stakeholders involved, further incentivising the industry to work towards achieving the intended targets. There are emerging questions and concerns pertaining to the Indian green hydrogen economy, this section explores some of these unanswered aspects.

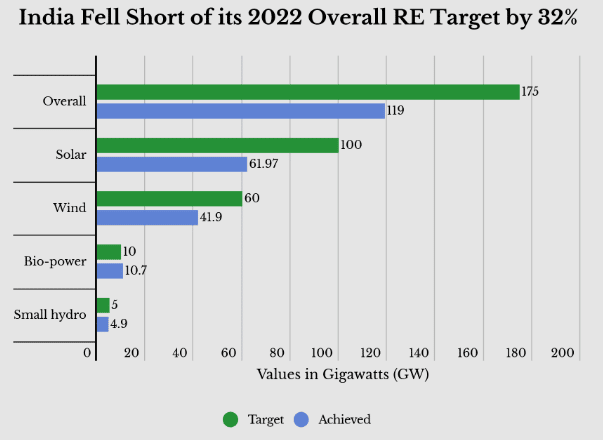

The premise of a green hydrogen economy lies in the utilization of renewable sources to produce this hydrogen, and the most widely used means at present is through the process of electrolysis, which uses electricity and water, and expensive metals like platinum as a catalyst [7]. In this regard, it is critical to note that India generates about 60% of its energy from fossil fuels as of 2022 [8]. On the other hand, despite attaining a 66% increase in renewable energy capacity (excluding large hydropower) since 2018, it has been estimated that India fell short of its installed renewable energy target for 2022 by 32% [9].

It has also been projected that with an expected requirement of 35 Mt by 2050 (assuming 25% export capacity), India would require a tentative capacity in the range of 192 GW to 224 GW of electrolysers by 2050, assuming all of it is green hydrogen [11]. Given that the global capacity of electrolysers just crossed 300 MW in 2021, this signifies that India itself would require an electrolyser capacity of 640 to 750 times the current global capacity, by 2050. For India to achieve this, it would require 110-130% of its current total electricity generation (2020-21) by 2050, creating an immediate need for a road map for meeting the rapid growth in demand for electricity, especially from renewables [12]. Furthermore, as of June 2022, just 7.8GW of electrolytic hydrogen projects have been announced, while announced electrolyser manufacturing plants amount to just 4GW/year by 2030 [13].

Other than the role of external factors such as Covid-induced supply chain disruptions obstructing the achievement of the national renewable energy targets, other domestic factors such as inadequate funding for clean energy, challenges of land acquisition for renewable energy projects as well as lack of coordination between national targets and state-level enforcement played a crucial part. It is important to note that these challenges will also spill over as hurdles to meeting the targets set for green hydrogen.

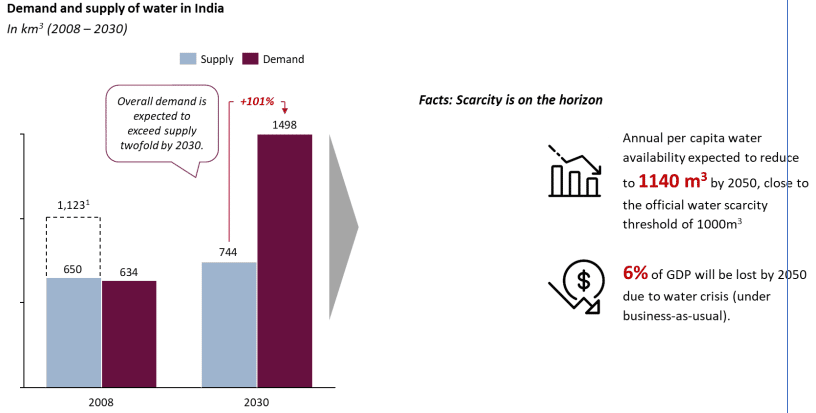

One key challenge in the Indian context is water availability, as 1kg of renewable hydrogen produced via electrolysis requires roughly 10 litres of water, and India is amongst the most water-stressed countries in the world [14]. One estimate suggests that India would require ~50 billion litres of demineralized water supply to meet its target [15]. Solutions such as desalination have been suggested, but this will increase the physical footprint of the infrastructure required, while also potentially adding to the competition for land use and the impact on biodiversity, and also creating challenges and limitations in the location of electrolysers.

What next?

A sustainable green hydrogen economy thus hinges upon the creation of a supply chain, starting from the manufacture of electrolysers to the production of green hydrogen, using renewable source generated electricity; while also keeping green hydrogen cost competitive as compared to other alternatives. The levelized cost of green hydrogen production and storage (LCOH) is currently ~ INR 400/kg [13] which will have to be drastically brought down in the near future for the hydrogen vision to become a feasible reality. With implicit subsidy support and a government-backed R&D push, the plan is to target lower costs of renewable power generation and to bring down the costs of electrolysers to make the production of green hydrogen cost-competitive [17]. In reality how this is implemented and achieved will be a different ballgame altogether as the nation attempts to balance its socio-economic needs and decarbonization ambitions. Another consideration is that would converting green hydrogen from its original form to another such as ammonia, liquid fuel, etc be the most efficient utilisation of resources across the value chain?

The need for legal and administrative adherence including certification mechanisms, recommendations, and regulations for different components of the system, will also be a big challenge, going ahead. India could play an important role in facilitating harmonising standards and certification systems for green hydrogen globally, given its G20 presidency. Also while the mission will give the much-needed direction to the states to undertake their own priority-based actions that align with the overarching decarbonisation goal; however, this state-centre coordination would be critical to the success of the mission.

The success of this mission thus hinges on how the incentives would be planned and executed, and how the country manages to create demand locally, create legislative frameworks that facilitate hydrogen-based sector coupling. The foundation for a policy-led hydrogen ecosystem has been laid in India with the passing of this mission in the cabinet however, reality will be defined as finer details emerge, followed by implementation alongside the balancing of economic and environmental objectives for the nation. Concerted national and international efforts going forward would be required in the field of finance and investments, policy planning and research.

Notes

[1] IRENA, “Hydrogen: A renewable energy perspective,” 2019. [Online]. Available here.

[2] Niti Aayog, “Harnessing GREEN HYDROGEN,” no. June, 2022, [Online]. Available here.

[3] Ministry of Power GoI, “Green Hydrogen Policy,” Policy Document. pp. 1–3, 2022, [Online]. Available here.

[4] R. Prasad, “India’s $2-billion green hydrogen mission needs push from government: Industry,” Moneycontrol, 2023. Available here.

[5] Livemint, “Cabinet approves ₹19,744 cr National Green Hydrogen Mission | Mint,” 2023. Available here.

[6] The Hindu, “OIL commissions India’s first pure green hydrogen plant in Assam,” 2022. Available here.

[7] Down to Earth, “What will the National Green Hydrogen Mission mean for India?,” 2023. Available here.

[8] “Power Sector at a Glance ALL INDIA,” Ministry of Power, Government of India, 2022. Available here.

[9] D. Dubey, “Did India really achieve its goal of 175 gigawatt of renewable energy by 2022?,” Scroll India, 2023. Available here.

[10] The Hindu, “Has green hydrogen sprung a leak?,” 2022. Available here.

[11] EY and SED Fund, “Accelerating Green Hydrogen Economy,” no. June, 2022.

[12] The Hindu, “Energy independence through hydrogen,” 2022. Available here.

[13] EY, “India needs ~115 GW of renewable power generation capacity and ~50 billion litres of demineralized water supply: EY – SED Fund report,” 2022. Available here.

[14] S. BHAGWAT and M. OLCZAK, “Green hydrogen : bridging the energy transition in Africa and Europe,” FSR Glob., no. October, p. 33, 2020, doi: 10.2870/126402.

[15] World Bank, “World Water Day 2022: How India is addressing its water needs,” 2022. Available here.

[16] Niti Aayog, “COMPOSITE WATER MANAGEMENT INDEX In association with Ministry of Jal Shakti and Ministry of Rural Development,” 2019.

[17] The Indian Express, “Union Cabinet approves Green Hydrogen Mission: A look at India’s push for the fuel,” 2023. Available here.