If you care, you prepare! Thoughts on the EU ETS2 and the need of “early auctions”

This article is published in the context of the LIFE COASE project

In February 2024, the European Commission presented its assessment of a 2040 climate target, ensuring a path for the EU to reach its net zero target by 2050. The target is challenging, and to achieve it, all sectors need to contribute.

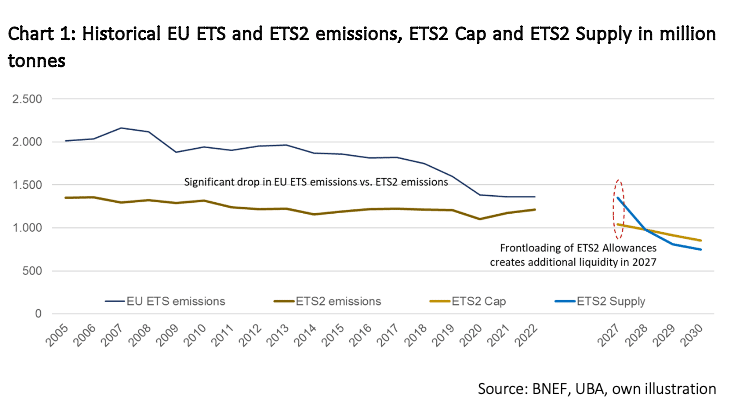

GHG emissions in the EU ETS have dropped significantly during the last decade, primarily due to a drop in power emissions and the growth in renewables. The development has been less promising in other sectors.

To address this, the EU established a second emissions trading system for buildings and road transport, the “EU ETS 2.” By putting a price on carbon, the EU aims to change behaviour and incentivise innovation in road transport and buildings, reducing GHG emissions. Besides, it raises money through the Social Climate Fund for governments to support investments and soften the social costs for the more vulnerable parts of society.

Putting a price on carbon will change behavior and incentivises investments but how do you proxy hedge EU ETS2 Allowances (“EU2A”)?

While the ETS2 only starts in 2027[i], discussions intensified recently. One reason for increased discussions was that monitoring and reporting of ETS2 emissions will begin in 2025.

There were questions about the system itself and concerns about a potential implementation delay, due to political risks and a fear of a “gilets jaunes 2.0”, the pricing of ETS2 allowances, abatement costs, and proxy hedges.

In particular, an ETS2 regulating fuel supplier companies implies that long-term supply contracts will be affected, and companies will need to include the carbon costs in their decision-making process.

Besides questions about the potential price of EU2As, the crucial question firms face is on how to hedge their potential exposure in longer-term contracts. Are there any proxies?

In the EU ETS, trading started in 2004, before the official start in 2005 and EU allowances were issued. Transactions were primarily forward transactions with delivery in December 2005. These forward trades enabled some price discovery, but volumes were small, often just 10,000 tonnes. Large volumes were not required, as companies received free allocation. This differs significantly from the EU ETS2, where companies will not benefit from any free allocation. Instead, all EU2A will be auctioned. Accordingly, companies will need to price and hedge their full carbon exposure.

NER300 provided additional allowances for power hedges in 2012

In 2012, the EU introduced early auctions with the phase-out of free allocation to the power sector. Many power companies were actively hedging power sales years forward, and the NER300[ii] provided additional allowances during 2012 to cover hedging needs.

When the EU included aviation in the EU ETS in 2012, airlines could hedge their exposure with forward purchases of EU allowances, as they could surrender both standard and aviation allowances.

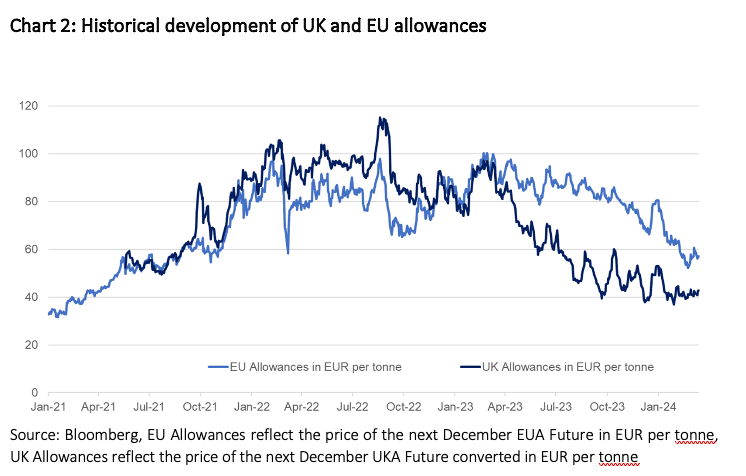

UK utilities used EU allowances to proxy hedge their carbon exposure after Brexit

After Brexit, many UK utilities purchased EU allowances as a proxy hedge, as UK auctions were delayed and EU allowances were the best availably way to hedge the carbon exposure of power sales. This hedge worked well in the beginning, but correlations broke during 2023 among others on the back weaker demand and increase in supply.

Proxy hedges to cover future EU ETS 2-exposures are more challenging, as the market structure and the abatement costs differ significantly from the EU ETS.

Early EU2A auctions would create price discovery and enable hedging

The EU ETS 2 regulation foresees that governments will auction allowances in the amount of 130% of the cap during 2027. While this will create additional liquidity initially and might soften prices in the beginning, early auctions starting in 2025 or 2026 might be more advantageous. Early auctions would generate confidence in the system, create price discovery, and enable companies to hedge long-term supply agreements. Besides, “early auctions” would provide additional financing for the Social Climate Fund in 2025 and 2026.

The article expresses the author’s personal opinion and does not necessarily need to reflect the view of BBVA or the EUI.

[i] According to Article 30k of the EU ETS directive, a postponement of the EU ETS2 until 2028 would be possible in the event of exceptionally high energy prices

[ii] The NER 300 programme took its name from the sale of 300 million emission allowances from the New Entrants’ Reserve (NER) set up for the third phase of the EU emissions trading system (EU ETS). The funds from the sales have been distributed to projects selected through two rounds of calls for proposals, covering 200 and 100 million allowances respectively.

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights