Flexibility in Power Systems

What does it mean flexibility in power systems? Why does flexibility in power systems matter? Where is flexibility traded? What flexible resources can we currently mobilize? What are the main challenges ahead? How does the EU regulatory framework address flexibility?

The notion of flexibility in power systems has gained significant attention as variable renewables like solar and wind continue to develop. In light of the European Electricity Market Design Reform (Regulation (EU) 2024/1747), Member States are now tasked to perform a periodical flexibility needs assessment that can lead to the definition of an indicative national objective for non-fossil flexibility and the implementation of non-fossil flexibility support schemes. However, flexibility remains an ambiguously defined term, encompassing various aspects and needs of power systems. This article explores this notion and addresses its current multifaceted reality.

Why does flexibility in power systems matter so much?

Electricity is a very peculiar good as for a power system to work properly, supply and demand must match at all times. Unlike any other traditional commodity like oil, gas, or wheat, an imbalance in the grid — either stemming from an excess or a lack of power — can lead the system to collapse in a so-called “blackout,” which the system may take several days to recover from. As electricity can hardly be stored with current technologies at a large scale in a cost-effective manner, there is a need for generation to equal demand at each moment. However, the rapid expansion of solar and wind power—whose generation depends on weather conditions and time of the day—has exacerbated this challenge. The variability and unpredictability of renewables add to the traditional fluctuations in demand, making grid management more complex. Moreover, their decentralized nature has increased network congestion concerns, as distribution systems were not originally designed to accommodate thousands of small, dispersed generation units.

How did the notion of flexibility in power systems evolve?

The notion of flexibility has evolved through time as the impact of renewables on system operation and grids has become more important.

In the early 2010s, when renewable generation capacity was still relatively limited, flexibility was considered a short-term issue only, related to the uncertainty of weather forecasting. At that time, an unexpected drop in production from solar or wind farms would trigger the need for a swift response from traditional power plants, but there was no concern about the adequacy of the system to cover peak demand, as the bulk of electricity was still produced by traditional means. Flexibility was thus mainly related to “reliability”, i.e., the ability of the system to adapt to abrupt and unanticipated changes in the load to be served. As solar and wind power began supplying a significant share of electricity in some European countries, the concept of flexibility evolved to encompass multiple timescales. Indeed, as renewable capacity progressively increased, traditional thermal plants were gradually phased out, shifting the responsibility for security of supply increasingly onto renewables (Heggarty et al., 2020). Flexibility thus embraced a broader meaning of resource “adequacy”, i.e., the ability of the system to keep the lights on even during prolonged periods without sun or wind. More recently, the notion of flexibility has been used also in the context of increasingly congested electricity networks at both the transmission and distribution level. Indeed, flexible resources can be mobilized by system operators to deal with local constraints in the network and keep the voltage level within appropriate boundaries.

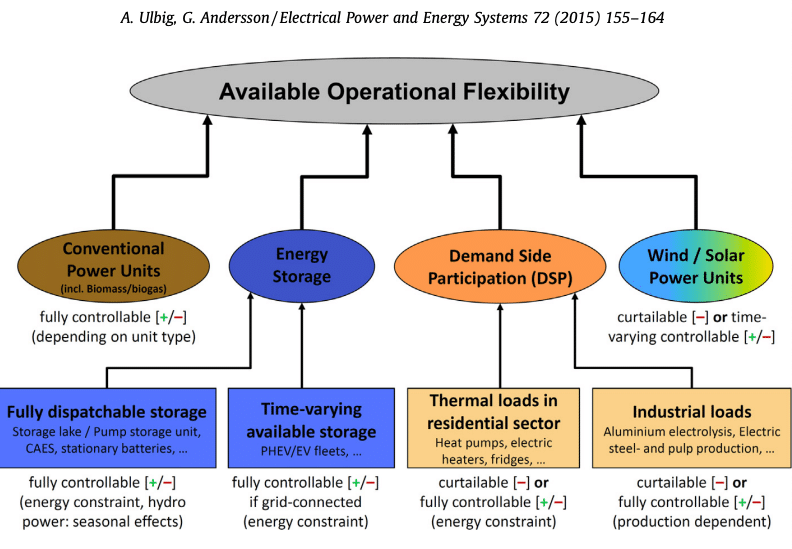

Thus, the definition of flexibility has not been unique and is still evolving. Likewise, different metrics or parameters have been proposed to quantify the contribution to system flexibility provided by generators, loads, and storage systems in a given grid. In the case of generation assets, for instance, reference is often made to their ramping rates (i.e., the speed at which generation output can be adjusted), the immediate power they can deliver, or the amount of energy they can generate in a certain time interval (Ulbig & Andersson, 2015).

Where is flexibility traded?

In Europe, there is a sequence of electricity markets, from forward markets (several years before delivery), to day-ahead and intraday markets. The economic value of flexibility thus materializes in the different markets where it is traded. Long-term flexibility options, such as investment decisions in power plants to accommodate for long-run trends in the evolution of demand, are typically traded through long-term contracts such as Power Purchase Agreements (PPAs) or Contracts-for-Difference (CfDs) that allow for securing and triggering investment. Day-ahead and intraday markets enable flexibility to be valued as new information on weather conditions, demand levels, and potential outages is gradually revealed. Eventually, redispatch markets and ancillary service markets allow Transmission System Operators (TSOs) to mobilize flexible resources closer to real-time to ensure the operational boundaries of the grid are respected and account for any imbalance.[1] Notably, as flexible resources can serve local and system-wide needs, close coordination is required by different market participants across various timeframes.

What flexible resources can we currently mobilize?

Gas turbines and hydropower generators have long been the primary source of flexibility in power systems due to their economics (low fixed costs for gas turbines, high opportunity cost of using the limited amount of water stored in reservoirs for hydro) and their fast-ramping capability. This makes them well-suited for load-following operations, where generation adjusts to meet demand. However, as energy systems move toward decarbonization, relying on fossil gas is no longer a viable solution, requiring alternative approaches to maintain a clean, reliable, and affordable power system.

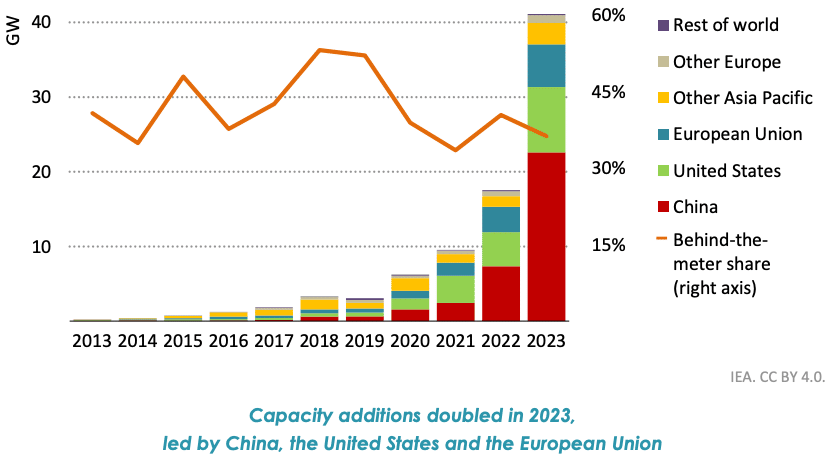

For short-term flexibility (seconds to hours), new technologies are emerging. The most notable example is the surge in stationary batteries, with global installed capacity rising from 5 GW to 40 GW between 2020 and 2023—an eightfold increase displayed in Figure 1 (IEA, 2024). Most of this capacity relies on lithium-ion batteries, which are limited to storage durations below 8–10 hours. However, alternative chemistries like iron-air batteries could extend storage to weeks, though they remain in early development. Other forms of electricity storage include Compressed Air Energy Storage (CAES), where air is compressed and stored underground when electricity prices are low, and released to generate power when prices rise. Thermal storage also offers a viable solution, particularly for industrial and residential applications. For instance, water heaters can store heat efficiently for hours using electricity when it is cheaper.

Figure 1: Battery storage capacity additions worldwide, 2013-2023 (IEA, 2024)

Beyond supply-side solutions, demand-side flexibility is becoming increasingly important with the rise of electrification and digitalization. On the one hand, the increasing use of electricity in final uses expands the set of potentially flexible electricity-consuming assets, while on the other hand the increasing availability and usability of data enables a more granular monitoring and control of consumption. In this context, the deployment of smart meters across Europe has been particularly notable as it enables variable price retail contracts, incentivizing consumers to adjust their electricity use based on the expected or actual wholesale market price of energy (Cabot & Villavicencio, 2024).[2] This innovation unlocks new sources of flexibility, particularly in sectors like electric mobility. Indeed, electric vehicles (EVs) can help balance the grid by shifting charging to periods of low demand or high renewable generation. In some cases, EVs could even act as distributed storage, feeding electricity back into the grid when supply is tight (vehicle-to-grid, V2G). Similarly, hydrogen production via electrolysis—if widely adopted for decarbonizing hard-to-abate sectors—could provide additional flexibility by adjusting production to times of lower electricity prices.

For long-term flexibility — i.e., prolonged extensive periods of energy scarcity or balancing energy mismatch at the seasonal scale — the challenge is much greater. The historical practice of using thermal power plants to follow the demand is currently the only existing way of coping with such imbalances, but as we already said, this comes along with additional carbon emissions. Nuclear can alleviate this problem as being both a dispatchable and low-carbon energy source, but the financial structure of the technology, involving massive fixed costs — up to 85% of the total — makes it economically problematic (Cany et al., 2016). Hydrogen could also be an option since it can be stored in underground caverns or tanks on a large scale and transformed back into electricity when needed, either by being burnt in gas turbines or using fuel cells (Li & Mulder, 2021). However, the low round trip efficiency and large investment costs make this option economically challenging. Biogas — a gas produced from biomass, mainly agricultural waste — is sometimes presented as a relevant choice for replacing fossil gas, but the resource base is estimated to be rather limited (Sesini et al., 2024). Figure 2 shows some of these different flexibility options, from Ulbig et al. (2015).

Figure 2: Sources of operational flexibility in power systems (Ulbig et al., 2015)

What are the main challenges ahead?

Of all the low-carbon options that can provide flexibility, only batteries have shown a recent uptake with a sharp cost decline. In contrast, demand response has yet to scale significantly due to several barriers, including regulatory ones (ACER, 2023), and its ability to replace firm capacity remains uncertain. High activation costs of demand-side resources remain a key barrier, often exceeding the cost of ramping traditional thermal plants (Cabot & Villavicencio, 2024). Nuclear has struggled economically over the past decade, with persistent delays and cost overruns. Hydrogen faces its own challenges, as technological maturity remains insufficient and anticipated cost reductions have yet to materialize.

More broadly, market signals may fail to incentivize flexibility adequately. In theory, price fluctuations should drive investment, but market distortions—such as price caps, capacity mechanisms, and direct subsidies—can undermine incentives, particularly for long-term storage (Mays, 2021). These imperfections, combined with the high-risk profile of flexibility investments, further complicate financing (Taylor and Ribeiro, 2024). High upfront costs, uncertain technological progress, and volatile revenues make such projects difficult to sustain.

How does the EU regulatory framework address flexibility?

The 2024 Electricity Market Design Reform introduces a formal definition of flexibility, which is “the ability of an electricity system to adjust to the variability of generation and consumption patterns and to grid availability, across relevant market timeframes”. The reform also provides a regulatory framework to address flexibility shortages, recognizing that market signals alone may not ensure sufficient investment. Member States must periodically assess their national flexibility needs over a 5 to 10-year horizon, using a common European methodology. Based on this assessment, they must define indicative targets for non-fossil flexibility, specifying the contributions of demand response and energy storage. These targets and supporting measures must be integrated into the National Energy and Climate Plans (NECPs).

If market-based approaches prove insufficient, Member States can implement support schemes for non-fossil flexibility, provided they meet key principles, such as targeting new investments and considering locational criteria (to ensure that investments occur in optimal locations and participate in reducing grid congestion). By formalizing flexibility planning and enabling public support, the reform aims to secure reliability and adequacy in a decarbonized electricity system.

Do you want to know more?

If you want to know more about this topic and get in touch with the FSR electricity team, please contact Chiara Canestrini.

This Cover the Basics benefited from the contribution of Ange Blanchard, Ellen Beckstedde and Nicolò Rossetto.

[1] For congestion management and voltage control in the distribution network, local flexibility markets have also developed. These markets allow Distribution System Operators (DSOs) to procure flexibility services from local providers during congestion, leveraging distributed energy resources (DERs) like battery storage, demand response, and decentralized generation (Schittekatte & Meeus, 2020).

[2] Smart meters also support the use of variable network tariffs that can incentivise customers to shift consumption to the times of the day in which the network is (expected to be) less congested.