EU Regulation on wholesale energy market integrity and transparency (REMIT)

In this Cover the Basics article, we break down what is REMIT? Why do we need an EU framework for wholesale energy market transparency and integrity? Which obligations and prohibitions are set by REMIT and who is subject to them?

This text unpacks Regulation (EU) No 1227/2011 of the European Parliament and of the Council of 25 October 2011 on wholesale energy market integrity and transparency (REMIT). This piece of legislation introduces the most important definitions on the topic (i.e. insider trading, market manipulation), as well as the main obligations and prohibitions falling on the actors involved (the obligation to disclose inside information, or the obligation for market participants to register). Furthermore, the article describes the process of identifying and sanctioning REMIT breaches, exemplifying the role of national and European authorities.

For a brief overview, listen to the podcast below in which Research Associate Sofia Nicolai breaks down the main points of the article:

What is REMIT?

In force since 28 December 2011, REMIT is the legislative act introducing a sector-specific, directly applicable framework to detect and deter insider trading as well as market abuse in European long and short-term wholesale energy markets, both for electricity and gas. It presents a three-sided aim:

- to increase the trust operators and customers[1] pose in the integrity of the gas and electricity markets;

- to allow prices of the wholesale energy markets to mirror a competitive and fair interplay between supply and demand, securing the optimal allocation of resources;

- to prevent profits resulting from market abuse.

The 2011 Regulation has been complemented by the 2015 Implementing Acts. With their adoption, the European Commission (EC) defined some details of the reporting obligation (see below): for example, a list of reportable contracts and derivatives, timing and form of reporting.

At the time of its entry into force, there were already other EU legislative instruments tackling market manipulation, like the Directive 2003/6/EC of the European Parliament and of the Council of 28 January 2003, on insider dealing and market manipulation (market abuse), known as Market Abuse Directive (MAD). Nevertheless, REMIT introduced, for the first time, a framework specifically applicable to energy markets. This means that REMIT provisions complement MAD for the energy (gas and electricity) sectors and provide for certain carve-outs. Furthermore, its peculiarity lies not only in the sector-specific obligations and prohibitions, but also in the complex and interconnected monitoring system, involving national actors like National Regulatory Agencies (NRAs), as well as European ones, like the Agency for the Cooperation of Energy Regulators (ACER).

Why do we need an EU framework for wholesale energy transparency and integrity?

In the 1990s, the EC started taking action to liberalise the energy sector and achieve the integration of European energy markets. This led to increases in cross-border trading, a plethora of more complex transactions and the diversification of market actors. At that time, the sector was regulated by general contract discipline, EU and national competition legislation and certain financial law rules. A more specific set of provisions was needed to master the new state of the sector and tackle its challenges, for example, to ensure that all the agents can benefit from the knowledge of the same information.

Moreover, the more specific provisions and supervision to secure the integrity and transparency of these markets are essential in order not to compromise the benefits of their integration at EU level. ACER estimates welfare gains of more than 150 million euros per year by virtue of a more interconnected electricity system. Both market integration and market integrity and transparency do not aim at securing lower energy prices for consumers. On the other hand, they aim at better prices, which are the result of an optimal allocation of resources and of economic efficiency as well as of a fair and competitive interplay between supply and demand.

What are some of the most important concepts that REMIT introduced?

There are several notions on which REMIT builds upon. Two of the most topical, market manipulation and insider trading, are in accordance with those introduced under MAD. Important is also the definition of a market participant, which is key to understanding every prohibition and obligation set by the Regulation.

A market participant is” any person, including transmission system operators, who enters into transactions, including the placing of orders to trade, in one or more wholesale energy markets” (art. 2.7). Examples provided by ACER are energy trading companies, producers of electricity or natural gas, balance responsible entities, wholesale customers and shippers of natural gas.

The concept of market manipulation is wide and can encompass different behaviours. In general, it is the result of actions aiming at interfering with the usual functioning of the market, normally inspired by market fundamentals, like the competitive interplay between supply and demand. The behaviours constituting market manipulation can be divided into behaviours related to transactions and those related to the dissemination of information.

Inside the first group, behaviours related to transactions, three categories can be identified. Firstly, transactions or orders which provide “false or misleading” signals about the demand, supply or price of wholesale energy products, for instance, placing and withdrawing of false orders (REMIT Recital 13). Secondly, transactions or orders aiming at securing prices at an artificial level (unusually high or low), and not at the price naturally resulting from the fair and competitive interplay between supply and demand. Thirdly, transactions involving fictitious devices or deception are also under the category of market manipulation. One example is circular trading, a practice according to which a sell order is executed knowing that an offsetting buy order is contemporarily put in place, weakening competition.

The second group includes behaviours related to dissemination of information. They are considered market manipulation when they give, or are likely to give, “false or misleading signals as to the supply of, demand for, or price of wholesale energy products […]” (art. 2.2.b) The justification underlying the provision lies in the fact that spreading false or misleading information leads to transactions that otherwise would not have taken place, compromising the regular economic outcome of the market.

One of the most important prohibitions set by REMIT is insider trading, meaning trading based on inside information. It aims at eliminating potential information asymmetries between market participants. Therefore, it is essential to clarify the concept of inside information, because the definition given by the EC as information “a reasonable market participant is likely to use as part of the basis for his decision to enter into a transaction” seems vague. There are several criteria to be met to identify insider trading:

- The information must be “specific enough to enable a conclusion to be drawn as to the possible effect of that set of circumstances or event on the prices of wholesale energy products” (art. 2.1).

- The information must not have been made public yet, otherwise, it is not considered inside anymore.

- It must concern, directly or indirectly, wholesale energy products.

- The information must be so significant that its diffusion is likely to remarkably affect the prices of the products at stake.

Examples of inside information are those on the capacity and use of facilities for the production, consumption, transmission or storage of electricity or natural gas, encompassing their planned and unplanned unavailability.

Which obligations and prohibitions are set by REMIT?

REMIT uses the concepts clarified above to identify three main categories of prohibitions: a) market manipulation (REMIT art. 5); b) attempted market manipulation (art. 5); c) insider trading (art. 3).

To prevent breaches of point c), inside information must be shared with all the other market participants (art. 4), not only with selected agents, except in case this is done in the normal exercise of employment duties (art. 3.1.b). Prior to the disclosure, a positive act based on that information (acquiring or disposing of wholesale energy products) is prohibited, irrespective of the fact whether an economic benefit has been obtained. Furthermore, specific speculative intent and the knowledge by the concerned market participant that the information is qualified as inside are irrelevant. Negative acts (decisions not to trade) do not seem to be covered by the provision. Generally, the disclosure must aim at reaching the largest possible audience, therefore, central platforms aggregating the most relevant information are deemed as effective means for this purpose. An example is the European association for the cooperation of transmission system operators for electricity (ENTSO-E) Transparency Platform.

In addition to the main prohibitions, there are obligations aiming at ensuring a solid framework to detect potential information asymmetries and market manipulations. For example, Member States (MSs) must introduce a national registry, through their NRAs, where market agents established, resident or active in their country have an obligation to register (art 9) if they perform transactions to be mandatorily reported to ACER (art 8). The reporting obligation encompasses transactions, including trades and orders, identified by the EC in the 2015 Implementing Acts: for instance, day-ahead contracts for the supply of electricity or natural gas where delivery is in the Union, or options, futures, and other derivatives relating to electricity or natural gas produced, traded or delivered in the Union. Furthermore, duties of cooperation and information sharing are instituted (art. 10 and 16), according to which ACER should share relevant information with other competent authorities (national and European), and NRAs shall inform the national competition authority, the EC and ACER in case of potential breaches in energy markets, even in other MSs.

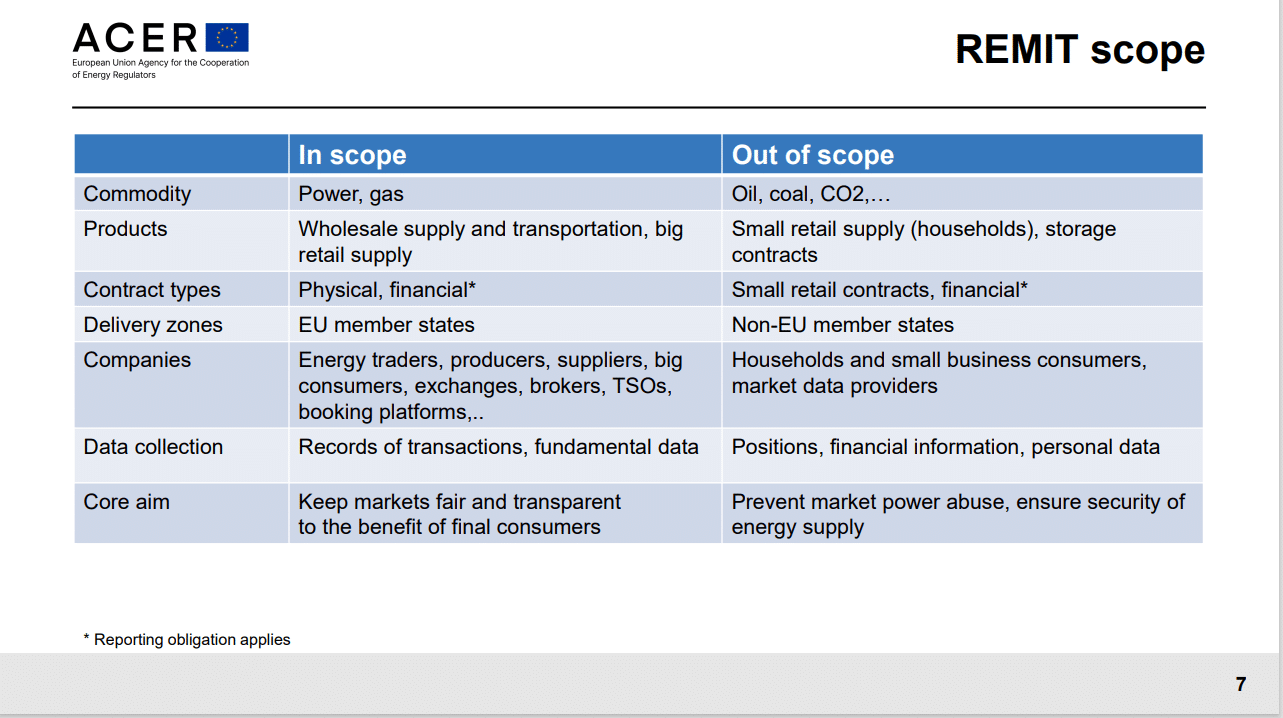

What products are covered?

Three main categories of contracts are the object of the reporting obligation of market participants:

- physical and financial settlements related to the transportation of natural gas and electricity in the EU and contracts for their supply delivered in the EU;

- derivatives, like options and futures of energy transportation or supply, traded or delivered in the EU;

- contracts to be reported at the request of ACER, for example, for contracts balancing services.

Contracts can be standardised (wholesale energy products accepted for trading at an organised marketplace, like energy exchanges). In this case, the details of the deal must be forwarded to ACER as soon as possible and no later than one working day after it has been concluded. Standardised contracts can also involve Over-the-Counter (OTC) transactions. The specifics of nonstandard contracts must be reported no later than one month after the contract has been concluded, amended or terminated.

Retail contracts must be reported only when the consumption capacity of the final customer is greater than 600 GWh per year. Below this threshold, this type of transaction is considered not susceptible to market manipulation at the same degree as wholesale contracts.

Who has obligations under REMIT?

The definition of market participant has been mentioned, as well as the main obligations and prohibitions: to publish inside information in an effective and timely manner (art. 4.1), and to notify ACER when applying exemptions to the reporting duties (i.e. transactions with the sole purpose to cover immediate physical loss due to unplanned outages, art.3.4.b).

Other institutional actors such as ACER and NRAs also need to fulfil their obligations to ensure an effective deterring and detecting framework. The ordinary process to identify and sanction cases of market manipulation is usually initiated by ACER or NRAs through their shared monitoring task. ACER monitors the entire European-wide energy markets, while NRAs mostly focus on national transactions. Once they identify suspicious behaviour, they must flag the abnormality to the other actor. National competition authorities must also be informed if the behaviour is likely to constitute a breach of competition law. However, once the notification has taken place, only the NRA can impose penalties (fines) on the market participant guilty of having breached REMIT provisions.

To ensure this process is effective, REMIT gives NRAs the power to enforce its obligations and prohibitions (art. 13). Each Member State, with national laws (for example, law 161/2014 in Italy), assigns powers of investigation to NRAs to monitor the system and to delineate the general principles for potential penalties sanctioning REMIT violations. Moreover, as already mentioned, NRAs and EU agencies bear the responsibility to cooperate to ensure market integrity and transparency, both horizontally (between EU agencies, like ACER and ESMA – the European Securities and Markets Authority – or between NRAs), and vertically (between EU agencies and NRAs). This is particularly relevant in light of the different powers that actors retain. For instance, ACER can provide assistance and alerts in case of suspected market abuses, but it cannot impose fines, which is a task for NRAs.

Focusing more on the role of ACER, a relevant surveillance task has been legally mandated, involving data collection and analysis together with data sharing (daily with NRAs) and cooperation with other institutions to coordinate the follow-up of any possible breach. Its work is financed through REMIT fees, introduced in January 2021 by the Commission Decision (EU) 2020/2152 and paid by market participants proportionally to the data they report.

ACER’s role is essential to support NRAs in the monitoring task, providing a pan-EU perspective. NRAs are able to guard only part of the EU-wide energy market, which encompasses millions of transactions per day; on the contrary, ACER, being in charge of data collection, can have a more holistic view. This implies that the Agency notifies the responsible NRA for further investigation and prosecution when detecting possible market abuses. To comply with its duties, ACER has set up the ACER REMIT information system (ARIS), a dedicated information and communication technology system (ICT) to gather and communicate data with NRAs and other authorities. The system comprises the Centralised European Registry for Energy Market Participants (CEREMP), to be updated with data from national registries transmitted by NRAs. The core of the system is data collection and reporting, being it the main database of all trading activities. To avoid multiple actors accessing ARIS to report their transactions, ACER defined the characteristics for parties to be qualified as Registered Reporting Mechanism (RRM), an entity which gathers data from one or more market participants and submits them to ARIS. ARIS pre-screens the transactions to detect market abuse (through algorithms programming and economic modelling) and sends alerts in case of irregularities. In 2022, 110 alerts per month on average are shared by ACER with NRAs.

Lastly, ACER devised a notification platform where anyone can notify suspicious behaviours in wholesale energy markets and delays due to applied exemptions.

What are examples of REMIT breaches?

The line between legitimate actions and market misconduct is blurred, depending on a variety of factors, like the features of the market where the transaction is concluded. One example is capacity withholding, which consists in keeping available generation capacity from being competitively offered on the market despite it would be profitable to do so. This behaviour must be carefully assessed on a case-by-case basis since it does not automatically constitute a manipulation. It needs a 2-step assessment on whether: 1) the market participant is able to influence the price or the interplay between supply and demand with such behaviour; 2) it has no legitimate technical, regulatory (force majeure) or economic (opportunity cost) justification for not offering or offering above its cost.

To sanction breaches, REMIT Recital 31) clarifies that penalties must be “proportionate, effective and dissuasive, and reflect the gravity of the infringements, the damage caused to consumers and the potential gains from trading on the basis of inside information and market manipulation.”

A Spanish case decided in 2022 exemplifies the above-mentioned breaches and the guiding principles for sanctions. The Spanish NRA CNMC imposed fines of €6 million to both GASELA GMBH and SOLSTAR Limited for breaching art. 5 of REMIT on market manipulation. The two companies concluded pre-arranged transactions on the Spanish wholesale gas market to avoid low prices resulting from the oversupply of GASELA. They secured artificially higher prices and colluded to avoid that other market participants could benefit from them.

What does the future hold?

With the current energy crisis, emerging in the Summer of 2021 and further aggravated by the Russian invasion of Ukraine in February 2022, which enhanced difficulties linked to supply chain disruptions and inflation, wholesale energy market design regained momentum. Some governments claim the need for reform, in order to ease the burden on consumers and benefit from the low variable cost of renewable energy sources. However, REMIT does not seem to be, so far, part of the debate. Since the first hints of the current crises, ACER emphasised how the current market design is worth keeping, given the benefits that it entails for consumers; therefore, interventions to tackle the worrisome scenario should not be to the detriment of the integrity of the European energy market. For the moment, REMIT remains a more than ever essential tool to restore the trust consumers lost in the benefits of a single, interconnected European energy market.

Notes

[1] A sector inquiry divulged the poor trust customers had in the functioning of wholesale markets, believing that the price increases of energy products were mainly due to market manipulation of large generators. European Commission, DG Competition Report on Energy Sector Inquiry, Brussels, 10 January 2007, pp. 120-122 AVAILABLE HERE

If you still have questions or doubts about the topic, do not hesitate to contact one of our academic experts: