Carbon contracts for difference

What is a CCfD? How does a CCfD work? For which industrial sectors could the CCfD be a good fit? What is important in the contract design?

In this article, we introduce you to Carbon Contracts for Difference (CCfDs), a tool to incentivise industrial decarbonisation projects. We address five key questions: What is a CCfD? How does a CCfD work? For which industrial sectors could CCfDs be a good fit? What is important in the contract design? What is important in the auction design?

If you want to dig deeper, our FSR online training on Getting to Net Zero might be what you are looking for!

What is a CCfD?

The industrial sector must decarbonise its production over the next decades and avoid being penalised by the increasing price of carbon emissions in jurisdictions that adopt a carbon tax or introduce a cap-and-trade scheme, such as the EU ETS. However, at least where a cap-and-trade scheme is in place, the price of carbon emissions is rather uncertain, which makes it difficult for industrial companies to finance investments in low-carbon technologies.[1]

A Carbon Contract for Difference (CCfD) aims to address the carbon price risk faced by industries investing in low-carbon technologies (Richstein, 2017). It provides financial support by covering the gap between a reference CO₂ price (e.g., the EU ETS price) and a guaranteed strike price, ensuring that decarbonisation investments remain economically viable even if the carbon price is too low to make them competitive.[2]

Additionally, CCfDs help de-risk investments in low-carbon technologies by providing predictable revenue streams, thereby encouraging industrial decarbonisation. However, their effectiveness depends on factors such as market decarbonisation speed, whether carbon costs are passed through in product prices, and policy design choices like benchmark selection and sectoral scope.

How does a CCfD work?

Similarly to CfDs in renewable support schemes, a CCfD works by guaranteeing, for a certain period of time, a fixed carbon price for an industrial project, reducing uncertainty about future CO₂ prices. The price guarantee may be defined in an auction, where different project developers bid in the CO₂ price required to realise their investment.

Typically, although not necessarily, a CCfD operates as a two-way contract between the government and a project developer:

- If the CO₂ market price is below the agreed strike price, the government pays the difference to the project owner. This ensures that low-carbon investments remain financially viable even if the carbon price is, at a certain point in time, too low to justify those investments;

- If the CO₂ market price exceeds the strike price, the project owner repays the excess to the government. This prevents windfall profits and enhances public acceptance.

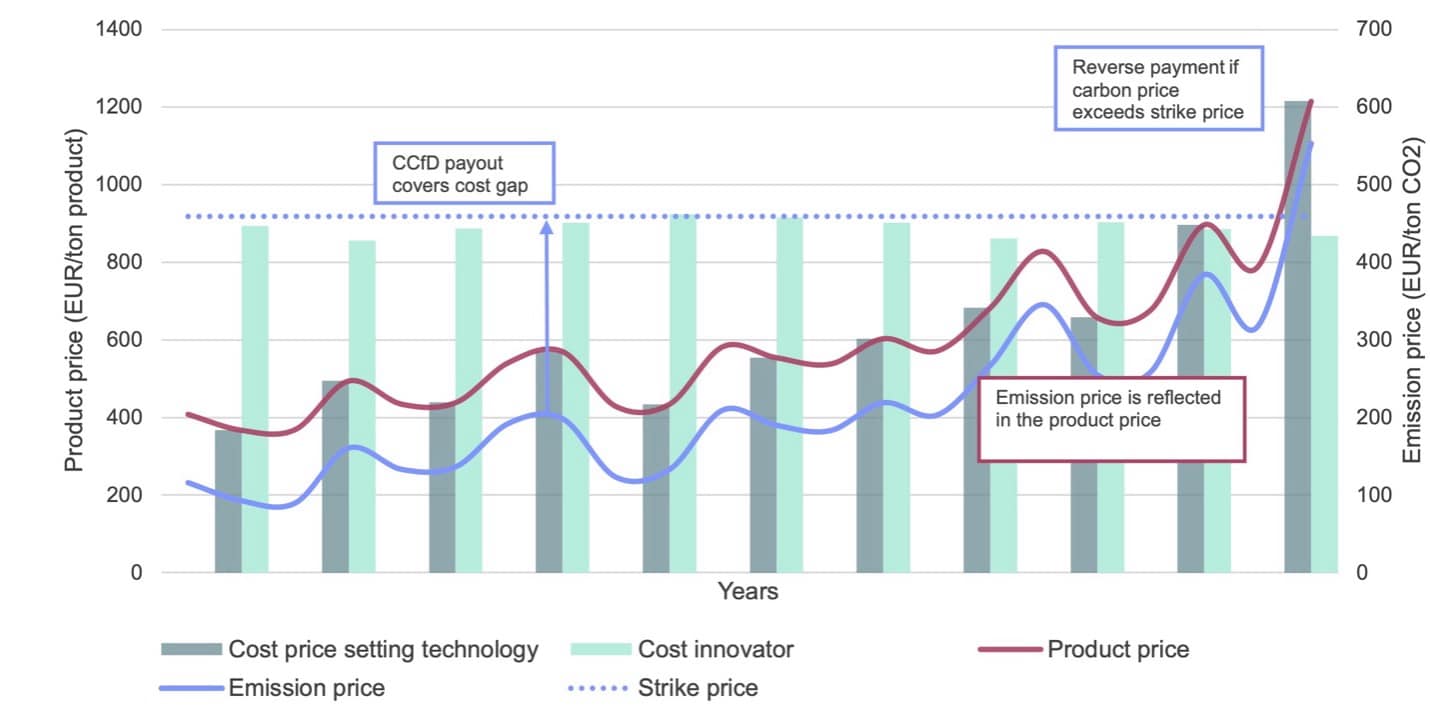

The goal is to de-risk investments in innovative, CO₂-reducing technologies by ensuring their relative competitiveness against traditional, carbon-intensive, technologies is no longer dependent on the (short-term) fluctuations of the carbon price. To explain how a CCfD achieves this, consider Figure 1, in which we show the cost of an innovative, CO2-reducing technology and of a traditional, carbon-intensive technology.

Figure 1: A CCfD pays out the difference between the strike price and the carbon market price, as such it aims to bridge the competitiveness gap between the low-carbon technology and the traditional, carbon-intensive technology when the latter is price setting. Source: Hoogsteyn et al. (2025) © CellPress 2025 All rights reserved.

The cost of emitting CO2 is a fundamental driver for the competitiveness of a company that invests in a low-carbon technology compared to a company that relies on a traditional, carbon-intensive technology. If the carbon price is low, the cost advantage of avoiding emissions is minimal, making it harder for the company investing in a low-carbon technology to be competitive.

A CCfD helps in two ways: it reduces the uncertainty of carbon pricing and provides financial support to close the cost gap. CCfD payouts depend on the difference between a pre-agreed strike price and the actual carbon price, multiplied by a benchmark that reflects the considered industrial product’s carbon intensity. You can think of the contract payout as consisting of two parts:

- Under the CCfD contract you receive a fixed financial support per produced quantity of a low-carbon product, covering extra operational and investment costs of the low-carbon technology;

- From that fixed support, a variable amount is subtracted, based on the carbon price on the market. The higher the carbon price, the higher the amount subtracted. This ensures that both the company investing in the low-carbon technology and that relying on the traditional technology are equally exposed to the carbon price, shielding them from carbon price volatility.

The fixed support normally exceeds the variable subtracted amount, resulting in a net positive subsidy, making the low-carbon technology more competitive. However, if carbon prices rise significantly, the payment could reverse, meaning the company investing in a low-carbon technology pays back to the government instead.

A benchmark in a CCfD determines the reference emissions level or cost against which the contract compensates the project. It determines by how much the variable subtracted amount should fluctuate with the carbon price. It is essential because it defines how much CO₂ a project is expected to avoid compared to the traditional technology. The CCfD then pays the project based on the difference between the CO2 market price and the strike price agreed in the contract, multiplied by the benchmark emissions factor. A well-chosen benchmark ensures fair compensation and prevents over-subsidisation.

In the case of hydrogen production, for instance, the benchmark could be based on the emissions from Steam Methane Reforming (SMR), which is currently the dominant method for producing hydrogen. SMR typically emits around 10 kg CO₂ per kg of hydrogen, so a CCfD for electrolysis-based hydrogen would compare its emission savings relative to this baseline. In steel production, a benchmark could be set using traditional blast furnace emissions, which release approximately 1.8 tonnes of CO₂ per tonne of steel. In the chemical sector, defining benchmarks is more complex due to the diversity of processes and global market conditions. Ethylene trade, for instance, occurs on a global scale where CO₂ pricing is inconsistent, making it difficult to establish a meaningful benchmark that ensures fair compensation while maintaining competitiveness.

For which industrial sectors could the CCfD be a good fit?

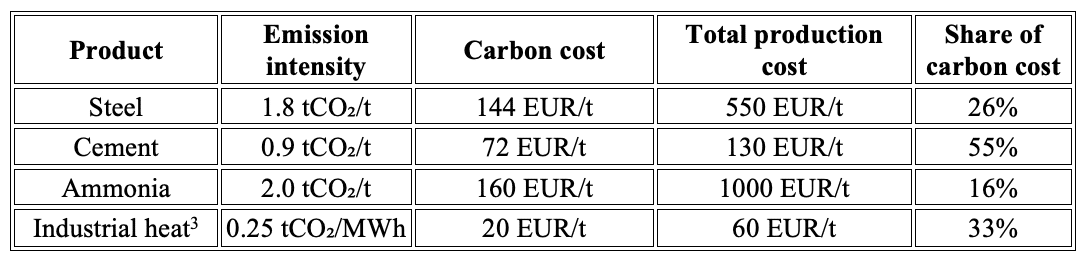

One should think very carefully about the technological scope of CCfDs and determine whether they are the best solution for promoting the decarbonisation of a certain economic sector. The most important criterion here connects to the purpose of the CCfD: mitigating carbon price risk. One should then assess how substantial the contribution of carbon price is to the total production cost of the considered product. An example where carbon price risk is definitely an issue is the cement industry. In steel production, the carbon price is a rather substantial cost component as well. Finally, the cost of carbon can be material in the competitiveness of the various processes used to generate industrial heat (e.g., natural gas-based heat vs. electricity-based heat) (see Table 1).

Table 1: Contribution of carbon cost to total production costs in various industries. Assumptions: carbon price 80 EUR/tCO2; steel price 550 EUR/t; cement price 130 EUR/t; ammonia price 1000 EUR/t; natural gas price 40 EUR/MWh.

Supporting chemical products is generally less attractive to do using a CCfD since the carbon cost only makes up a fraction of total production costs. Furthermore, markets for bulk chemicals such as ammonia, ethylene and propylene are typically international markets. In these markets, producers operating in a jurisdiction that applies a price to carbon may have to compete with producers that do not have to pay that price. As a result, the carbon price will not appear in the international price of those commodities. Therefore, the use of a CCfD would not be a good choice. The situation for products covered by a carbon border adjustment mechanism is different, however: in this case, the import tax provides a level playing field and the carbon price is supposed to appear in the commodity price.[4] Having said that, in the chemical industry it is perhaps better to support the production of green molecules directly. How to best design support instruments for such molecules (such as green hydrogen) is an active area of research.

What is important in the contract design?

The contract design of a CCfD is crucial for ensuring its effectiveness in reducing CO₂ emissions while maintaining economic efficiency. Benchmark selection is a critical element, as it sets the reference emissions level used to calculate payouts. Defining an appropriate benchmark is particularly challenging in sector-wide applications. In that case, benchmarks need to be selected for each industrial product within the sector that is eligible for the auction. Setting them up poorly might lead to a product being favoured or disadvantaged. Selecting the right benchmark is also essential to avoid overcompensating decarbonisation projects while ensuring adequate financial support (Hoogsteyn et al., 2025).

Risk allocation should be a key consideration in contract design as well. A fundamental question is whether the CCfD should cover only the CO₂ price risk or extend to operational cost risks as well. Striking the right balance is difficult, as a broader coverage increases financial security for low-carbon investments but raises the cost of the programme (Hoogsteyn et al., 2025). Including an opt-out clause or exploring alternative mechanisms, such as unilateral CCfDs, can enhance flexibility and make the scheme more adaptable to changing market conditions.

Finally, implementation complexity must be managed carefully. Compared to simpler subsidy schemes, CCfDs require more administrative effort. However, their two-way nature, which allows excess profits to be clawed back when market prices exceed the strike price, can enhance their political appeal. This feature increases public acceptance by ensuring that subsidies do not lead to excessive windfall profits for the industry while still providing downside protection against volatile CO₂ prices.

What is important in the auction design?

Setting up a cost-effective auction for CCfDs requires a careful design to maximise competition while minimising administrative complexity and subsidy costs. A well-functioning auction should attract sufficient participation, ensure fair price discovery, and prevent excessive market concentration.

Structuring the auction format is critical. A competitive bidding process—such as a pay-as-bid or uniform-price auction—can help identify the lowest-cost projects while maintaining transparency. A uniform-price auction, where all winning bids receive the same clearing price, may encourage more aggressive bidding and reduce the risk of strategic behaviour. However, a pay-as-bid approach could elect more projects with the same budget, increasing the impact of the funding round.[5]

Another key decision is defining whether the support is targeted at a specific technology, product, or sector. For instance, a technology-specific approach could focus on industrial heat pumps, while a sector-specific design might allow different chemical producers to compete. A product-specific contract, such as one focused on steel production, is generally easier to organise and simplifies benchmark selection since only one needs to be chosen; however, it reduces participation and, as a result, competition in the auction awarding the CCfD.

Ensuring broad participation is essential to avoid excessive concentration among a few large players, which could lead to higher costs for the support scheme. This requires designing eligibility criteria that allow different technologies and industrial sectors to compete fairly while maintaining a level playing field.

Do you want to know more?

If you want to know more about this topic and get in touch with the FSR electricity team, please contact Chiara Canestrini.

This Cover the Basics benefited from the contributions of Alexander Hoogsteyn, Nicolò Rossetto and Jacopo Cammeo.

[1] Realising such projects using their own capital is expensive for industrial companies, and securing a loan might be difficult because of the uncertainty associated with the carbon price.

[2] A CCfD could be two-sided, meaning that claw-back payments by the beneficiaries of the contract are also possible in case CO2 prices go beyond the strike price. The purpose of these claw-back payments is to avoid windfall profits.

[3] Industrial heat is only a component of an end-product, but because it is common between various industrial end-products a CCfD auction could be organised for it.

[4] In the EU, the CBAM currently apply to cement, iron, steel, electricity, hydrogen, ammonia and fertilizers.

[5] In a pay-as-cleared mechanism, participants have no incentive to bid higher than their actual project cost since they will be paid the as-cleared price anyway. While the cost for the government of a pay-as-bid auction is lower for an identical bid curve, participants are incentivised to bid higher than their actual project cost, which typically leads to a higher bid cure, increasing costs.