An EU industry fit for Net Zero

This is the second instalment of the Topic of the Month on the Green Deal

In this second instalment of the Topic of the Month, we analyse the three legislative initiatives foreseen by the Green Industrial Plan and anchored in the EU Green Deal: the Net-Zero Industry Act, the Critical Raw Materials Act and the electricity market design reform.

Introduction

In the context of the European Green Deal, the European Commission (EC) put forward in February 2023 ‘A Green Deal Industrial Plan for the Net-Zero Age’ to tackle the economic dimension of the net-zero target: EU’s industry. The 2019 Green Deal Communication gathered interest on the competitiveness of EU industry, innovation and skills, but it was only after the 2021-2022 energy crisis and the subsequent disruptive economic and social consequences that the EU decided to boost its industrial arm, aligning with the trend of global initiatives with similar objectives (e.g., US Inflation Reduction Act). Interestingly, the proposals related to the Green Industrial Plan were still framed under the umbrella of the Green Deal, showing how the extensive plan is able to incorporate the response to new issues.

The EU’s industrial Plan aims to equip Europe’s economic model, built on its Single Market, with the tools that are necessary to make it fit for net zero, allowing a massive increase in technological development, manufacturing production and installation of net-zero products and energy supply in the next decade, at the same time tackling the challenges related to these actions (e.g., global competition for raw materials and skilled personnel). The International Energy Agency estimated that the global market for core mass-manufactured clean energy technologies will be worth around USD 650 billion a year by 2030 (around EUR 600 billion), more than three times today’s level.

Net-Zero Industry Act and Critical Raw Materials Act

The Green Deal Industrial Plan is backed by two novel legislative actions supporting the European clean tech sector, the Net-Zero Industry Act (NZIA) and the Critical Raw Materials Act (CRMA). Both are examined in greater depth in a recent FSR Cover the Basics post. In tandem, these instruments aim at strengthening, diversifying and securing supply chains to make sure that the EU can realise its ambitious decarbonisation, energy efficiency, and especially renewable energy targets at the pace necessary to reach net-zero by 2050. Both Acts introduce a new governance architecture for this reinforcement of the EU’s clean tech sector. These governance frameworks operate along similar lines and can be thought of as consisting of five overarching, principal building blocks.

The first of these is prioritisation. The CRMA and NZIA create lists of the raw materials and technologies, respectively, which the EU deems particularly important for the achievement of the objectives of the European Green Deal and which thus merit stronger legislative support. The CRMA’s list of Strategic Raw Materials (SRMs) is compiled based on the economic importance and supply risk associated with these materials as determined by the Joint Research Centre (JRC). To enter the NZIA’s list of Net-Zero Technologies, meanwhile, a technology needs to clear a certain maturity threshold, must be considered particularly important for decarbonisation, and, similar to the CRMA, must be subject to a certain degree of supply risk.

Secondly, strategic raw materials and net-zero technologies are assigned certain 2030 headline targets by the legislation. The NZIA stipulates that, by 2030, the EU should be able to manufacture 40% of its annual deployment needs through domestic manufacturing. For SRMs, meanwhile, the domestic production objectives for 2030 are 10% for the extraction element of the value chain, 20% for processing capacity and 25% for recycling capacity. The CRMA thus provides a more granular set of objectives, while the NZIA specifies that the 40% target applies to the deployment needs of all net-zero technologies as a whole. Nevertheless, all targets are non-binding and are referred to as “benchmarks” in the legislation.

Thirdly, to achieve this rapid improvement in domestic capacity regarding raw materials and clean tech, one of the EU’s chief tools is the acceleration of permitting procedures. As mentioned in the first instalment of this Topic of the Month series, the acceleration of permitting was a supply security tool brought in as part of the REPowerEU emergency measures for certain renewable energy installations and has now been mainstreamed into to the amended Renewable Energy Directive. This approach is now going to be extended to raw materials and clean tech. The NZIA calls for maximum permitting timeframes of 9 months for the construction or expansion of net-zero strategic projects with a capacity of less than 1GW and 12 months for projects exceeding 1GW. Permitting procedures for the operation of a CO2 storage site should take at most 18 months. For SRMs, the CRMA calls for maximum permitting times of 27 months for extraction projects and 15 months for processing and recycling projects.

Fourthly, both Acts seek to diversify EU imports where domestic production is not possible. For SRMs, the CRMA calls for no more than 65% of the EU’s annual demand for any single SRM at any stage of processing to come from a single third country by 2030. For net-zero technologies, the NZIA specifies that, where a third country accounts for more than 50% of “the supply of a net-zero technology or its main specific components within the Union”, the supply should be considered “insufficiently diversified”. This means, inter alia, that in any call for tenders for that technology, public authorities must take account of the effects on the resilience of supply in their decision on how to award the contract.

Fifthly, both Acts recognise that the actual delivery of their ambitious targets will depend heavily on Member State action, and that coordination between Member States, as well as between Member States and the Commission, will be crucial in reaching the objectives in an efficient manner. This is why each Act sets up a governance body meant as a forum for the coordination on projects and financing opportunities. The NZIA establishes the Net-Zero Europe Platform, while the CRMA establishes the Critical Raw Materials Board.

While the adoption process of the Commission’s CRMA proposal was relatively smooth, the NZIA was subject to heated political debate in both the European Parliament and the Council. Controversy centred on the issue of whether, under the NZIA, nuclear energy installations should benefit from the same advantages as those related to, for example, renewable energy. The Commission’s proposal had acknowledged nuclear energy as a net-zero technology, but reserved priority status regarding permitting and financing to a smaller sub-set of strategic net-zero technologies (mirroring the CRMA, which distinguishes between critical and strategic raw materials), which excluded nuclear energy. However, majorities in both Parliament and Council pushed for the inclusion of nuclear energy on the same terms as clean tech such as solar and wind power. The political agreement that was reached on 16 February 2024 abolished the distinction between “regular” and “strategic” net zero technologies altogether and includes a single list of technologies on equal footing. The NZIA is expected to be formally adopted in the near future. Regarding the CRMA, Council and Parliament reached political agreement on 12 December 2023, followed by the Council’s formal adoption on 18 March 2023.

Electricity market design reform

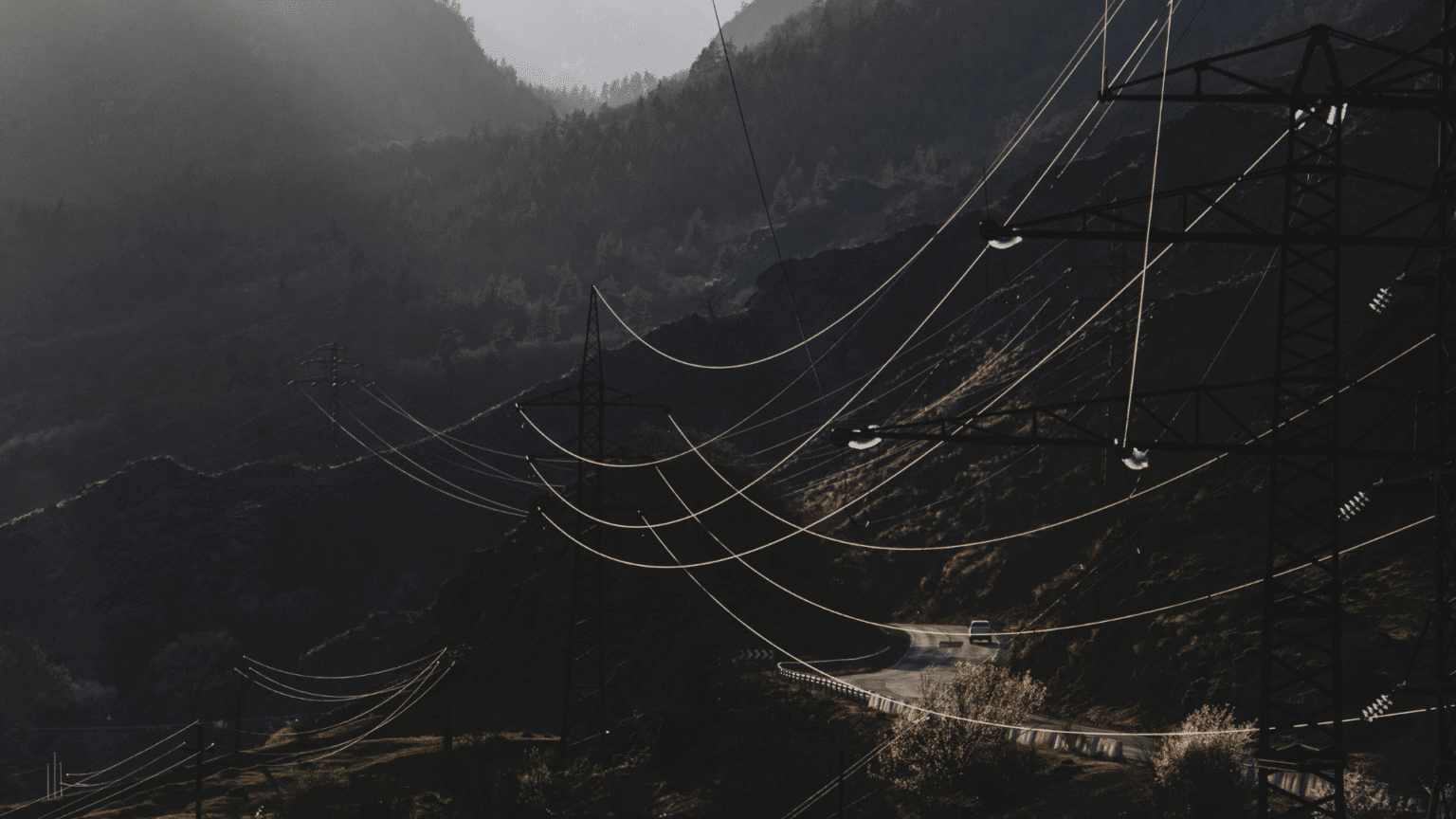

The proposal for a reform of the electricity market design was published in March 2023 by the EC and is a response to calls for structural reform triggered by the energy crisis that started in 2021 and was further aggravated by: the Russian invasion of Ukraine in February 2022; the insufficient hedging by consumers and energy retailers; the difficulties in accessing cheap renewables by consumers; and investment uncertainty, which increased with the many emergency interventions during the crisis.

The reform encompasses three areas of action: protecting consumers from volatile energy prices; enhancing stability and predictability of the cost of energy; boosting investments in renewable energy. The European Parliament and the Council reached a provisional agreement on the reform on 13 December 2023.

One major aspect of the proposal focuses on reinforcing the long-term components of the electricity markets. This should notably help providing more hedging opportunities for all types of market participants.

On that note, the reform aims to boost the development of long-term Power Purchase Agreements (PPAs), private contracts typically lasting 10 or 15 years between a renewable or low-carbon energy generator and a consumer. These contracts provide simultaneously stable revenues for sellers (e.g. RES developers), and long-term price stability for buyers. While the EU PPA market is growing, their availability has remained limited to a few Member States (MSs), and to very large offtakers. The reform aims at fostering the uptake of PPAs in the EU by removing existing barriers. However, some paid focus on the possible risk of market foreclosure (both downstream, in the retail segment, and upstream, in the wholesale one) that PPAs and long-term contracts in general (LTCs) could have, as they tie the hands of consumers to one specific supplier for a long period of time and, therefore, limit liquidity in the market. This is why the EC, since the opening of electricity markets to competition more than 20 years ago, has adopted cautious positions when it comes to LTCs.

The reform also foresees the use of two-way Contracts for Difference (CfDs) in public support schemes for new, non-fossil and low carbon electricity generation. A CfD provides the electricity producer with a revenue guarantee by ensuring a minimum buying price (strongly called for by France and Germany). “Two-way” means that the CfD includes, in addition, a payback mechanism, such that any revenue made from selling energy above a certain strike price is paid back to the counter party, typically a public entity in the case of financially supported RES plants. The provisional agreement on the reform reached in December 2023 broadly aligns with the European Commission’s initial proposal in mandating the use of CfDs. However, two-way CfDs can distort short-term operational signals as well as investment signals. To reduce potential distortions, the reform includes additional guidelines and examples of good practices that MSs can use, such as injection-based CfDs with one or several strike prices and a floor price. Additionally, some argued that the revenues of CfDs will be limited due to potentially lower electricity prices in the future compared to the ones of today; in this case, the real issue would be to allocate the costs of CfDs rather than their benefits.

Moreover, the reform has clarified the role of capacity mechanisms (CMs) in electricity markets. It was discussed in the past whether these tools could be considered a last resort mechanism for resource adequacy or an institution to resort to on a more regular and structural basis. The issue of resource adequacy and the need for CMs has been extensively debated in academia, also recently (see Hancher et al., 2022 and Pototschnig, A., Glachant, J.-M., Meeus, L. and P. Ranci, 2022). In the context of the 2023 reform, both co-legislators agreed to make CMs a more structural element of electricity markets, revising the approach adopted in the Clean Energy Package according to which CMs are only to be implemented if the need for them is demonstrated by an EU-wide adequacy assessment, which can be complemented by national adequacy assessments. The more structural nature of CMs was welcomed by TSOs.

Lastly, the original proposal of March 2023 did not address the claw-back mechanisms introduced in 2022 to capture the windfall profits of power companies, meaning that they would have stopped unless extended as an emergency measure. The mechanisms were not retained in the final agreement of December 2023 either, relieving the concerns of renewable energy producers.

After the provisional agreement reached in December 2023 between the Council and the European Parliament, the latter adopted the reform on 11 April 2024. The Council now also needs to formally approve the act.

Relevant links

The Green Deal Industrial Plan (eui.eu)

A summary of the proposal for a reform of the EU electricity market (eui.eu)

Electricity market reform: what is (not) in the European Commission proposal

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights