ACER’s assessment of the EU wholesale electricity market design

This the first instalment of the Topic of the Month: Reacting to the new energy landscape

Over the last year, energy prices in Europe have increased sharply, reaching unprecedented levels.

This was:

- initially mainly due to a tight LNG market in the face of a faster-than-expected economic recovery after the COVID-19 pandemic, with gas demand outpacing the recovery of supply capacity; and

- later exacerbated by the unprovoked invasion of Ukraine by the Russian Federation army, and the perceived uncertainty around the future availability of gas supplies. Such a perception was clearly justified, given that Russia recently suspended gas supplies to a number of EU Member States, including Bulgaria, Poland and Finland, using specious argumentations.

As gas is still, in many Member States, the fuel used by (marginal) power plants, i.e. those setting the price in the electricity market, high gas prices translated into high electricity prices, which, in turn, led to an increase in the price paid by consumers, not only for gas, but also for electricity.

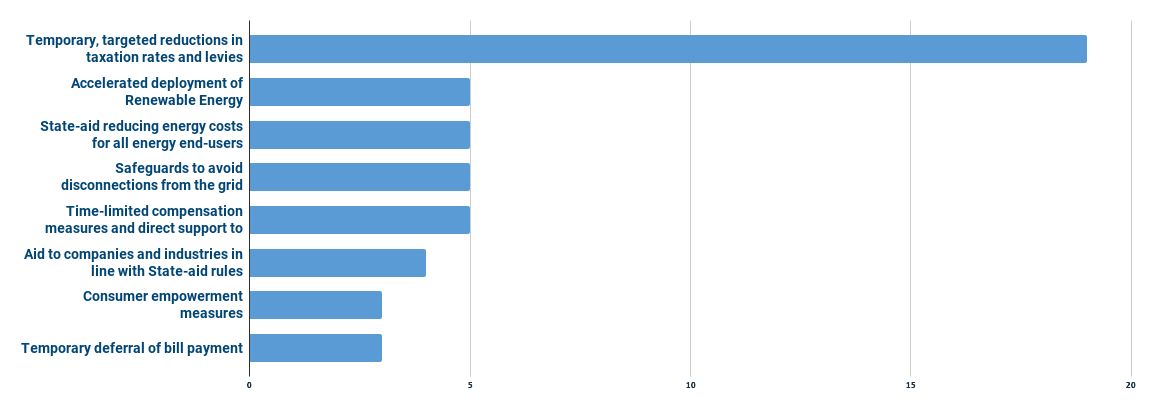

In this context, already in autumn 2021, a number of Member States adopted measures to reduce the impact of higher energy prices on consumers. Most of these measures involved reducing taxation and the level of other levies (for example those to fund renewable support schemes) on energy bills.

The following chart shows the number of Member States which have adopted the main types of measures.

There were also calls to revise the electricity market design. These calls were, in some instances, interpreted as suggesting the replacement of the “pay-as-cleared” remuneration mechanism with the “pay-as-bid” approach in the day-ahead market.[1]

This debate led the EU Agency for the Cooperation of Energy Regulators (ACER) to issue a Note on High energy prices already in October 2021,[2] aiming, inter alia, at bringing some clarity in the “pay-as-cleared” vs. “pay-as-bid” debate. In particular, ACER considered that “the future electricity system is likely to remain inherently volatile, with prices varying significantly as a function of generation availability. As a result, there is a need to incentivise those providers and technologies that can ‘smooth’ this volatility (be it batteries, larger-scale storage, aggregated demand-response providers like electric vehicle fleets, energy communities etc.)”, concluding that “these factors combined would seem to imply that any future market design needs to be able to (a) remunerate technologies above their marginal costs, sometimes quite significantly so, and (b) incentivise the alleviation or smoothing of volatility in the market. The ‘pay-as-clear’ model allows for both of these elements”.[3]

The moves by Member States outlined above also led the European Commission, on 13 October 2021, to issue a Communication proposing a toolbox of measures that Member States or the Commission itself could adopt to counter the increase in energy prices and its causes.[4] Most measures in the proposed “toolbox” were aimed at protecting final consumers directly, but the Commission also called on the ACER “to assess benefits and drawbacks of the current wholesale electricity market design, among other its capacity to address situations of extreme price volatility in the gas markets and available measures to reduce such situations, while ensuring a cost effective transition towards a net zero energy system, and to propose recommendations which the Commission will assess for follow-up as appropriate”.[5]

ACER issued its preliminary assessment in November 2021[6] and its final assessment Report in April 2022.[7] The Report contains important statements about the overall electricity market design, to dispel some of the misconceptions that have fuelled the public debate over the last months. In particular, ACER found that the current wholesale electricity market design:

- “ensures efficient and secure electricity supply under relatively ‘normal’ market conditions” and therefore it is worth keeping. At the same time, ACER recognised that “the current circumstances impacting the EU’s energy system are far from ‘normal’”;

- “is not to blame for the current crisis. On the contrary, the market rules in place have to some extent helped mitigate the current crisis, thus avoiding electricity curtailment or even blackouts in certain quarters”.

However, ACER also recognised that “some longer-term improvements are likely to prove key in order for the framework to deliver on the EU’s ambitious decarbonisation trajectory over the next 10-15 years, and to do so at lower cost whilst ensuring security of supply”. These improvements include:

- Fully implementing current legislation across the EU, in particular with respect to: (a) the minimum 70% cross-zonal capacity target by 2025 (thus enhancing electricity trade between Member States); (b) the roll out of flow-based market coupling in the Core and Nordic regions as soon as possible; (c) the integration of national balancing markets; and (d) the review of the current EU bidding zones to improve locational price signals;

- Promoting the development of liquid and efficient long-term markets;

- Increasing the flexibility of the electricity system.

ACER also warned against wholesale market interventions at times of crises. In particular, ACER suggested that “the need for interventions in market functioning should be considered prudently and carefully in situations of extreme duress and if pursued should, ideally, seek to tackle ‘the root causes’ of the problem (currently gas prices)”.

ACER also proposed measures to protect consumers against excessive price volatility whilst addressing inevitable trade-offs.

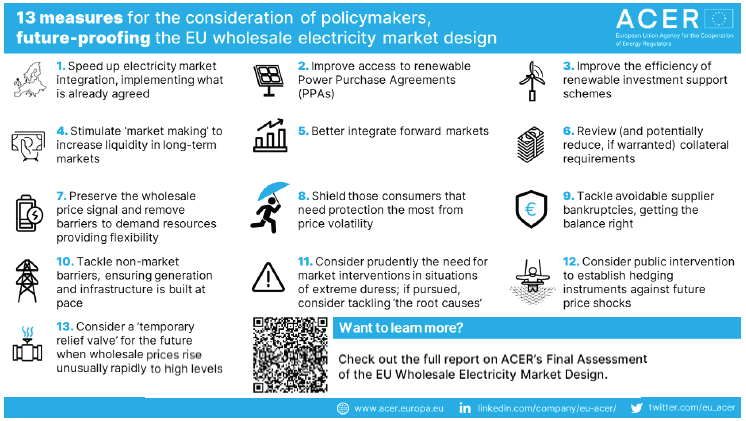

The following chart summarises the main measures proposed by ACER in its Report.

Notes

[1] This was, in fact, an interpretation of what some Member States proposed, since this specific change was not explicitly advocated by any of the proposals.

[2] ACER, Note on High energy prices, October 2021, available at: Energy Prices_Final.pdf (europa.eu).

[3] Ibid., page 12.

[4] Communication from the Commission to the European Parliament, the European Council, the Council, the European Economic and Social Committee and the Committee of the Regions, Tackling rising energy prices: a toolbox for action and support, Brussels 13.10.2021, COM(2021) 660 final.

[5] Ibid., page 14.

[6] ACER’s Preliminary Assessment of Europe’s high energy prices and the current wholesale electricity market design, Main energy price drivers, outlook and key market characteristics, November 2021, available at ACER submits to the European Commission its Preliminary Assessment of Europe’s high energy prices and the current wholesale electricity market design | www.acer.europa.eu.

[7] ACER’s Final Assessment of the EU Wholesale Electricity Market Design, April 2022, available at: ACER publishes its Final Assessment of the EU Wholesale Electricity Market Design | www.acer.europa.eu.

Related FSR content:

- Energy prices and the dimensions of the current market design| Highlights from the debate: Electricity prices and market design

- Electricity microeconomics does not change: only the use we make of it Highlights from the event: Are decarbonisation and the energy crisis challenging the electricity markets design?

Publications

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights