Third-party-access in railway electricity markets is possible

"Under normal economic circumstances, competition in a market is there to stay. It is hardly possible to put a broken egg back into its shell. But what are normal circumstances, nowadays? Currently, we see regulation entering the wholesale electricity market as so-called “excessive” revenues of different electricity generators are curtailed" writes Florian Baentsch, Regulatory Manager at DB Energie GmbH, in this new opinion piece, where he reflects on the discussions of the 22nd Florence Rail Forum.

This article by Florian Baentsch, Regulatory Manager at DB Energie GmbH, originally appeared in the European Transport Regulation Observer “Electricity and Infrastructure Managers: Is there a need for Regulation?” (February, 2023).

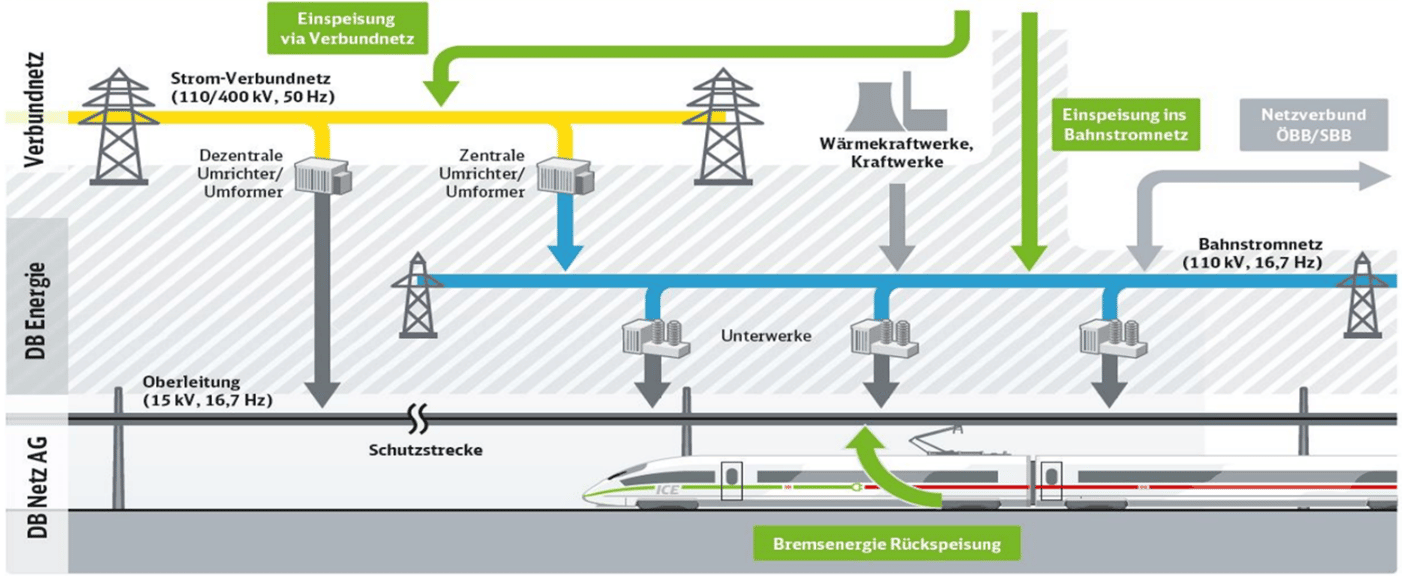

Third-party-access (TPA) in the railway electricity market is possible – this was the main conclusion drawn from the German experience presented at the 22nd Florence Rail Forum in December 2022. On the basis of the European Electricity Directive (2019/944/EC) as well as the national Energy Economics Law (Energiewirtschaftsgesetz) and various domestic regulations, the electricity distribution network to supply traction power to railways in Germany is regulated to promote competition. This nation-wide distribution network on the technical basis of 110 kV and 16,7 Hz is owned and operated by DB Energie GmbH, which is a subsidiary of Deutsche Bahn AG. DB Energie guarantees open access to this network and offers the contractual and technical means for all relevant parties.

Within the competitive railway electricity market, all railway companies are free to contract an electricity supplier of their choice. Accordingly, about ten to twelve electricity suppliers have decided to enter this market to serve railway companies. The legal contracts, economic processes and data exchange formats are similar but not completely identical to those applicable to the regular 50 Hz electricity market. This is due to certain specific qualities of the railway market. For instance, railway customers are travelling around the country and also cross national borders, which is rather unusual in the normal electricity sector. Moreover, railways use different trains and locomotives to serve their transport obligations and may also exchange locomotives with other operators from time to time. Therefore, the point of supply had to be defined in order to aggregate electricity consumption to the correct railway operator. Each railway operator needs to be responsible for the electricity he or she has actually consumed. Market rules are therefore based on the definition that all trains and locomotives operated by each railway unit at each point in time constitute the “virtual point of supply”.

The electricity consumption of each virtual point of supply is calculated as the sum of all measured volumes of electricity consumption. Therefore, the measurement of the electricity consumption of each train and locomotive is a key feature of the competitive railway electricity market. Electricity consumption data is provided by on-board-meters and exchanged with the electricity grid operator. DB Energie, therefore, processes and delivers such consumption data to all eligible parties, such as the train operators and their electricity suppliers, as well as to other railway infrastructure managers in neighbouring countries. This data is also used to charge for the use of the electricity network. Those network access charges are calculated by DB Energie and regulated by the national electricity regulator. All customers find these network charges publicly available on the internet.

Under normal economic circumstances, competition in a market is there to stay. It is hardly possible to put a broken egg back into its shell. But what are normal circumstances, nowadays? Currently, we see regulation entering the wholesale electricity market as so-called “excessive” revenues of different electricity generators are curtailed. Additionally, strict regulation is also entering the end-user market. “Electricity price brakes” have been introduced by the German government to come into effect starting in March 2023. Is there any room left for competition? Hopefully, curtailed revenues in the wholesale market as well as legally binding caps in the end-customer market of electricity, will remain temporary instruments to cope with the energy crisis. As we all hope that this crisis may not last forever, we are also hopeful that competitive electricity markets will prevail.

Traction Power is distributed via the Railway electricity network of DB Energie GmbH

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights