The origin of REMIT and its initial implementation

This is the first installment of the Topic of the Month: The Regulation on Wholesale Energy Markets Integrity and Transparency (REMIT)

The integration of electricity and gas markets across the Union

In the energy sector, the European Union has been working since the early 1990’s to create an Internal Market for electricity and gas, in which consumers would be able to choose their energy supplier and electricity and gas would move seamlessly between Member States. This process was supported by a sequence of legislative packages and took new impetus after an Inquiry by the European Commission in the mid-2000’s found that there were still significant barriers to the development of a fully competitive Internal Energy Market (IEM)[1], including too much concentration in most national energy markets and the lack of transparently available market information leading to distrust in the pricing mechanisms.

With the 2009 Third Energy Package, rules for cross-border exchanges of electricity and gas were reinforced, supported by a stronger governance framework with the establishment of the Agency for the Cooperation of Energy Regulators (ACER) and the European Networks of Transmission System Operators for gas and electricity (ENTSO-E and ENTSOG). This framework also provided for Network Codes and Guidelines to be developed, to define the implementation rules for the integration of electricity and gas markets across the Union.

In the IEM, electricity and gas are expected to move across Europe by responding to prices, so that they flow from where they are cheaper to produce or be made available to where they are more valuable. In this way, consumers would benefit from being able always to resort to the cheapest available energy.

Reliance on prices to govern the flows of electricity and gas across the Union required that such prices reflected the fair interplay of demand and supply. This, in turn, called for a high degree of competition in the wholesale markets, which was itself promoted by the widening of their geographical scope, and for greater integrity and transparency of such markets.

The Regulation on Wholesale Energy Markets Integrity and Transparency

In this latter respect, at the time of the Third Energy Package, no specific provisions existed to prevent market abusive behaviour in the electricity and gas market. Therefore, taking inspiration from the market abuse framework which existed in the financial markets[2], in 2011 the Regulation on Wholesale Energy Markets Integrity and Transparency (REMIT)[3] was adopted.

According to its Article 1, REMIT established “rules prohibiting abusive practices affecting wholesale energy markets which are coherent with the rules applicable in financial markets and with the proper functioning of those wholesale energy markets whilst taking into account their specific characteristics”.

REMIT also introduced provisions for the monitoring of wholesale energy markets by ACER in close collaboration with national regulatory authorities, to detect and deter market abuse. To increase the integrity of wholesale energy markets, prohibitions were introduced with respect to three types of abusive practices: market manipulation, attempted market manipulation and insider trading (i.e. trading based on inside information). The scope of REMIT included contracts and derivatives for or related to the supply of electricity or natural gas or the transportation of electricity or natural gas, where delivery is in the EU and irrespective of where and how such contracts and derivatives (collectively referred to as ‘wholesale energy products’) are traded, Moreover, to promote the transparency of such markets, REMIT also introduced a number of obligations, such as the obligation to publish inside information[4] related to wholesale energy products in a timely and effective manner.

The roles of ACER and NRAs

Monitoring and enforcement under REMIT were split between ACER and the national regulatory authorities for energy (NRAs). In particular, ACER was entrusted with monitoring wholesale energy markets at EU level, as it was the only entity which could have visibility of trading in wholesale energy products across different markets and trading venue. However, ACER did not receive investigatory powers, which were assigned to NRAs, which could also monitor the wholesale energy markets at national level. Any cross-border investigation would then be handled by the relevant NRAs, with ACER having a support and coordinating role.

REMIT also involved the creation of new profiles, such as that of the ‘registered reporting mechanisms’ (RRMs), i.e. entities reporting trades and fundamental data on their behalf or on behalf of market participants[5].

The implementation of REMIT imposed a formidable challenge on all stakeholder involved. Market participants had to introduce internal procedure to comply with the new prohibitions and obligations. NRAs had to organise themselves to investigate market abuse cases notified by ACER of detected by themselves, and to enforce the new prohibitions and obligations. ACER had to develop the human and infrastructure capabilities to monitor wholesale energy markets across the EU, to conduct an initial assessment and analysis of transactions and orders to trade on such markets to identify suspicious events to be notified to NRAs, and to provide access to the relevant information to enable NRAs and other relevant authorities at national level to perform investigations and enforcement (‘data sharing’). ACER was also given the responsibility to ensure a coordinated approach to REMIT at Union level.

The monitoring and enforcement framework

In this latter respect, ACER had to establish a new, sector-specific, monitoring framework to detect and deter market manipulation and insider trading. In this respect, the Agency was tasked with collecting detailed information on:

- all wholesale energy market transactions, irrespective of where they are concluded (on organised markets[6], through other trading venues or over the counter) and of the type of product traded (for physical delivery or financial settlement);

- on all orders to trade,

- on the physical state of the electricity and gas system (referred to as ‘fundamental data’).

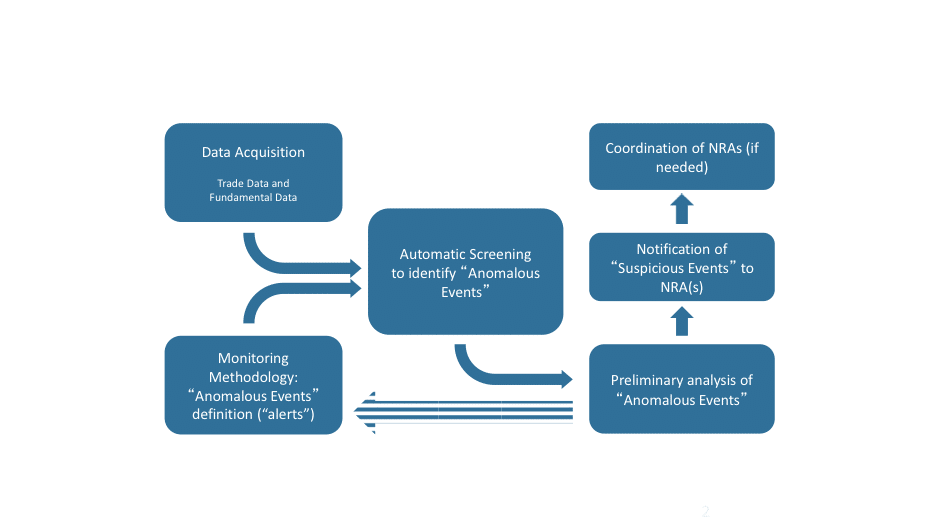

Figure 1 illustrate the monitoring and enforcement framework put in place by ACER to comply with its responsibility under REMIT.

Figure 1: ACER approach to market monitoring under REMIT

The automatic assessment to identify anomalous events, which is the first stage in the monitoring process, is mostly carried out on the basis of ‘alerts’, which are codified types or sequences of transactions and/or orders to trade, possibly in association with other market-relevant developments (e.g. the release of information on the availability or unavailability of certain resources in the market) which are deemed conceivably to entail market abuse. Over time, ACER developed an increasing number of ‘alerts’ covering different market abuse types[7].

The monitoring framework introduced by REMIT was unprecedented worldwide in terms of its geographical and product scope. At that time, and still today, only the Federal Energy Regulatory Commission (FERC) in the US had a comparable task, and, in fact, in January 2015 ACER signed a Memorandum of Understanding with FERC, followed in December of the same year by an Administrative Arrangement covering the sharing of information and the exchange of expert staff between the two entities. However, while FERC collected most of its data on wholesale market transactions from market monitors and other reporting sources, ACER was required to collect individual transactions and orders to trade directly from market participants or RRMs reporting on their behalf.

Following the entry into force of the REMIT Implementing Acts on 7 January 2015[8], the new monitoring framework with its reporting obligations went live in October 2015. In the meanwhile, ACER had started to issue guidance[9] on the application of REMIT[10]. While such guidance was formally addressed to NRAs to ensure the consistent application of REMIT, it is particularly valuable also for market participants, especially regarding the applications of the definitions contained in Article 2 of REMIT.

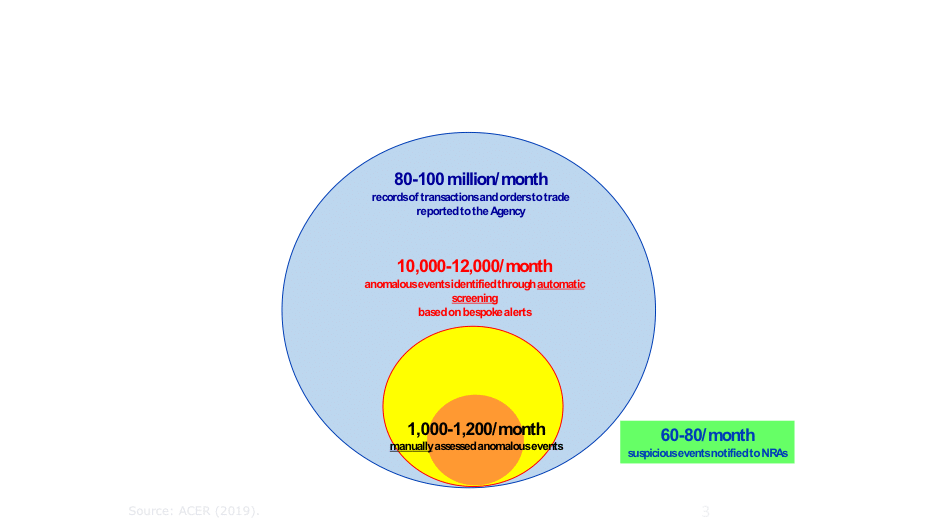

The volume of reported data handled by ACER rapidly increased. The following Figure shows the volume of data typically collected and processed by ACER in 2019, four years after the new monitoring framework started to operate and before the pandemic and the following energy crisis impacted the wholesale energy markets in the EU.

Figure 2 – Wholesale market surveillance at ACER in 2019

Figure 2 shows that, the assessment of approximately 80-100 million records of transactions and orders to trade submitted to ACER monthly resulted in the notification of 70-80 suspicious events to NRAs for investigation and, possibly, enforcement.

Since then, the number of records of transactions and orders to trade has continued to increase, reaching 200-240 million a month in 2020 and 2021 and an average of over 350 million a month in 2022.

The first enforcement decisions were adopted by the Spanish and Estonian NRAs in 2015, imposing fines of 25 million euro on Iberdrola Generaciòn S.A.[11] and of 10 thousand euro on Elering[12], respectively. Since then and up to 2023, close to 100 enforcement decisions have been adopted by NRAs, imposing fines totalling more than 110 million euro[13],[14]. Almost 97% of these fines were imposed for manipulating markets or attempting to manipulate markets, while breaches of the obligation to disclose inside information accounted for slightly over 2% of the total fines. The largest payment for market manipulation was imposed by Ofgem, the British NRAs, on InterGen in 2020, totalling 24.5 million GBP in penalty and 12.8 million GBP is disgorged profits[15].

The development of new forms of trading – such as algorithmic trading – in wholesale energy markets and the experience gained in the implementation of REMIT – including regarding the challenges in coordinating cross-border investigations and the differences in the enforcement regimes across the different Member States, led the European Commission to propose, in March 2023, a revision of REMIT.

The scope of such a revision will be cover by a later episode of this Topic of the Month.

[1] https://ec.europa.eu/commission/presscorner/detail/de/MEMO_07_15.

[2] Directive 2003/6/EC of the European Parliament and of the Council of 28 January 2003 on insider dealing and market manipulation, as amended by Directive 2008/26/EC of the European Parliament and of the Council of 11 March 2008 amending Directive 2003/6/EC on insider dealing and market manipulation (market abuse), as regards the implementing powers conferred on the Commission (Market Abuse Directive – MAD); Directive 2004/39/EC of the European Parliament and of the Council of 21 April 2004 on markets in financial instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC (Market in Financial Instruments Directive – MiFID).

[3] Regulation (EU) No 1227/2011 of the European Parliament and of the Council of 25 October 2011 on wholesale energy market integrity and transparency.

[4] According to Article 2(1) of REMIT, ‘inside information’ means information of a precise nature which has not been made public, which relates, directly or indirectly, to one or more wholesale energy products and which, if it were made public, would be likely to significantly affect the prices of those wholesale energy products.

[5] At the moment, there are more than 130 RRMs registered with ACER.

[6] At the moment, there are 65 Organised Market Places registered with ACER.

[7] For example, to detect ‘wash trades’, ‘transmission capacity hoarding’, ‘layering and spoofing’. On these types of abusive behaviour, ACER also published later on specific guidance notes: (https://www.acer.europa.eu/sites/default/files/REMIT/Guidance%20on%20REMIT%20Application/ACER%20Guidance%20on%20REMIT/Guidance%20Note%20v6.0._published%20on%2019_06_2017.pdf; https://www.acer.europa.eu/sites/default/files/REMIT/Guidance%20on%20REMIT%20Application/ACER%20Guidance%20on%20REMIT/Guidance%20Note%20-%20Transmission%20Capacity%20Hoarding.pdf; and https://www.acer.europa.eu/sites/default/files/REMIT/Guidance%20on%20REMIT%20Application/ACER%20Guidance%20on%20REMIT/Guidance%20Note_Layering%20v7.0%20-%20Final%20published.pdf.

[8] Commission Implementing Regulation (EU) No 1348/2014 of 17 December 2014 on data reporting implementing Article 8(2) and Article 8(6) of Regulation (EU) No 1227/2011 of the European Parliament and of the Council on wholesale energy market integrity and transparency.

[9] The first edition of the ACER Guidance on the application of Regulation (EU) No 1227/2011 of the European Parliament and of the Council of 25 October 2011 on wholesale energy market integrity and transparency was issued on 3 July 2012. Subsequent editions and updates were published in 2012 (2nd edition), 2013 (Updated 2nd edition and 3rd edition), 2015 (Updated 3rd edition), 2016 (4th edition), in 2019 (Updated 4th edition), in 2020 (5th edition) and in 2021 (Updated 5th edition and 6th edition).

[10] As required by Article 16(1), second sub-paragraph, of REMIT: “The Agency shall publish non-binding guidance on the application of the definitions set out in Article 2, as appropriate”.

[11] https://www.cnmc.es/la-cnmc-sanciona-iberdrola-generacion-con-25-millones-de-euros-por-manipulacion-en-el-precio-de-la.

[12] https://www.konkurentsiamet.ee/en/news/competition-authority-imposed-fine-breach-wholesale-energy-market-rules-elering.

[13] 112.7 million euro, of which 1

[14] Between 2012 and 2013, FERC concluded a number of market abuse investigations, including three landmark ones on Constellation Energy Commodities Group, resulting in a settlement for a civil penalty of 135 million US$ and the disgorgement of profits of 110 million US$, J.P. Morgan Venture Energy Corporation, imposing a civil penalty of 285 million US$ and the disgorgement of profit of 125 million US$, and on Barclays Bank PLC and four of its traders, resulting in civil penalties totalling 453 million US$ and the disgorgement of profits of 35 million US$.

[15] https://www.ofgem.gov.uk/publications/ofgem-requires-intergen-pay-ps37m-over-energy-market-abuse.

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights