This Policy Brief reflects upon the discussions at the 16th Florence Rail Forum that took place in Florence on May 7th 2018.

On the dedicated webpage, all presentations and summaries are also available.

Download full pdf – European Transport Regulation Observer – Policy Brief 2018/10

Read it Online:

[accordion tag=h2 clicktoclose=”true” scroll=”true”]

[accordion-item title=”Highlights” id=1 state=closed]

European Rail Freight could offer a way to solve many transport related problems, mainly heavy congestion and pollution. It is also, in theory, the more efficient way to transport goods on longer distances. There are good reasons why national and European policies support the sector and aim at improving the European network.

Yet, the modal share of international rail freight remains low in Europe. The reason for this mainly lies with the fragmented national railway systems that create high costs and wait times at border crossing.

As part of the so called 4th Railway Package the EU has passed a bundle of legislative measures to improve the situation. Meanwhile the 2016 Rotterdam Ministerial Declaration and several dedicated national railway plans gave another push from the national level to overcome some of the long lasting issues.

The 16th Florence Rail Forum discussed the persisting challenge of improving rail freight in Europe based on these ongoing initiatives and exploring what further action might be needed.

[/accordion-item][accordion-item title=”What is wrong with European Rail Freight?- a comment by Matthias Finger” id=2 state=closed]

Matthias Finger

Director of the Transport Area of the Florence School of Regulation (EUI)

Professor at the École Polytechnique Fédérale de Lausanne (EPFL)

The results of the 16th Florence Rail Forum are quite sobering: rail fright is not making significant progress. Still, all the good arguments are there and remain valid: rail freight is economically superior to road, especially on long distances. Not to mention the fact that it is also ecologically superior, thus actively contributing to the EU’s decarbonisation objectives. Yes, there is intermodal competition which is tilted towards transport by road, but this cannot fully explain why rail freight stagnates at 17% market share. And there is also no excuse anymore that the regulatory frameworks are not sufficient; indeed, much of the regulation is in place and has been so for quite a while, namely when it comes to interoperability, most recently thanks to the 4th Railway Package (2016). Significant investments have also been made; one can mention the fact that 75% of all the CEF investments go into railways, but also contributions from structural and cohesion funds, along with EFSI and EIB investments. Also, in terms of research and innovation (e.g., Shift2Rail), significant efforts have been made recently, which should lead to cost reductions and efficiency improvements in the rail sector overall. Furthermore, market liberalization has happened and should stimulate competition and investments.

The focus on Rail Freight Corridors (RFCs)

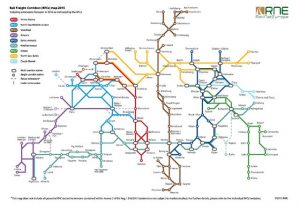

Already back in 2005 an international corridor management approach was promoted among Infrastructure Managers (IMs) and Allocation Bodies (ABs). Regulation No. 913/2010 concerning a European rail network for competitive freight became effective on 9 November 2010, requiring Member States to establish international, market-oriented RFCs. Already then the main challenges had been identified, namely, coordination of path allocation among the IMs involved in a given corridor, interoperability, infrastructure investments and development, as well as integrating intermodality and especially terminals into the corridor management process. Today there are 9 corridors and corresponding corridor management bodies, coordinated in turn by RailNet Europe (RNE), as shown on the below map (two additional ones are proposed (Amber and New Alpine-Western Balkan) in Eastern Europe).

And this focus on corridors is clearly the right approach, especially when integrated into the TEN-T network. This approach has been developed further since and become institutionalized with corresponding executive boards. In 2016 the so-called Rotterdam Declaration gave explicit support to the rail freight corridor approach, reflecting the agreement of both the railway sector and the politicians.

What is wrong? Why is there not more progress?

The reasons for the slow progress are actually mainly the same ones as the ones for which remedies have already been taken: there is first of all lacking interoperability and lacking investments, a typical chicken-and-egg problem: investments will only come if progress is made in terms of interoperability and, inversely, progress in terms of interoperability requires more investments. And this is of course a much broader problem which cannot be handled by corridors and the corridor approach.

To recall, half of the European rail freight is cross-border. So, corridors would be particularly crucial, yet there are still big cross-border problems, which have not been overcome by corridor governance. National specificities in many technical and commercial matters still significantly prevent efficient solutions, not to mention the lack of data exchange across both companies and countries. And this despite the fact that railway infrastructures remain an underutilized asset in most of the countries. In short, the potential of rail freight corridors is not yet fully exploited, owing to the fact that national priorities still generally prevail.

Overall, while there is some progress in matters of rail freight corridors, rail freight and railways more generally, such progress is simply too slow as compared to the other transport modes, namely road, where we witness, as of recently, disruptive innovations in terms of automatization and digitalization. This, of course, again increases modal competition. In short, in the current rapidly evolving mobility world, rail turns out to be the most vulnerable mode of transport, to the point that one wonders whether, despite all the good arguments and huge amounts invested, rail freight can remain competitive at all.

So, what to do?

At this point, I see mainly three types of remedies, that could potentially get us out of the gridlock in which cross-border rail freight and rail freight corridors in particular are trapped:

- The first remedy pertains, in my view, to a broader, more intermodal definition of the rail freight corridor. Indeed, corridors and corridor management should not be limited to rail, but should also include both the front and the back ends of the corridor, namely ports and dis/charging stations, i.e., the link to maritime and road transport. Such a broader definition of freight corridors, including a broader governance of such corridors involving road and maritime actors certainly has the potential to improve modal shift.

- The third remedy pertains to rail freight corridor governance: the point was convincingly made by one of the participants to the 16th Rail Forum, namely that an EU-wide rail freight corridor governance body should be set up so as to harmonize the various and often similar efforts in the various corridors and, especially, to create visibility for the corridor approach.

Given the urgency to make rail freight corridors more competitive in light of the more rapidly innovating road sector, one may indeed ask the question whether the purely sector (railway) approach to corridors is still appropriate. And the Commission’s recent focus on multimodality (e.g., the “Year of Multimodality”) is certainly pointing into exactly that direction, and is as such certainly a good indication of the way forward.

[/accordion-item][accordion-item title=”Improving European Rail Freight- a summary of discussions by David Kupfer” id=3 state=closed]

David Kupfer

Florence School of Regulation, Transport Area

The 16th Florence Rail Forum picked up the topic of European Rail Freight analyzing the state of play of the sector, notably since it was last discussed in Florence 3 years prior at the 14th Florence Rail Forum. Discussions at the Forum were structured around four questions.

Which way forward for European Rail Freight – what are the political priorities and what are the sector priorities?

In the beginning, the discussions looked at the assessment of the current situation of rail freight which many described as somewhat disappointing. Several discussants pointed out that the market share has remained stable over the past 15 years. The share is at about 17% in the EU which is very low by comparison, for instance with North America where it is at about 55%.

The EU’s regulatory framework in place was generally viewed positively and as providing stability after the long discussions around the fourth railway package. EU regulatory policy addresses the organization of the market, technical interoperability and infrastructure development. All these elements were also at the focus of the discussions at the Rail Forum.

In 2016 the transport ministers passed the so-called Rotterdam Declaration. Unlike other council declarations, this political document was joined by a sector declaration in which the industry affirmed its approach for the strategy and lay out its own priorities. Participants at the Rail Forum underlined the importance of the Rotterdam declaration and discussed the state of play of several initiatives that had followed it. The ten sector priorities that were part of the Rotterdam declaration have been followed up by the nomination of dedicated rapporteurs for each issue and regular follow up meetings at the ministerial level.

Another development of the recent years is the emergence of national rail freight plans, notably in the Netherlands and Germany. These contain measures that are well known, such as reduced track access charges for rail freight. While everyone considers such additional support helpful, the European perspective of such initiatives need to be strengthened and they could possibly be scaled up to a European Rail Freight Plan.

The Rail Freight Corridors (RFC) were the other main element of the discussion. The RFC was set up in 2010 (Regulation EU 913/2010 ) with the following objectives:

- strengthening co-operation between Infrastructure Managers on path allocation, deployment of interoperable systems and infrastructure development;

- striking a balance between freight and passenger traffic along the Rail Freight Corridors, giving adequate capacity and priority for freight in line with market needs and ensuring that common punctuality targets for freight trains are met;

- promoting intermodality between rail and other transport modes by integrating terminals into the corridor’s management and development.[1]

The discussion at the rail forum showed that one of the prime political priorities is to further develop the European Network to create multimodal lines with clear minimum standards. The RFC play an important role for this, but there needs to be more cross-corridor activities and greater alignment between the RFC and the Core Network Corridors (CNC) which have a multimodal approach.

The vision for the future of the RFC that was formulated is that they could eventually merge into a single network. Concrete steps towards that vision were discussed: The single information document, informal meetings of network managers. There were, however, different views on the most desirable system of governance for the RFC: at which level should capacity be allocated? How to overcome cross-border issues?

It was often suggested in the discussion to adopt a more multi-modal perspective: especially when it comes to the question of how to grow the demand for rail freight overall, port connections may be the most important aspect to take into consideration. Furthermore, some also suggested that the antagonistic view between road and rail needs to be overcome in the sense that stronger rail freight will partly depend on well-functioning road based feeder services.

In this context, the role of digital technologies was pointed out to foster integration between different countries and actors as well as a greater customer focus. It was pointed out that the road sector is moving ahead faster than rail in adopting new technologies, most of all autonomous driving.

RFCs as a tool to develop and offer more customer-oriented services – how to meet expectations?

Among the challenges defined for the rail sector, improving service quality is still high on the agenda. There was an agreement in the discussion that the European industry is changing overall and that rail freight needs to adapt to the evolving transportation needs. There were different views on the priorities. Some pointed out the shrinking number of raw materials; others pointed out that that the continuing growth of e-commerce may provide future opportunities for rail freight.

The RFC can play a role in this: their function can be to develop products and manage markets and capacity in collaboration with the sector. Secondly, they can help to deal with interoperability and operational issues.

A current lack of performance measurement was voiced by several actors. Depending on how one defines the main purpose of the RFC, the appropriate KPIs need to be deployed to measure their performance. The next question in relation to performance is which financial incentives, both positive and negative, could be given to stimulate better performance. Here the RFC’s remit needs to be more clearly defined in the regulation.

Regulatory Bodies play a crucial role for the RFC. They take over responsibility and need better framework conditions specifically in the areas of performance assessment, capacity allocation and coordination between the different regulatory bodies.

The challenges the RFCs face are to increase the visibility, reliability and accountability while increasing their flexibility, so as not to create further administrative burdens.

A new governance model for the RFC could be a two-tier approach where capacity is allocated at a European level and cross-border issues are dealt with at the regional level. Some discussants feared, however, that a multi-layered approach could create additional confusion and bureaucracy.

In order to speed up infrastructure improvements, it was suggested to introduce rewards for member states, which build infrastructure that goes beyond the minimum standards defined by EU regulation: a financial incentive is needed as IMs often do not face enough financial gain from investments in infrastructure that only payback at a much later stage. The prominent example for this was longer and heavier trains: there are many cases where infrastructure is currently being upgraded and made suitable for 750m trains when it would be much more prudent to already implement the requirements for 1000m long trains.

Many actors in the railway sector appreciate the role the RFCs play in carrying out pilot projects. However, it seems that they could move even faster in promoting new solutions. As technologies evolve more and more, IT-tools emerge that would offer quick wins and opportunities to overcome long-standing issues at a limited financial cost. One example that was brought up in this regard refers to applications that can help in overcoming the language issue at border crossings.

Solving technical cross-border issues and bringing about seamless interoperability – what are the most urgent needs?

There seems to be some urgency to bring structure and prioritization to the abounding technical cross-border issues. Clearly, and on top of the list, ERTMS implementation needs to be accelerated. In the discussion the question was raised, whether industry and the sector are ready to complete ERTMS within the highly ambitious timeframe that foresees completion by 2030. Even though the long-term economic benefits of ERTMS are not disputed, there is often a lack of financial incentive for Infrastructure Managers to invest in ERTMS upgrades. Therefore, to accelerate deployment, the proposal was made to create packages for Infrastructure Managers combining ERTMS deployment obligations with other measures that provide more immediate benefits.

The implementation of the technical pillar of the 4th Railway package may take longer than 2019, as is foreseen by regulation. The Commission currently focusses on actions in the area of timetabling and getting rid of obsolete national rules. But the number of operational issues that slow down cross-border rail freight is long and tackling them efficiently needs prioritization: among the operational problem areas discussed at the Rail Forum are energy metering, tail lights, braking sheets, train numbers and train composition. Among these, it appeared that the current lack of a harmonized system for energy metering may be among the most urgent issues to address.

In light of the recent Rastatt incident, new solutions for contingencies were prominently discussed. Most importantly the incident seems to have created some momentum for cross-border cooperation in order to prevent similar incidents in the future. Two lessons learnt seem to be: the European rail freight system is currently vulnerable; overcoming this vulnerability should be of the highest priority for all involved. Secondly, cross–border action is possible in a timely manner if the pressure is high. After the incident rail freight actors got together to develop a contingency management handbook. This is not only a highly useful tool for future incidents, but also a demonstration of what is possible in terms of finding quick compromise and agreement between a number of actors in the rail freight sector.

Taking Stock and Looking Ahead: Challenges and Opportunities for Rail Freight in Europe

Regarding the challenges discussed during the day, the concluding debate came back to diagnosing a quality challenge, a cost challenge and a service challenge. Together these bring about a European challenge which mainly consists of the fact that rail freight is currently unable to make use of its competitive advantages on longer distances. Rail freight has clear efficiency advantages over road transport, especially on longer distances. Yet in Europe, these are nullified by the immense cost (both financially and in terms of time), created due to the procedures at border crossings.

Among the things most frequently mentioned in the discussion was the need for better exchanges between the relevant actors in the sector in the areas of research. To foster technological development Infrastructure Managers should communicate more with the S2R joint undertaking about possible synergies between existing research projects. There is a challenge to align S2R with ongoing programs at national level – S2R member organizations are the key players to provide this link.

Future opportunities were seen when looking at Central and Eastern European Countries. It was pointed out that the sector is growing in Poland which is already the second biggest rail freight market in Europe. Yet, as in many eastern EU countries there is a considerable infrastructure investment backlog. Nevertheless, new companies have recently entered the rail freight market in the region, which can be seen as a good sign for the future growth potential of the sector and for the benefits of introducing competition.

[1] https://ec.europa.eu/transport/modes/rail/infrastructures/rail_freight_oriented_network_en

[/accordion-item][accordion-item title=”Shift to Rail. Are We Doing Enough – a comment by Juan Montero” id=4 state=closed]

Juan Montero, part-time Professor, European University Institute, Florence School of Regulation

Railways are more competitive than road when transporting freight over long distances. The strong position of rail companies in the United States is a good example. The underlying economics are not different in the European Union. However, bottlenecks in the provision of cross-border services have limited the market-share of railways against road: delays at borders, lack of harmonization in signaling, train length, axle-load, etc.

There is substantial room for growth for rail freight services in the EU if bottlenecks are reduced. The EU institutions have identified such opportunities. EU policies are focused on the creation of harmonized conditions along the so-called Rail Freight Corridors. A specific institutional framework, with specific funding, has been designed and implemented to reduce bottlenecks in the leading cross-border freight corridors, with the objective to reduce costs, increase reliability and as a consequence increase the competitiveness of rail against road.

There is wide consensus around the notion that the future of rail freight transport in the EU depends on the success of long distance cross-border services. It is widely agreed that the EU has correctly identified the existing obstacles for the success of long distance rail services. The EU is devoting substantial resources to reduce such obstacles, specifically in terms of the elimination of bottlenecks in infrastructure.

However, there is growing disappointment with the actual results of such a widely shared policy. Substantial investment in the short term is required in order to achieve results in a much longer term. Member States and Infrastructure Managers face budgetary restrictions. Results in terms of increase of rail market share have not materialized so far. A further effort is requested in order to reach results.

The EU institutions are trying to increase the efficiency of their harmonization policies. They want to identify the most efficient short term measures that, with lowest cost, would have the largest impact in terms of elimination of bottlenecks. This seems a sensible approach.

However, in the long term, it is important to make sure incentives are correctly defined for all actors. In particular, the right incentives have to be provided to those actors required to make the heavy investments to eliminate bottlenecks: the Infrastructure Managers.

Infrastructure Managers across Europe receive low payments for the provision of their services for freight transportation (even if there are strong divergences across States, the overall average is clearly below track access charges for passenger services). Railway undertakings pay very low access charges when providing freight transportation. As a consequence, Infrastructure Managers have little incentive to increase the volumes of freight transportation.

New incentives for Infrastructure Managers might be necessary. Increase in access charges would damage the competitiveness of rail freight transport, so it does not seem to be the right incentive for Infrastructure Managers. However, new incentives can be designed, for instance in the form of higher public funding when targets related to larger traffic volumes are met.

While the direction of the EU shift to rail policy is widely shared, there is growing consensus that it is not enough to meet the goal of the migration from road to rail. It might be the right time to analyze the existing incentives, in particular the incentives for Infrastructure Managers.

[/accordion-item]

[accordion-item title=”Further Readings” id=5 state=closed]

The goal of the 16th Florence Rail Forum was to discuss how to improve the conditions for European Rail Freight. Representatives of the European Commission, major stakeholders as well as leading academics engaged in the discussions which addressed four central issues:

- Which way forward for European Rail Freight – what are the political priorities and what are the sector priorities?

- RFCs as tool to develop and offer more customer-oriented services – how to meet expectations?

- Solving of technical cross-border issues and bringing about seamless interoperability – what are the most urgent needs?

- Taking Stock and Looking Ahead: Challenges and Opportunities for Rail Freight in Europe

There is a shared vision across Europe to develop a rail freight system that is capable of significantly shifting freight traffic from road to rail. The 10th Florence Rail Forum was an opportunity to take stock of achievements and remaining challenges on the way to that goal. The central focus lay on the most crucial initiative in the area of rail freight infrastructure: the Rail Freight Corridors. Their aim is to eventually establish a network of fully interoperable corridors that allow seamless cross border freight transport throughout Europe. Discussions at the Forum addressed several challenges among others technical barriers to interoperability, diverging standards and safety requirements, language requirements for train drivers and the conflicting issue of network access priorities. The 10th Florence Rail Forum underlined the importance of a European dialogue and closer cooperation to achieve what is shared among all actors in the rail freight business. Against the background of growing traffic volumes and strong competition from the road sector, the European rail freight sector has no choice but to push these processes forward.

MINISTERIAL DECLARATION “Rail Freight Corridors to boost international rail freight”, 2016

This Declaration on the Rail Freight Corridors was endorsed by ministers from the EU Member States, Switzerland and Norway during the TEN-T Days 2016 in Rotterdam. Ministers wished to express their strong support for the development of international rail freight transport and in particular their strong support for the continuation of the market-oriented development of the Rail Freight Corridors. Member States play a vital role in these corridors through the Executive Boards and by ensuring coordination among them.

Railway freight transport statistics, Eurostat, 2018

This article focuses on recent rail freight transport statistics in the European Union (EU). The total performance in the EU-28 can be estimated at around 403 billion tonne-kilometres in 2016.

Islam, D.M.Z. & Blinge, M. Eur. Transp. Res. Rev. (2017) 9: 11

Rail freight transport plays an important role in creating a sustainable and competitive transport market, but has lost ground to other competing modes of transport, particularly road. The freight market is driven by a mix of external influences, including spatial planning, the decline of bulk traffic such as coal, and the arrival of a competent, aggressive and commercially competitive alternative. Transport demand is evolving, both in terms of cargo characteristics and customer requirements, and will continue to change in response to industrial and consumer needs.

The assessment of the economic damage has been made by determining the losses of added value for the manufacturing sector (customer side) and the service sector of the railway-based supply chain. The full report is available in German language only.

The concept of a European rail network for competitive freight has met much interest and response from the rail freight sector and other stakeholders. Several parties raised questions about the interpretation of different parts of the Regulation. The Directorate-General for Mobility and Transport (DG MOVE) has therefore decided to publish this handbook on the Regulation with guidelines and recommendations for its implementation, contributing to a harmonised implementation of the regulation and the use of existing good practices. The handbook contains practical advice for the parties concerned and gives examples on how to deal with the various aspects of implementation. The examples given in this handbook are partly taking up practices, methods and suggestions from the parties involved in the Rail Freight Corridors or in the ERTMS-corridors (…).

[/accordion-item]

[/accordion]