Written by Ross Baldick

Today, the majority of electric energy consumed in the US is served in so-called “organized” or “centralized” markets that are operated by Independent System Operators/Regional Transmission Organizations (ISOs/RTOs). These entities, established in the late 1990s/early 2000s, have significantly supplemented traditional bilateral trading between utilities with additional centralized trading options that include centrally dispatched “real-time” (RT) markets.

RT markets typically involve economic dispatch of offers for every five minute interval. Dispatch signals are sent to individual generation units, representing a target “base-point” to be reached at the end of the upcoming five minute interval. Transmission constraints are taken into account in the economic dispatch calculation and locational market prices are used to settle the market. To the best of my understanding, no European electricity market clears offers for energy at this timescale, and none of them represent physical transmission constraints at the nodal level nor use locational pricing.

Besides RT markets, US ISOs/RTOs also operate day-ahead (DA) markets, including unit commitment and locational pricing. These type of markets considers both energy and ancillary services, and is basically a forward market. That is, unlike in the EU markets, accepted generation offers in the US DA markets are not necessarily assumed to be accompanied by physical commitments to generate.

In the US, the RT market, which might be viewed as the “spot” market, is settled based on deviations from day-ahead positions, which in this context should be viewed as short-term forward financial commitments. The representation of transmission and other constraints is explicitly designed to match, where possible, the features represented in the DA market. That is, unlike EU markets, there is not the distinction between a market for trading and a “technical market” for, for example, dealing with transmission limitations. US DA and RT markets are, to the extent possible, designed to be consistent.

In addition to these options for trading through the ISO/RTO, bilateral trade options are available. These can be for financial performance (for example, as in a contract for differences), but market designs also allow for “physical” scheduling of generators. Bilateral trade options are available across seams between the various ISO/RTO markets too. In addition, several US exchanges trade monthly and longer term contracts (e.g., the Chicago Board of Trade and the Intercontinental Exchange).

ISOs/RTOs are also responsible for “reliability” and administer certain other markets, such as for transmission rights and, in some cases, longer term capacity.

Although the majority of the electricity in the US is now delivered through ISOs/RTOs, there is a large part of the country, particularly in the Western Interconnection outside of California, that is served by more traditional vertically integrated utilities with bilateral trading. However, over time, the organized markets have grown geographically. We might say that the “seams” between a particular ISO/RTO market and the geographically adjacent region outside that organized market have typically been “stitched” through growth of the organized market.

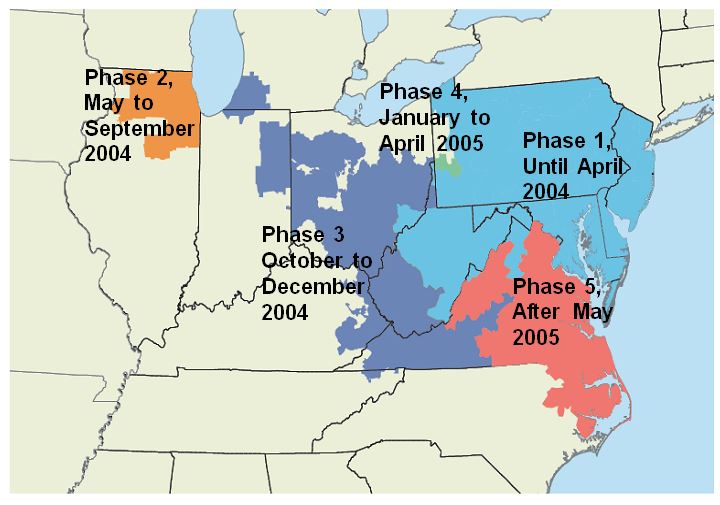

For example, as shown in Figure 1, the PJM RTO footprint grew from somewhat larger than the original states of Pennsylvania, New Jersey, and Maryland to currently include 14 states. Various entities joined PJM, thereby becoming part of the organized market. Similarly, the Midwest (now Midcontinent) ISO has evolved over time into a larger footprint, connecting entities from Canada to Louisiana.

Figure 1: Growth of PJM over time. Source here

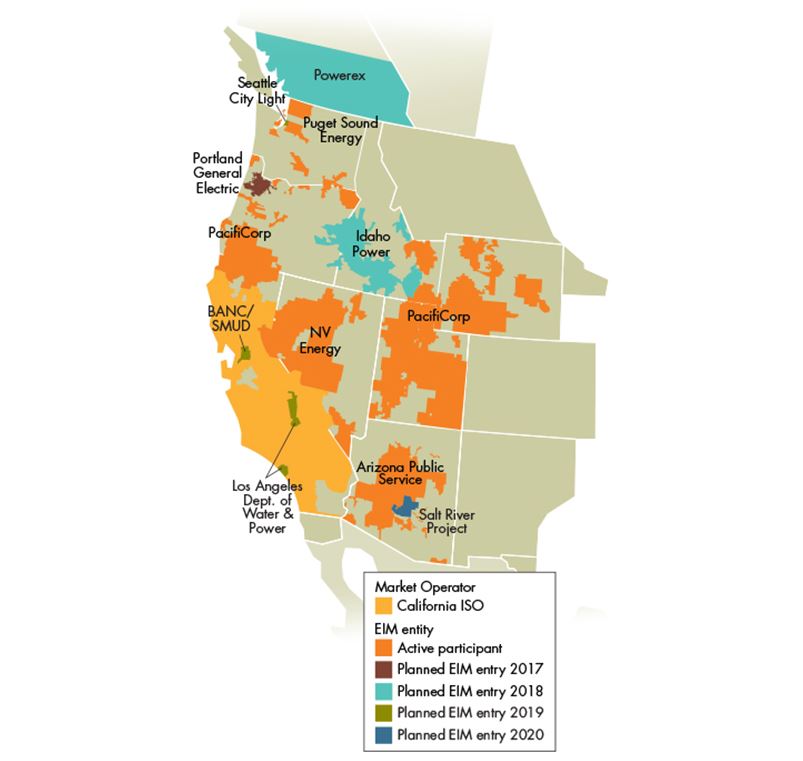

The case of the California ISO (CAISO) is particularly interesting in this regard. CAISO has operated DA and RT nodal markets in California since 2009, and as with other ISOs/RTOs, it has also supported bilateral (hourly and longer term) trading with other entities, mostly in neighbouring states. As shown in Figure 2, the geographical scope of the CAISO RT market was greatly expanded in 2014 with the development of the “Energy Imbalance Market”, which now involves entities from many states in the Western Interconnection, offering into the CAISO RT market.

Figure 2: Geographical scope of California Energy Imbalance Market. Source

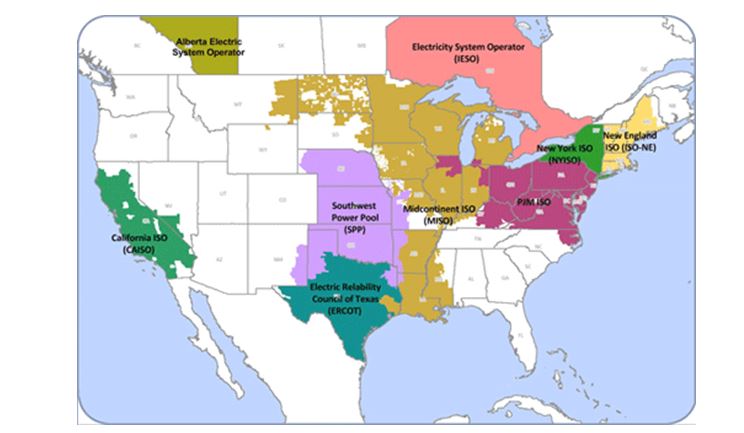

This “organic” growth of ISO/RTO markets has resulted in large areas operating under uniform real-time pricing rules, as shown in Figure 3. This has significant implications for the integration of renewable energy sources in the US. In particular, the wide geographical scale of current ISO/RTO RT markets often allows for the averaging of net load variability in a “single” large system. Such wide-scale balancing has clear advantages for dealing with variability in renewable output, since variations at the five minute to hourly range are likely to be uncorrelated across large geographical footprints.

Figure 3: Geographical extent of RTO/ISO regions (full extent of California Energy Imbalance Market not shown). Source

Moreover, since the generator base-points are updated every five minutes, net load following capability at this time scale is being obtained for “free” due to the action of RT markets. That is, ancillary services are not used for following most intra-hour variations of net load, except for cases of extreme ramps. Therefore, ancillary services in the US primarily deal with intra-five minute variability and uncertainty.

Wide-scale RT markets have facilitated and will continue to facilitate the integration of renewables in the US markets. Texas is a good case in point. The part of the state managed by the Electric Reliability Council of Texas (ERCOT) has been able to manage relatively smoothly a significant penetration of wind energy in the past few years, surpassing the analogous figure for many Western European countries.

The US now has several large ISOs/RTOs. Those in the Eastern Interconnection, including PJM and MISO, are geographically adjacent and electrically interconnected. These entities will likely continue to exist and it is doubtful that one will supplant the other, because institutional barriers hamper any further comprehensive integration of adjacent RTOs. That is, some of the existing seams between those ISOs/RTOs will persist in the future.

Nevertheless, there is work ongoing to improve the efficiency of trading and the coordination of system operation across the borders of adjacent ISOs/RTOs. Particular effort is currently being made to facilitate the integration of inter-ISOs/RTOs trading in RT markets within the Eastern Interconnection, as it has already occurred through the Energy Imbalance Market in California. This focus on real-time is based on the argument that efficient trading in all forward markets stems from efficient real-time trade.

This distinction between the evolution of wide geographical scale trading in US markets and that in EU markets is key. The emphasis on real-time coordination has already facilitated large-scale integration of renewable resources in the US, with ERCOT as a very positive example of this success. I will argue next week that similar progress in the EU will be much more difficult, in part, because of the lack of large-scale real-time coordination.

Note:

This discussion piece and the next are based on a presentation at the 2015 Berlin Conference on Energy and Electricity Economics (BELEC 2015), 28—29 May, 2015.