Regulatory Impetus to Enable Electric Vehicles Adoption

This is the first instalment of the Topic of the Months: Energy and Transport regulation, links between the sectors

The global electric mobility landscape is developing at a rapid pace, particularly in the efforts to decarbonise the road transport sector which account for 16% of global emissions[i]. In 2022, the world global electric vehicle (EV) car fleet exceeded 10 million, with a 55% increase in the number of new electric vehicle sales compared to the previous year[ii]. The EV ecosystem brings together several stakeholders as the transport sector couples with the power sector, and linking these two sectors is the EV charging infrastructure. The Electric vehicles ecosystem can be categorised at the electric vehicle level based on 1) chassis type (2-wheeler, 3-wheeler, 4-wheeler, Trucks, Buses, Mobile Machinery); 2) engine types (hybrid, battery); and at the charging infrastructure level based on 3) charging process (plug-in or swapping); 4) charging speeds (slow, fast, medium); 5) power flow (unidirectional, bidirectional); and 6) use (public or private)[iii].

EV sales have been growing more in the 4 wheeler segment in advanced markets such as USA and Europe, while in developing countries (mainly China), it also includes a significant share of 2 wheelers, 3 wheelers and buses. With regard to the charging infrastructure, slow charging has been growing steadily, with fast charging emerging as an alternative, again dominated by China i. While there is traction for EVs in the USA, Europe and China, EVs is still not a global phenomenon, as developing and emerging economies are slow to adopt EVs due to high purchase costs or lack of charging infrastructure. Many countries have come up with national policies and schemes to enable EV adoption through targeted incentives for the purchase of EVs, manufacturing of EVs, setting up of charging infrastructure, special tariffs for use of EV charging infrastructure etc. As public funding is limited, a recent study by MIT[iv] addresses the ‘chicken or egg’ problem and suggests incentivising charging infrastructure could be a more cost-effective way of increasing EV adoption than direct vehicle subsidies, particularly to attract private sector participation. Bringing in both public and private sector participation will unlock innovative business models at the charging infrastructure level, as well as on how EVs can integrate and provide support services to the power sector.

Regulatory enablers for EV Charging Infrastructure

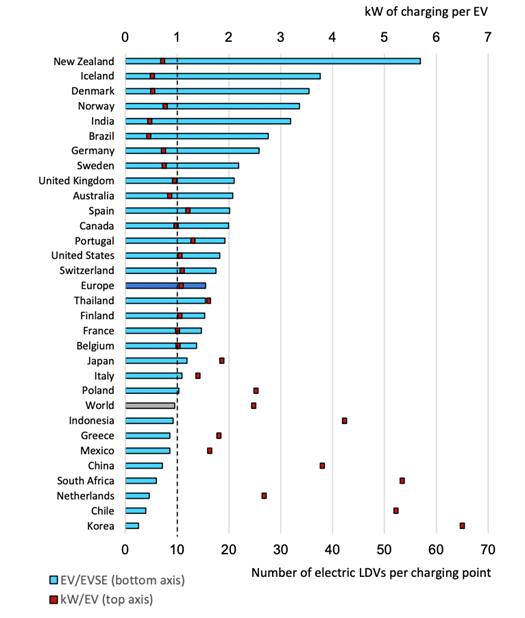

A key deterrent to EV adoption are concerns about availability of charging infrastructure for EV users iv. Many countries have introduced policies to help address this concern. For instance, in the European Union (EU), the 2014 Alternative Fuel Infrastructure Directive (AFID) recommended EU Member States to have a public charger per 10 electric light-duty vehicles (LDVs) by 2020 and in its proposed new legislation under the Fit for 55 Package[v], the Alternative Fuelling Infrastructure Regulation (AFIR)[vi] would mandate 1 kW of publicly available charger per battery electric vehicle (BEV). The figure below shows that the 2021 worldwide average was 10 EVs per charger and 2.4 kW per EV, however to further improve EV adoption and ease of use, other aspects such as charging time and range anxiety need to be addressed.

EV policies should therefore consider certain minimum parameters to enable faster deployment of the EV charging infrastructure and thereby improving EV service offerings. On the supply side (meaning entities that would setup charging infrastructure and provide charging services) regulation should focus on 1) reducing entry barriers and introducing competition either in the market or for the market; 2) incentives for setting up charging stations 3) deployment of charging station based on use and social geography; 4) end user data sharing and privacy; 5) eliminating administrative barriers to setup charging infrastructure; 6) vehicle to grid capabilities; and 7) charging price-setting mechanisms either regulated or market based. On the demand side (meaning the EV user) regulation should focus on 1) charging standards to enable interoperability; 2) digital platforms to access and book charging points; 3) multiple payment methods for ease of payments; 4) specification of minimum services to be provided at charging points; and 5) harmonisation of EV charging user registration across jurisdictions. With increased competition and as countries move from initial stages to growth stage, business model innovation can emerge in the form of service innovation (green retailing, multi charging speeds); partnership innovation (charging network access); and price innovation (subscription models or e-roaming)iii.

Regulatory enablers for EV Grid Integration

EVs interact with the power sector in two ways: as an additional load (mainly connected to the distribution grid) and as a potential source of flexibility (with vehicle to grid (V2X) capability). What this essentially means for the power sector is an increase in total electricity consumption and the required generation and network capacity. Therefore it is important to factor the location of charging infrastructure, charging infrastructure capabilities and charging times into the long-term power system planning. If charging infrastructure and its use is not well planned, then it can lead to two key issues: 1) grid congestion which induces service interruptions and ageing of assets and 2) increase in peak demand leading to high energy prices ultimately inconveniencing the EV users iii.

To manage these issues, the traditional approach would be to invest in additional new generation or distribution capacity in terms of wires or storage. Many alternative methods are emerging and have been applied or tested by countries to help utilities defer their investments in the conventional methods. An alternative method to manage peak demand could be to incentivise EV users to shift their EV charging from peak hours to off-peak hours through price signals e.g dynamic tariffs or time-of-use tariffs. Likewise, alternative options to manage the local grid congestion could be to allow the distribution companies to apply flexibility measures, which can be procured from the market place directly or through intermediaries such as aggregators and which can be provided by EV or non EV resources iii.

Many options are available for policy makers and regulators to enable quick adoption and deployment of EVs, and based on country demographics and market maturity these regulatory measures could be applied in a phased manner. With the introduction of EVs, mobility meets the power sector; while this presents multitude of challenges, it also provides avenues for innovation and cross-sectoral synergies to unlock benefits for various stakeholders in the EV ecosystem.

[i] International Energy Agency (2022), Global Electric Vehicle Outlook

[ii] World Economic Forum (2023), 1 in 7 cars sold globally now is electric

[iii] FSR Report, Pradyumna Bhagwat, Samson Yemane Hadush, Swetha Ravi Kumar (2019) Charging Up India’s Electric Vehicles : Infrastructure Deployment and Power System Integration

[iv] MIT Study, Emil Dimanchev, Stein-Erik Fleten, Don MacKenzie and Magnus Korpås (2023), Accelerating Electric Vehicle Charging Investments: A Real Options Approach to Policy Design, available at: https://ceepr.mit.edu/wp-content/uploads/2023/01/MIT-CEEPR-WP-2023-03.pdf.

[v] https://ec.europa.eu/commission/presscorner/detail/en/IP_21_3541.

[vi] Proposal for a Regulation of the European Parliament and of the Council on the deployment of alternative fuels infrastructure, and repealing Directive 2014/94/EU of the European Parliament and of the Council, Brussels, 14.7.2021 COM(2021) 559 final.