Opening up PSO services in France to competition: a true devolution of regional rail services

This opinion piece by Patricia Perennes, Rail Transport Economist, Trans-Missions, originally appeared in the European Transport Regulation Observer

This opinion piece explains how France’s “New Rail Pact” promotes decentralized implementation of competitive tendering for regional rail services, giving regions significant autonomy. This has resulted in diverse approaches to timelines, contract content, rolling stock procurement, facility maintenance, and ticket distribution, creating a valuable opportunity to learn and share best practices.

In line with the PSO Regulation, the ‘New Rail Pact’ mandates the opening of French regional rail services to competition. A key feature in this process is the truly decentralised legal framework established by the French legislator. The regions have been granted significant autonomy in determining both the timeline and the specific terms of the tendering processes for the rail services they oversee.

Various regional decisions regarding the timetable for opening up to competition

The New Rail Pact does not require a minimum (or impose a maximum) percentage of regional rail services to be put out to tender in new or renewed TER contracts. It also establishes a transition period (December 2019 to December 2023), during which French public transport authorities (PTAs) can either directly award contracts to the incumbent operator, SNCF Voyageurs, or initiate competitive tendering for regional contracts.

The only binding requirement under French law, derived from the PSO Regulation, is that by 2033 all TER services must be awarded through competitive tendering.

French PTAs have taken advantage of the flexibility offered by the law: during the transition period each region chose either to extend existing contracts or sign new agreements with SNCF Voyageurs. Some regions also initiated competitive processes. However, not all the contracts grant 100% of regional rail services to SNCF Voyageurs for their full duration. Many regions opted to progressively remove certain ‘lots’ (i.e. groups of railway lines) from these contracts, thus reducing their scope over time through what are called ‘detachable coupons.’

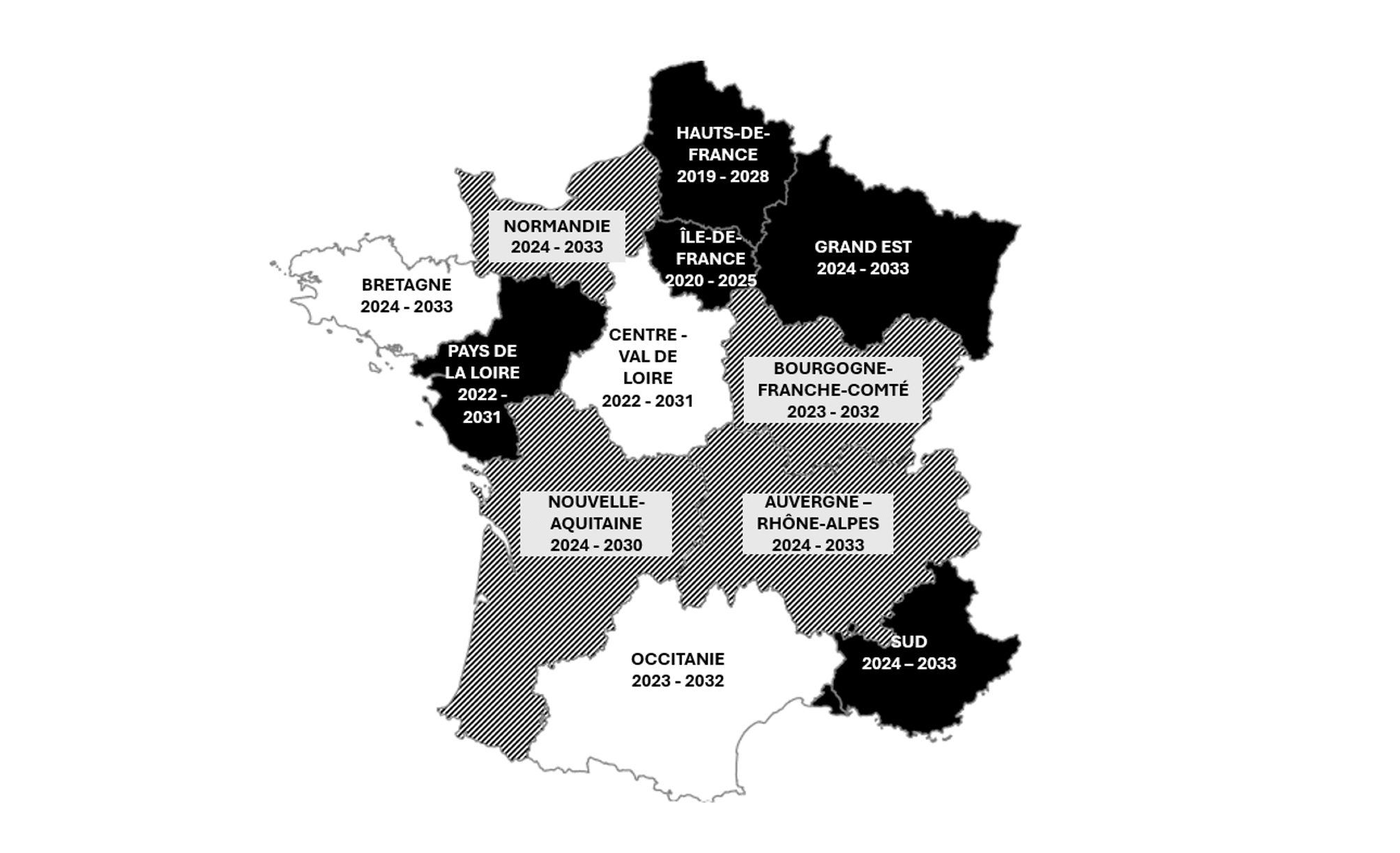

Hence, the current TER contractual landscape is very diverse in France, as is illustrated in Figure 1. Five regions (black) have successfully completed competitive tendering for some lots. Four regions (striped) have begun the process of tendering some lots to competition. The three remaining regions (white) have postponed competitive tendering until the expiry of their current contracts.

Figure 1

Various regional decisions regarding the contents of competitively attributed contracts

In addition to differences in timelines, the contents of newly awarded contracts vary significantly. The New Rail Pact provides PTAs with substantial freedom to tailor contracts to regional needs. There could be multiple examples, but we will limit ourselves to three illustrations.

First, the law does not specify who should purchase rolling stock when replacements are needed at the beginning of a new contract. Consequently, regions such as Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France and Occitanie have created Sociétés Publiques Locales (public bodies under direct regional control) to manage the purchase and/or maintenance of rolling stock. Other regions, such as Sud, in contrast require bidders to procure rolling stock themselves, supported by regional grants.

Second, approaches to maintenance facilities also vary. Sud requires bidders to build new facilities, with financial support from regional grants. Normandie, on the other hand, tasked SNCF Voyageurs with upgrading existing facilities near Caen before the beginning of the contract for the corresponding lot.

Third, ticket distribution strategies differ widely. Grand Est requires SNCF Voyageurs, in its directly awarded contract, to handle ticket distribution for all its lots, including those operated by competitors. Sud, in contrast, has removed ticket distribution from all TER contracts (both directly attributed and tendered) and awarded this responsibility through a separate competitive process.

This diversity in regional approaches will serve as a valuable resource to evaluate the outcomes of opening regional rail services to competition. The lessons learned and best practices identified can

then be shared and implemented across the French regions and maybe even in other European countries, ensuring continual improvement in service delivery and efficiency.

This opinion piece by Patricia Perennes, Rail Transport Economist, Trans-Missions, originally appeared in the European Transport Regulation Observer, “Tendering railway public service obligation contracts: a balance sheet” (January 2025).

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights