Written by Tim Schittekatte

Offshore wind development has become a hot topic in the energy community and beyond. To an outsider, it might not always be clear what the contribution of offshore wind is to our energy system[1]. In this post I will share some facts and figures, exploring offshore energy infrastructure and the importance of streamlining regulation in a broader perspective.

Offshore wind like Ireland – The total size of the turbines at work

The total offshore wind capacity installed in Europe by the end of 2015 equaled 11 GW, which is over 91% of the global offshore wind capacity installed[2]. This power is delivered by 3,230 turbines spread over 82 sites. As an easy comparison, 11 GW is approximately the total installed capacity on the island of Ireland[3]. Off course comparing the aggregated capacity of a national generation fleet with Europe’s offshore wind capacity is unfair. Wind is not blowing 24/7, while conventional thermal generation, still the major category of the generation portfolio in most EU nations, can be switched on and off when deemed appropriate.

Offshore wind like Bulgaria – The total energy flow

Therefore when comparing numbers, it makes more sense to look at electricity production. In the EU a total of slightly more than 40 TWh of offshore wind electricity was generated in 2015. Such a level of generation means an average capacity factor, defined as the average power generated divided by the rated peak power, of 42% was obtained. This was 18 percentage points more than onshore wind in Europe for that year. To put this number in perspective, 40 TWh is about the same volume of electricity consumed in Bulgaria[4],[5], a country inhabited by 7.2 million people, that year. Looking at the broader context, 11.4% of the total energy consumed in 2015 in the EU was generated by wind turbines, with 9.9 % onshore and 1.5 % offshore.

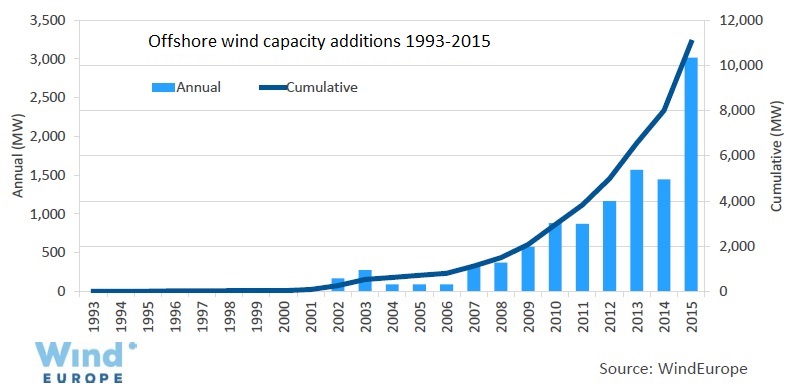

Offshore wind like Latvia – The speed of capacity growth

On the figure below the spectacular increase in offshore wind capacity installed in Europe over the period between 1993 and 2015 is shown. In 2015, 3 GW of additional capacity was installed, which was twice as much as the additional capacity installed in 2014. In financial terms, 2015 saw €13.3 billion was invested in new offshore wind assets. As a reference, €13.3 billion amounted to about half of the of Latvia’s GDP that year[6]. Today, about two third of clean energy investment in Europe is in wind energy. 2015 was the first year in which the total investment in new offshore wind assets was slightly higher than that of onshore wind assets.

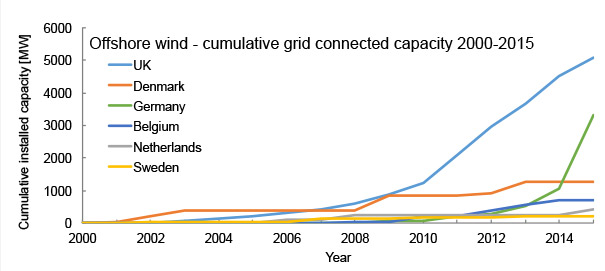

UK accelerating, Denmark standing still and Germany catching up

On the figure[7] below, the evolution of installed offshore capacity from 2000 to 2015 per country is displayed. Only the countries with a significant amount of offshore wind are shown[8].

Interesting trends are visible on the figure above. We can see that Denmark was pioneering offshore wind together with the UK and while the capacity installed in the UK is increasing significantly every year, the growth in Denmark has dropped off. Also it seems that Germany has recently started investing strongly in offshore wind, from being the 6th offshore wind nation in 2010 it caught up with the other countries and now convincingly ranks 2nd. In the first half of 2016, relatively little capacity was added in Europe, only in Germany and in the Netherlands were new offshore wind farms connected to the grid[9].

Technology and business versus policy and regulation

Explaining these somewhat diverging evolutions is not straightforward. Offshore wind project developers are global players and they all have access to the same turbines, why would they prefer building wind farms near the coast of one country over the other? Are wind conditions and the depth of the sea, two major cost drivers, really that different between countries? Or alternatively, can these developments be better explained by national energy policy and regulation? Are these national policies and regulations both efficient and effective? Should they be harmonised? Some of these questions are easier to answer than others. Next week I will write about the regulatory aspects in an attempt to explain who is in charge of the planning, construction and operation of offshore cables and who has to pay for these.

[1] If no specific source is mentioned, data is used from ‘Wind Power in Europe – statistics for 2015’ (2016) and ‘The European offshore wind industry – key trends and statistics 2015’ (2016), both published by EWAE (former name of Wind Europe) and a presentation by Andrew Ho (senior analyst, Wind Europe) on the stakeholder kick-off workshop 29 June of PROMOTioN (Progress on Meshed HVDC Offshore Transmission Networks, Horizon 2020 project).

[2] Source: http://www.gwec.net/global-figures/global-offshore/

[3] Data from ENTSO-E transparency platform, capacity installed in 2015 in the Irish bidding zone, link: https://transparency.entsoe.eu/

[4] Electricity consumption in Bulgaria in 2015 was 38 TWh. Source: ‘Electricity consumption in Bulgaria up 2.5 % in 2015’, article published on 5/01/’16 by the Sofia News Agency, link: http://www.novinite.com/articles/172506/Electricity+Consumption+in+Bulgaria+Up+2.5+in+2015

[5] It should be mentioned that although the total yearly energy volume generated by offshore wind and consumed by Bulgaria is similar, it would not be possible to power the country with this offshore energy as demand and supply would not be equal at every time step. This is due to the intermittency of the delivered wind power and the inflexibility of demand.

[6] Data from Worldbank, link: http://data.worldbank.org/data-catalog/GDP-ranking-table

[7] The figure displayed in this section is build up using data from ‘The evolution of offshore wind power in the United Kingdom’ by P. Higgins and A. Foley published in Renewable and Sustainable Energy Reviews (September 2014) for the 2000-2010 period and yearly reports published by Wind Europe for the period 2011-2015

[8] China (1 GW installed in 2015), but also the US (almost no installed capacity in 2015, but targets are set), are starting to show serious interest in offshore wind development. Source: http://www.gwec.net/global-figures/global-offshore/

[9] In Germany 258 MW was added and in the Netherlands 253 MW. Source: ‘The European offshore wind industry Key trends and statistics 1st half 2016’ published by Wind Europe