Network Industries Quarterly, Vol. 19, No. 2 – Problems of Regulatory Reforms in Electricity: Examples from Turkey

This issue of the Network Industries Quarterly looks into the change in the Turkish electricity markets. The regulatory reform in the Turkish electricity markets began in the 1990s. It has culminated with the privatization of distribution of retail companies in the early 2010s. The enactment of the Electricity Market Act in 2001 was a turning point toward a more competitive market environment. However, the evolution of the reform has not gone perfectly. The transformation of the electricity industry had conflicting consequences for the market structure. The tensions between economic and political preferences have become more prevalent. In this respect, the Turkish experience provides additional insights into issues surrounding the process of opening markets to competition. While regulatory reform seems complete in terms of unbundling, tariff policies and the institutionalization of regulatory processes, competition policy issues begin to surface and political interference become more prevalent.

In this issue, we look into different aspects of the recent Turkish experience. In the first article, Özbuğday and Alma discuss distribution/retail unbundling in the Turkish electricity markets. The paper draws attention to the increasing issues of competition policy as a result of privatizations in the industry.

The second article by Şenerdem and Akkemik brings forward a fundamental issue: the lack of data and the difficulty of constructing social accounting matrices. The authors introduce a social accounting matrix (SAM) with a special emphasis on electricity for the year of 2010. They put first steps forward of developing a general empirical perspective on the nature of electricity markets. The lack of reliable data has become a key issue in understanding the relative success of the reform efforts. Significantly, changes in efficiency are very hard to measure. These difficulties create opportunities for political interventions.

The third paper by Oğuz and Göksal addresses recent policy shifts in the Turkish electricity markets. Focusing on the existing distribution tariffs, the paper emphasizes the need to improve the regulatory framework.

In the last paper, Benli and Benli look into a major hurdle in the implementation of the regulatory reform; namely, how to deal with illegal use and electricity theft from a legal perspective. By applying the Coase theorem, they argue that electricity theft should be seen as a social problem rather than a contracting issue.

Guest editor: Dr Fuat Oğuz

The guest editor of this special issue on “Competition Policy in Energy Markets: The Experience of Emerging Economies” is Dr Fuat Oğuz (B.A.: Ankara University, M.A.: The American University, Ph.D.: George Mason University). Dr Oğuz works in the areas of competition and regulation. He published extensively on telecommunications and energy markets. Dr Oğuz has experience in the tariff models, regulatory policies, market analyses and regulatory impact analysis. Currently, he is a professor of economics at Yıldırım Beyazıt University. He teaches law and economics, economics of regulation and antitrust.

Download full pdf – Network Industries Quarterly – vol 17 – issue nr 2 – year 2017

Read it online:

[accordion tag=h2 clicktoclose=”true” scroll=”true”]

[accordion-item title=”The Effectiveness of Unbundling in Turkish Electricity Supply Market” id=1 state=closed]

Fatih Cemil Özbuğday[1] and Hasan Alma[2]

[1] Assistant Professor of Economics, Ankara Yıldırım Beyazıt University, Faculty of Political Sciences; fcozbugday@ybu.edu.tr

[2] Ph.D. in Finance, the Energy Market Regulatory Authority; halma@epdk.org.tr

Abstract

Supply competition in electricity markets requires a sufficient degree of vertical separation between distribution and retail segments. If unbundling is imperfect, an uneven playing field emerges in which some suppliers are sabotaged by network operators. In this regard, the experience of the Turkish electricity market is not uncommon. The incentive of distribution companies and affiliated supply companies to prevent entry and competition is even stronger in Turkey in the wake of joint privatization of electricity distributors and supply businesses. However, for various reasons, both the Competition Authority and the Energy Market Regulatory Authority have been lenient towards the actions by distribution companies, associated last-resort suppliers or parent companies that prevent the effectiveness of unbundling. Recently, a new wave of investigations that cover suppliers serving one-third of the electricity supply market has been initiated by the Competition Authority. The final verdicts on these investigations will impinge upon the effectiveness of unbundling in the Turkish electricity supply market.

1. Introduction

Traditional electricity markets are characterized by various positive vertical synergies. Meyer (2012) counts two possible sources of these positive synergies: coordination economies and market risk economies. While the former refers to the fact that all rings of the supply chain in the electricity market must be coordinated because of real-time balancing requirement of the system, the latter relates to the dependencies of electricity enterprises on other market players’ operational and strategic decisions. Thus, given the positive vertical synergies and the complexity of vertical relations, imposing unbundling to boost competition in the electricity supply market is a very demanding task. As put by Mulder and Shestalova (2006), transformation of the vertically integrated electricity industry into markets governed by competition rules is quite complicated, and according to Joskow (2005) even the best experts have disagreements about how to achieve this transformation.

The solution to transform vertically-integrated electricity markets in to competition-based markets is unbundling, in which retail services and distribution activities are vertically separated.[3] Unbundling (referred to as legal unbundling) started to take place in Europe with the European Commission’s introduction of the Second Electricity Directive in 2003, and since then many European countries unbundled their electricity markets to varying degrees. The approach to unbundling in the United States (US) has been quite different. Due to the cessation of deregulation of the power markets since the 2000-2001 energy crisis in California, vertically integrated franchised suppliers remained as monopolies in their geographic areas. Besides the absence of deregulation, the fragmented regulatory structure of the US electricity supply industry and strong private ownership rights resulted in less emphasis on unbundling in the US in comparison to Europe (Meyer, 2012).

Distribution/retail unbundling is the most essential element of retail competition in which consumers are free to choose their suppliers. However, experience to date suggests that vertical separation of the electricity supply industry is a necessary but not sufficient condition of competitive electricity supply markets. Legal unbundling, which corresponds to the execution of supply and distribution activities under different legal entities and is the most generic form of unbundling observed, cannot fully eliminate the incentive of the distribution company to provide a favorable treatment to its affiliated supply companies. This risk of preferential treatment to affiliated companies is also recognized by the European Commission in its Sector Inquiry on the energy markets. The Commission argues that even under legal unbundling, network operators and affiliated supply companies have both the incentive and the ability to obstruct entry and competition in the electricity supply market. Thus, in the words of Beard et al. (2001), an upstream firm with market power (a natural monopoly network operator that provides “access to the grid” for supply companies) can sabotage rivals (competing suppliers) at the downstream stage by degrading the quality of input and/or raising rivals’ costs. For instance, network operators can employ non-price discrimination such as delays in network connection or administrative obstacles to prevent customers from switching. At the extreme, this form of “sabotage” could result in vertical foreclosure (Meyer, 2012) and thereby a loss in consumer welfare.

2. The Experience of Turkey with Retail Competition and Unbundling

Turkey’s electricity market saw a dramatic restructuring during the last 15 years. There has been a radical transition from a vertically integrated public monopoly model to a model of regulated competition with privatized and unbundled firms. Each of the distribution companies together with the affiliated last-resort suppliers is privatized, the distribution activities and retail sale (supply) operations are legally unbundled, and the supply market is gradually opened to competition. As of 2017, consumers with an annual consumption of at least 2,400 kWh of electricity (which corresponds to approximately 83 TRY or 23 US dollars per monthly bill) are free to choose their suppliers. The number of eligible consumers as of March 2017 is about 3.5 million, a substantial majority of which (2.2 million) is residential consumers. The most recent available figures suggest that switching rates (based on consumption value) hover around 1.4% (EMRA, 2016). The last-resort suppliers have near-monopoly positions in their franchised regions. All these suggest that there are problems with the development of retail competition in Turkish electricity markets. Part of the problem can be attributed to many other factors such as cross-subsidized tariffs, regulated rates below market prices, low levels of customer awareness, and public involvement in the electricity market for political purposes. Yet, a major obstacle to the development of the electricity supply sector in Turkey is insufficient vertical unbundling of supply and distribution.[4]

As mentioned previously, the observation that network operators and affiliated supply companies have both incentive and the ability to hinder entry and competition in the electricity supply market is prevalent across many electricity markets. Non-price discrimination by network operators is common to obstruct customers’ switching activity. This incentive of network operators and affiliated supply companies to prevent entry and competition is stronger in Turkey than in Europe? Than in the US? in the wake of joint privatization of electricity distributors and supply businesses.[5] The new owners spent billions of US dollars (12.75 billion in total) to own not only electricity distribution assets but also the customer base in the regions concerned. Combined with the legal unbundling of the retail and distribution businesses, the enhancement of retail competition is likely to undermine the profitability of last-resort suppliers leaving them with significant losses in cash flow (Ozbugday et al., 2016).

The incentives of network operators and affiliated supply companies to prevent entry and competition in the electricity supply market are apparent in the complaints filed before the Competition Authority. The themes in these early complaints indicate non-price discrimination against rival suppliers and preferential treatment over affiliated last-resort suppliers (regarding meter reading, billing, repairs, advertising, sharing consumer information, etc.) by the network operators. The problems with the effectiveness of unbundling are also mentioned in the Sector Inquiry report of the Competition Authority (Competition Authority, 2015). However, these early complaints were dismissed by the Competition Authority. It argued that the dynamic structure of the liberalization process and time frame make it difficult to distinguish whether the complaints should be attributed to abuses of dominant positions, and therefore to the ineffectiveness of unbundling, or to problems resulting from the implementation of sectoral regulations.

A new wave of investigations has been initiated by the Competition Authority since the second half of 2016. All these investigations refer to the violation of the Article 6 of the Competition Act, as the firms concerned allegedly acted against the principles of legal unbundling. In two of the investigations, the investigation also covered the parent company (Enerjisa and Bereket) that jointly owns the distribution company and the affiliated supplier company. The supplier companies in the investigations collectively sell about one third of the electricity at the retail level in Turkey. More detailed information about the investigations is provided in Table 1.

Table 1: The New Wave of Investigations Initiated by the Competition Authority

|

Date |

Decision Number |

Distribution Company |

Associated Supplier |

Market Share of the Supplier in 2015[6] (%) |

Parent Company |

|

19.07.2016 |

16-24/407-M |

Akdeniz Elektrik Dağıtım A.Ş. |

CLK Akdeniz Elektrik Perakende Satış A.Ş. |

3.26 |

CLK |

|

28.12.2016 |

16-45/715-M |

Toroslar Elektrik Dağıtım A.Ş. |

Enerjisa Toroslar Elektrik Perakende Satış A.Ş. |

8.96 |

Enerjisa |

|

28.12.2016 |

16-45/715-M |

Başkent Elektrik Dağıtım A.Ş. |

Enerjisa Başkent Elektrik Perakende Satış A.Ş. |

6.38 |

Enerjisa |

|

28.12.2016 |

16-45/715-M |

İstanbul Anadolu Yakası Elektrik Dağıtım A.Ş. |

Enerjisa İstanbul Anadolu Yakası Elektrik Perakende Satış A.Ş. |

4.47 |

Enerjisa |

|

16.02.2017 |

17-07/69-M |

ADM Elektrik Dağıtım A.Ş. |

Aydem Elektrik Perakende Satış A.Ş. |

3.84 |

Bereket |

|

16.02.2017 |

17-07/69-M |

GDZ Elektrik Dağıtım A.Ş. |

Gediz Elektrik Perakende Satış A.Ş. |

6.34 |

Bereket |

The final verdicts on these investigations will impinge upon the effectiveness of unbundling in the Turkish electricity supply market. If the Competition Authority acts leniently and finds that the allegations against the distribution companies and associated last-resort suppliers are irrelevant (as it did before), the perception of insufficient unbundling is expected to carry on.

3. Recent Regulatory Stance on Unbundling

The investigations led by the Competition Authority are kept on according to its own legislation. Elsewhere, the Energy Market Regulatory Authority (EMRA), which is the regulatory body in the Turkish electricity market, is also taking the relevant regulatory measures and precautions to overcome the problems related to the effectiveness of unbundling in the Turkish electricity supply market. For instance, in a recent decision,[7] the Energy Market Regulatory Board (EMRB) banned distribution companies from using web sites, web or mobile applications, social media accounts, advertisements etc. to create the impression that distribution and supply activities were related. In the same decision, the Board also established that a distribution company, the associated last-resort supplier, the parent company that owns both, and an enterprise that provides support services and is owned by the parent company cannot continue their operations in the same building.

Despite its current involvement, in its past decisions, the EMRB has been lenient towards the actions by distribution companies, associated last-resort suppliers or parent companies that prevent the effectiveness of unbundling. The main reason behind this attitude was the aim of controlling increases in costs.

Theoretically, the ultimate and radical solution to all these problems about unbundling could be ownership unbundling. Yet, there is no such plan in the agenda. Instead, the current approach of the EMRA towards unbundling can be summarized using the motto of “leave it to consumers”. The EMRA essentially considers that the issues around unbundling will resolve themselves as the public opinion learns more about unbundling and supply competition. Thus, even though the EMRB takes relevant regulatory decisions, the main expectation is that consumers take the lead in this process.

References

Baarsma, B., De Nooij, M., Koster, W. and van der Weijden, C., 2007. Divide and rule. The economic and legal implications of the proposed ownership unbundling of distribution and supply companies in the Dutch electricity sector.Energy Policy, 35(3), 1785-1794.

Beard, T.R., Kaserman, D.L. and Mayo, J.W., 2001. Regulation, vertical integration and sabotage.Journal of Industrial Economics, 49(3), 319-333.

Cetinkaya, M., Basaran, A.A. and Bagdadioglu, N., 2015. Barriers to competition in the Turkish electricity market. Network Industries Quarterly, 17(1), 10-12.

Competition Authority, 2015. Sector Inquiry of Wholesale and Retail Electricity Sale. Ankara.

EMRA (2016), Elektrik Piyasası Gelişim Raporu 2015 (Electricity Market Developments Report 2015), Ankara.

Eroğlu, M., 2015, Regulating electricity markets via competition regulation rather than sector-specific regulation: what are the consequences in Turkey?. Network Industries Quarterly, 17(1), 13-18.

Joskow, P.L., 2005. The difficult transition to competitive electricity markets in the United States.Electricity Deregulation: Choices and Challenges, 31-97.

Künneke, R. and Fens, T., 2007. Ownership unbundling in electricity distribution: The case of the Netherlands.Energy Policy, 35(3), 1920-1930.

Meyer, R., 2012. Vertical economies and the costs of separating electricity supply-a review of theoretical and empirical literature.Energy Journal, 33(4), 161-185.

Mulder, M. and Schestalova, V., 2006. Costs and benefits of vertical separation of the energy distribution industry: the Dutch case.Competition & Reg. Network Indus., 7, 197-230.

Özbuğday, F.C., Öğünlü, B. and Alma, H., 2016. The sustainability of Turkish electricity distributors and last-resort electricity suppliers: What did transition from vertically integrated public monopoly to regulated competition with privatized and unbundled firms bring about?.Utilities Policy, 39, 50-67.

Pollitt, M., 2008. The arguments for and against ownership unbundling of energy transmission networks.Energy Policy, 36(2), 704-713.

Acknowledgements and Endnotes

We thank Alpaslan Mutlu for his valuable comments.

[1] Assistant Professor of Economics, Ankara Yıldırım Beyazıt University, Faculty of Political Sciences; fcozbugday@ybu.edu.tr

[2] Ph.D. in Finance, the Energy Market Regulatory Authority; halma@epdk.org.tr

[3] For a comprehensive treatment of unbundling and its variations, see Pollitt (2008), Mulder and Shestalova (2006), Baarsma et al. (2007).

[4] For the development of competition policies in Turkish electricity markets see also Çetinkaya et al. (2015) and Eroğlu (2015).

[5] The sequence of privatization and unbundling was different in another example. In the Netherlands, ownership unbundling was seen as a precondition for the privatization of supply operations. For more details, see Künneke and Fens (2007).

[6] Market shares are calculated at the national level using 2015 consumption figures. More information can be found in EMRA (2016). This is the most recent report published by the Energy Market Regulatory Authority on the electricity market.

[7] The Energy Market Regulatory Board, 26.01.2017, Decision No. 6877-14.

[/accordion-item]

[accordion-item title=”An Electricity-Based Social Accounting Matrix for Turkey for 2010″ id=2 state=closed]

Erisa Dautaj Şenerdem[1] and K. Ali Akkemik[2]

[1] Argus Media Ltd. London UK; erisa.dautaj@gmail.com

[2] Kadir Has University Department of Economics Istanbul Turkey; ali.akkemik@khas.edu.tr

Abstract

In this paper we construct a Social Accounting Matrix (SAM) for Turkey with an emphasis on electricity sectors. For this purpose, we collect data from various sources and reorganize them into a balanced SAM. We specifically disaggregate the electricity sector into public generation and private generation sectors, and introduce four satellite accounts: public wholesale trading, private wholesale trading, distribution, and organized power market.

1. Introduction

Electric power is a vital source of energy for households and a key input for industries. The sector has traditionally been recognized as strategic by governments and large sunk costs give the industry features of a natural monopoly. This approach has mostly led to high inefficiencies and large burdens on state budgets. The trend has reversed in the beginning of the 1980s upon arguments that it was possible and economically viable to open up the power sector to competition at least for certain segments within the industry.

Power market reforms were launched in a number of countries and Turkey has been no exception. Various attempts in the past to unbundle the state-owned and vertically integrated electricity facilities resulted in a complex system of ownership. Since the start of the reforms in 2001, the Turkish electric power sector has undergone a comprehensive reform process. Organized markets, including day-ahead balancing and settlement, an intra-day market, and a power exchange, have been established recently in a bid to generate price signals for future investment. In this regard, the power sector has been an important component of competition policy.

In this paper, we introduce a Social Accounting Matrix (SAM) with an emphasis on electricity markets for 2010, which can be used to analyze the electricity market. SAM is “a comprehensive and disaggregated snapshot of the socio-economic system during a given year” (Thorbecke, 2000). We collect data from various institutions and reorganize them into a SAM which can be used for analysis of the power market and the power market reforms. In constructing the SAM, we make much use of Erten (2009) and Telli (2006) in some stages. We chose 2010 because data were available at a desired sectoral level for energy sectors.

2. The Social Accounting Matrix (SAM)

2.1. Structure of the SAM

SAM is a square matrix in the form of an extended Input-Output Table (IOT), mapping intersectoral transactions and interrelations among institutions (households, firms, government, capital, rest of the world) in an economy. It has been used for policy analysis (Sadoulet and de Janvry, 1995). Columns in a SAM represent payments and rows represent receipts. For the respective accounts, the sum of total spending equals total income. The aggregated matrix is presented in Table 1. “Activities” account refers to production entities that produce goods and services and “Commodities” account refers to the goods and services produced. There are three factors of production: labor, privately owned capital, and public capital. Institutions include households, enterprises, government, private savings, public savings, and the rest of the world.

Input-Output Tables: The core part of the micro-SAM is the IOT which reports transactions among production activities. We used the I-O coefficients in 2002 IOT and updated the monetary values of all intersectoral transactions to 2010. We reorganize and aggregate the sectoral classification of the IOT into 16 sectors before disaggregating the power sector. The number of sectors increases to 21 with the introduction of detailed power sectors. The IOT in Turkey are reported in basic prices, i.e., payments to producers net of taxes, trade and transport margins, inclusive of subsidies. In the SAM, the final demand columns are expressed in producers’ prices.

Output, Value-added, and Intermediate Demand: Sectoral distribution of value added is available in GDP (Gross Domestic Product) series. Disaggregated data at the sectoral level for exports and imports were obtained from Turkstat. However, data on final demand, i.e., private and public consumption and capital formation at NACE Rev. 3 disaggregation are not available and they are estimated. To estimate intermediate demand (inputs) data, we follow Erten (2009) and estimate the ratios of intermediate input to gross output by each sector. The difference between gross output and value added yield total intermediate demand.

Foreign Trade: We reorganized export and import data which are published annually by Turkstat into 16 sectors. Trade data for services are taken from the balance of payments tables published by the Central Bank. To estimate natural gas imports, including LNG (liquefied natural gas) imports, volumes in 2010 are taken from the annual natural gas report published by EPDK (Turkish Energy Market Regulatory Authority). Since import prices vary with the countries of origin and are not officially announced we use price approximations in line with media reports for natural gas imported from Russia, Iran, and Azerbaijan. For LNG imports from Algeria and Nigeria we use average import prices paid by Germany which is available in a 2013 Statistical Review of BP. Average price in the UK is used for spot LNG imports. Finally, we also correct for the discrepancies regarding trade flows with Turkey’s free trade zones which are not included in GDP series as in Erten (2009).

Labor Compensation: To estimate labor compensation, we obtain data by sectors from the Social Security Institution of Turkey (SGK) on the basis of NACE (Statistical classification of economic activities in the European Community) Rev. 2 classification. We calculate annual labor compensation. We adjust the number of workers and labor compensation in the private sector by inflating the number of workers and labor compensation using the adjustment factors in Erten (2009). To avoid inconsistency with official statistics, we apply 2006 shares to calculate cost components of Turkey’s GDP in 2010, because they were the most recent ones available.

Operating Surplus: We separate public sector operating surplus from that of the private sector. Total operating surplus for state-owned companies is calculated as the sum of “factor income” from public sector general budget account as well as interest rate payments for social security institutions and State-owned Enterpises (SOEs) as in Erten (2009). Gross operating surplus is calculated as a residual.

Final Demand: Final demand block is composed of household consumption, government expenditures, private firms’ investments, and public firms’ investments. Aggregate figures for these accounts are taken from GDP series. Specifically, household consumption is calculated using the statistics in Household Budget Survey and sectoral household consumption shares computed from IOT and IEA (International Energy Agency) statistics for energy accounts. The relevant figures for electricity and gas-oil sectors are estimated using EDAS and IEA statistics. Sectoral distribution of public sector fixed investments is based on data published by the Ministry of Development. Energy investments are disaggregated using data obtained from TEIAS.

Institutions: The remaining parts of activity and commodity accounts in the SAM are calculated as residual so as to ensure column sum and row sum balance.

2.2. Disaggregation of the Electricity Sector

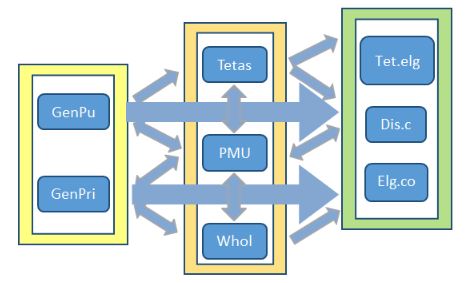

In this section, we introduce the dynamics of intermediate demand interactions among different categories of power sector participants. This is followed by separation of generation into private and public sector and the introduction of four satellite accounts for the electricity industry. Intermediate power use by electricity sectors is strongly related to the market structure. The interaction among participants is complex. For instance, state-owned generator (EUAS) can sell power to the state-run wholesale company (TETAS) and distribution companies (EDAS) under universal service obligations or at the balancing and settlement market (PMUM). Also, TETAS can buy and sell from EUAS; PMUM buys all output of BO, BOT, and TOOR plants, and sells to distribution companies and eligible consumers. We simplify these transactions in Figure 1.

Figure 1. A simplified version of the structure of the Turkish electricity market

Note: GenPu – public sector power generation; GenPriv – private sector power generation; TETAS – state-run wholesale company TETAS; PMUM – balancing and settlement market; Wholsl – private sector wholesale trading companies; Dis.co – distribution companies; Tet.elg. – TETAS eligible consumers; Eligible cons. – Eligible consumers.

The key characteristic of our SAM is the sectoral disaggregation which emphasizes the electricity sector. Electricity-related data are not available in the official IOT. We used data from IEA, grid operator (TEIAS), energy market regulator (EPDK), state-run utility (EUAS), state-run wholesale company (TETAS), state-run retail company (TEDAS), state-owned natural gas company (BOTAS), and private power companies. We obtained detailed supply-side data from the grid operator to compute I-O coefficients for electricity sectors. Data availability was a major constraint as generation data are available by TEIAS but demand-side data were largely unavailable. Supply-side and demand-side data for the remaining energy sectors, i.e., gas-oil and coal, are estimated using IEA statistics and data published by regulator.

We first split the electricity account into public and private generation sectors. Then, we introduce four satellite accounts: (i) state-run wholesale trading (TETAS), (ii) private sector wholesale trading, (iii) distribution companies (EDAS), and (iv) organized power market (day-ahead market and the balancing and settlement market PMUM). Public sector generation includes power generated by EUAS and its affiliates as well as BOO, BOT, and TOOR plants. Private sector generation sector includes independent private generators and autoproducers. We include these plants in the public sector because their output is subject to price guarantees by the state for a certain period of time, usually 15-20 years. Therefore, they are not exposed to market risks in competitive markets. Most of the state-run utilities’ sales are also guaranteed via bilateral agreements with TETAS and distribution companies. We treat PMUM as a sector because it gathers buyers and sellers in an anonymous power trading setting.

Most average prices at which power is purchased and sold in various segments by market participants are available from the relevant institutions. However, unregulated prices which are determined through bilateral negotiations between counterparties are missing. We make some assumptions about unregulated power prices:

- The price at which private sector producers sell to eligible consumers is 2.5% lower than the regulated price imposed on distribution companies.

- The price at which wholesale companies sell to eligible consumers is the same as the price they charge to PMUM.

- The prices IPPs and private wholesale companies sell to distribution companies are the same as respective average prices the former two sold to PMUM.

- The price autoproducers bought power from IPPs and TETAS is the same as the price they bought from PMUM.

- The price IPPs bought electricity from IPPs is the same as the price they paid to PMUM.

- The price wholesale companies sold power to IPPs is the same price as the price sold to PMUM.

- The price private wholesale companies sold to other wholesale companies is the same as prices these firms sold to PMUM.

- The price private wholesale companies bought power from IPPs and autoproducers is equal to the weighted average price IPPs and autoproducers bought from PMUM.

- The average export price of private wholesale companies is calculated as follows: we take the difference between total power exports from Turkstat and TETAS in and then divide it by physical volumes in MW exported by wholesale companies.

- The import price of private wholesale companies is the same as the import price of TETAS.

The cost of fuel used in generation is the most important intermediate input expenditure for electricity sectors. We calculate the generation mix of state-run and private utilities using TEIAS and TETAS data. We need to compute costs of generation in monetary terms. While no such data are available for state-run utilities, private sector generation costs by resources are available for 2013 in Aksa Enerji (2014). Once the costs of fuel are calculated for private generators, we subtract these from overall generation costs by each fuel type to compute fuel costs for public generators. We then calculate the shares of private and public sector generation sectors’ spending on fuels in total fuel cost by generators.

I-O data for satellite accounts, are presented in Table 2. Payments to services by TETAS, PMUM, and EDAS are estimated using data from reports published by TETAS, TEIAS, and TEDAS while payments to goods and services by satellite accounts to other sectors is assumed to be zero.

Electricity – Demand Side: Detailed information about the volume of power consumption by sectors is available in IEA (2012). Residential consumption of power was entirely from distribution companies. Before power sector reform was introduced in 2001, only distribution companies were eligible to deliver electricity to industrial and residential end-users. Information about which industries purchase power from which group of power market participants is not available. Therefore, we assume that these participants distribute power to all sectors in the same proportions as their shares in IEA data. An exception is TETAS sales to eligible consumers, which are available from the company’s reported sales.

Oil, Natural Gas, and Coal – Demand Side: For sectoral disaggregation of oil, natural gas, and coal at NACE Rev. 3 level of sectoral classification, we use physical quantities reported by IEA. Oil and oil product prices are not regulated so there is no single price for these commodities. We use oil indicative average respective producer prices in EPDK (2011: 90). Residential oil consumption is calculated using physical volumes from IEA data. Regulated natural gas prices are taken from official statistics to estimate gas consumption in monetary terms. We assume that industrial users, including in the electricity sector, purchase gas at the wholesale price of organized industrial zones. The gas price for residential consumers is taken from the subscribers category of regulated prices charged by distribution companies. To estimate the purchase price of household consumption of gas, we assume that 76.2% of total natural gas bill is the cost of gas and the remaining part is the distribution fee and indirect taxes.

2.3. Balancing the SAM

The constructed SAM ends up unbalanced owing to usage of data from different sources. However, row sums in a SAM must equal the columns sum for the respective accounts. We employ the RAS (Reliability, Availability and Serviceability) method as in United Nations (1999). The RAS method is an iterative method of bi-proportional adjustment of rows and columns and it is widely used to update and revise IOT when new information are available.

3. Conclusion

The aim of this paper was to construct a SAM for Turkey with a special focus on electricity market using data for the year 2010. The unavailability of electricity market aggregates in the IOT should be addressed. Significant discrepancies were observed in the data but we did our best to reconcile these data.

References

Akkemik K.A., Oğuz F. (2011). Regulation, efficiency and equilibrium: A general equilibrium analysis of liberalization in the Turkish electricity market. Energy 36(5), 3282-3292.

Aksa Enerji (2014). Investor Presentation, available online at http://img-aksayatirimci.mncdn.com/media/6388/investor-presentation-march-2014.pdf

EPDK [Energy Market Regulatory Authority] (2011). Electricity Market Report 2010.

Erten H. (2009). Türkiye İçin Sektörel Sosyal Hesaplar Matrisi Üretme Yöntemi ve İstihdam Üzerine Bir Hesaplanabilir Genel Denge Modeli Uygulaması. Expertise Dissertation, State Planning Organization, Ankara.

IEA (2012). Electricity Information. International Energy Agency Paris.

Sadoulet E., de Janvry A. (1995). Quantitative Development Policy Analysis. Baltimore & London, The John Hopkins University Press

Telli Ç. (2004). Sosyal Hesaplar Matrisi Üretme Yöntemiyle Türkiye Uygulaması. Planning Expertise Dissertation State Planning Organization, Ankara.

Thorbecke E. (2000). The Use of Social Accounting Matrices in Modelling. Paper presented at the 26th Conference of the International Association for Research in Income and Wealth.

United Nations (1999). Handbook of Input-Output Table Compilation and Analysis. New York, United Nations.

Table 1. Macro-SAM for 2010 (unit: billion Turkish liras)

|

1 |

2 |

3.1 |

3.2 |

3.3 |

4.1 |

4.2 |

4.3 |

5.1 |

5.2 |

6 |

TOTAL |

|||

|

1 |

Activities |

1171.0 |

231.4 |

1402.4 |

||||||||||

|

2 |

Commodities |

532.5 |

742.6 |

75.7 |

163.1 |

48.9 |

1562.8 |

|||||||

|

3.1 |

Labor |

355.3 |

355.3 |

|||||||||||

|

3.2 |

Public capital |

434.6 |

434.6 |

|||||||||||

|

3.3 |

Private capital |

39.5 |

39.5 |

|||||||||||

|

4.1 |

Household |

337.4 |

490.7 |

93.5 |

1.5 |

923.1 |

||||||||

|

4.2 |

Enterprise |

434.6 |

39.5 |

48.0 |

1.6 |

523.7 |

||||||||

|

4.3 |

Government |

40.5 |

90.7 |

17.9 |

69.3 |

20.9 |

0.9 |

240.1 |

||||||

|

5.1 |

Public investment |

163.1 |

163.1 |

|||||||||||

|

5.2 |

Private investment |

-51.8 |

17.0 |

83.8 |

48.9 |

|||||||||

|

6 |

Rest of the world |

301.2 |

12.0 |

6.0 |

319.2 |

|||||||||

|

TOTAL |

1402.4 |

1562.8 |

355.3 |

434.6 |

39.5 |

923.1 |

523.7 |

240.1 |

163.1 |

48.9 |

319.2 |

|||

Table 2. Simplified Turkish power market structure in 2010 (unit: million TL)

|

GenPu |

GenPri |

TETAS |

PMUM |

Wholesale |

EDAS |

Exports |

Eligible consumers |

|

|

GenPu |

9.8 |

3639.3 |

1214.1 |

122.4 |

1344.2 |

|||

|

GenPri |

22.1 |

645.8 |

11075.0 |

122.0 |

572.5 |

|||

|

TETAS |

479.0 |

1390.0 |

152.8 |

748.1 |

3766.7 |

|||

|

PMUM |

2.9 |

229.9 |

49.2 |

2.0 |

158.9 |

1638.4 |

||

|

Wholesale |

770.2 |

28.6 |

||||||

|

EDAS |

54.0 |

26.9 |

||||||

|

Imports |

479.0 |

1424.8 |

11095.1 |

6688.6 |

2038.3 |

23550.2 |

3583.7 |

Source: TEIAS/PMUM TEIAS/MYTM EUAS EDAS TETAS EPDK author’s calculations.

[/accordion-item]

[accordion-item title=”Should Turkey Change the Regulatory Model for Electricity Distribution?” id=3 state=closed]

Fuat Oğuz[1] and Koray Göksal[2]

[1] Yıldırım Beyazıt University, Department of Economics; foguz@yahoo.com

[2] Yıldırım Beyazıt University, Department of Economics

Abstract

The regulatory model in Turkey is not well suited for the changing market environment and a new model has to be designed in order to create necessary incentives for companies to increase customer satisfaction rather than following government intervention beyond regulation. Our aim is to discuss the actual and potential problems of the existing tariff model and show the need for a major revision in the regulatory framework, if the liberalization of the industry is expected to continue as planned.

1. Introduction

The regulatory model of electricity distribution was established in 2001 in Turkey. The lack of investments, vast inefficiencies in the industry and increasing demand contributed to the move toward liberalization (Cetin and Oguz, 2007). However, the model was not designed to push Distribution System Operators (DSOs) to follow the privatization agreements completely. The electricity industry evolved toward a more competitive structure, and companies began to see that electricity generation was not a risk-free market. The establishment of the energy exchange and the evolution of market transactions created problems for companies and put pressure on the downstream segments of the market.

During the design period of the tariff model, the infrastructure was not expected to change quickly. The natural monopoly characteristics of the industry assumed to remain intact for the foreseeable future. Thus, observing inputs and guaranteeing distribution companies some profit margin through regulatory processes were thought to be the right way to go. Another problem of incentive regulation model is the information asymmetry between the regulatory agency and the regulated firm. Since the regulatory agency depends on the firm for information, this creates tensions in the implementation process. Asymmetric information gives way to stricter regulations on DSO.

While there is a growing literature on different aspects of the Turkish electricity markets, the regulatory model and its assessment are usually ignored. The dearth of works that focus on the economic consequences of the tariff model provided the motivation for this paper. We believe to contribute to the literature by discussing the potential and actual problems with the existing model and address policy issues surrounding it.

2. Reasons for Reconsidering the Regulation of DSOs

The regulatory model of electricity distribution was designed during a period where the technology was relatively stable. When Stephen Littlechild and M. Beesley (1980) first developed incentive regulation, it was thought to be a method to eliminate the problems of the rate of return regulation. During the last decade the technology advanced and the natural monopoly model started to create inefficiencies in the tariff model.

In the traditional model, DSOs had the role of being ‘transporters’ of electricity. Thus, they have to provide some kind of universal access to electricity. They have to provide this service as efficiently as possible and transfer gains of efficiency to consumers. The regulatory model was designed under these conditions. However, the role of DSO changed substantially in the last decade. The following are major changes:

- One fundamental change is in advances in distributed generation. The advances in wind and solar power and small scale hydro turbine change the structure of tariffs. Advances in small scale generation such as rooftop solar also changes the relationship between the DSO and consumer.

- Another important development is advances in the storage technology and electric vehicles. The distribution tariffs started at a time when distribution meant using a resource that was not storable, and the use was not a substitute for other energy resources such as oil.

- Technological advances have the tendency to decrease the DSO revenues (Pérez-Arriaga, 2010). The integration of distributed generation, energy conservation measures and other factors reduce electricity demand during the implementation periods.

- The revenue-cap model does not encourage innovation as expected. Empirical studies show that the ratchet effect[3] is more prominent in the industry. The model does not have any variable or component to reduce the ratchet effect.

In this changing environment, the role of DSOs also evolve. They become more than just a network operator. Advances in financial and technological dimensions require changes in the tariff model as well. They create value as well by being the key player in the value chain of electricity industry.

3. The Outline of the Existing Tariff Model in Turkey

The Turkish regulatory model for electricity distribution follows European countries to some extent. In this model,

Allowed revenue = Authorized Opex + Depreciation + Opportunity Cost (WACC) + Tax Difference

And, the CAPEX is determined in the following way:

Authorized Capex = Base expenditures + Physical Growth + Productivity Parameter (X)

The fundamentals of the model is the same in many countries. Yet, small differences occur.

4. Shortcomings of the Existing Model

Now let us look at the problems of the existing model more closely.

- A major issue with the existing tariff model is its assumption of constant technology. Since the model was designed in a period where the technology of distribution did not change substantially, the evolution of technical and economic aspects of tariffs was not part of model.

- The existing tariff structure uses a revenue-cap model. It requires the national regulatory agency (Energy Market Regulatory Agency, EMRA) to follow DSOs very strictly in order to minimize the potential rent-extracting in the sector.

- The way OPEX and CAPEX are defined, implemented and estimated creates problems for EMRA. A major reason is the problems with data. Official numbers and predictions, in some cases, did not fit with the realities of the industry. The problem with the data is reflected in the tariff models as well. The productivity variables calculated in the model do not reflect the realities of the industry.

- EMRA corrects errors in the initial tariff decisions during the implementation period. This is usually done by postponing the problem to the next tariff period, in order not play with the existing tariffs a lot. Yet, this behavioral pattern creates wrong incentives in the industry and encourages firms not to take action to improve themselves.

- A major issue in this context is about the productivity variable in the tariff model. The existing tariff structure is supposed to push companies to improve their productivity during the implementation period. They are expected to keep the gains of productivity. However, more productive firms are expected to have less room for improvement in the next period. Because of the difficulty of monitoring the sector, some DSOs prefer not to increase productivity as planned in the initial tariff decisions.

- Most importantly, the methodology of EMRA on distribution tariffs is not clear. The reasoning and details of models are not made public. Thus, we try to understand it by guessing the logic of the regulator.

Regulators began to see that it is not easy to follow income tables and expenditures of DSOs, as theory expected. Being rational players, distribution companies used the system for profit-maximizing, which was not an assumption of the initial model. The model assumed that companies would act according to the rules of the model. This was also not realistic.

Recently, the government increased pressure over the DSO to improve customer satisfaction, their infrastructure, reduce costs and increase their investment activities. Yet, the current regulatory model is not appropriate for achieving these goals. It is time to look at alternative models rather than focusing on monitoring inputs in the revenue requirement tables of DSOs.

5. Conclusion

The incentive regulation model is used widely around the world. Its problems are also well documented. The problems with the price cap and revenue cap models in the distribution market led to a move toward a more output oriented tariff model. The problems of estimating, benchmarking and even defining CAPEX and OPEX push regulators toward observing output variables so that the need for investigating the expenditures of DSO is reduced. As a result, the output based, or result-based, regulatory models have become the subject of research.

A new model in this direction is introduced by the United Kingdom. The model is known as ‘the RIIO model’ (Revenue = Incentives+ Innovation + Outputs). In this model, the outputs such as consumer satisfaction, reliability and availability, safety, connectivity, environmental impact and social responsibilities are being considered. Each DSO submits an 8-year plan that specifies total expenditures rather than CAPEX and OPEX separately. The aim is to balance conflicting incentives for reducing costs and increasing investments. While this approach is new and its success is not certain, the need to modify the revenue cap model is clear. Turkey, in the face of the problems of the existing tariff model, should revise it and do it in a way to encourage productivity rather than manipulating the tariff model.

References

Cetin, T. and Oguz, F. (2007), “Politics of Regulation in the Turkish Electricity Market”, Energy Policy, 35(3), 1761-1770.

Pérez-Arriaga, I.J. (2010), “Regulatory Instruments for Deployment of Clean Energy Technologies”, EUI RSCAS; 2010/25; Loyola de Palacio Programme on Energy Policy

Beesley, M. and Littlechild, S.C. (1983) “The Regulation of Privatized Monopolies in the United Kingdom”, RAND Journal of Economics, 20 (3), 454-72.

Endnotes

[1] Yıldırım Beyazıt University, Department of Economics

[2] Yıldırım Beyazıt University, Department of Economics

[3] The rachet effect refers to distribution companies’ reluctance to reduce costs during a tariff period with the expectation that the regulator will have tougher cost standards in the future.

[/accordion-item]

[accordion-item title=”Cheapest Cost Avoider Approach to the Electricity Loss and Theft in Turkey” id=4 state=closed]

Erman Benli* and Hande Emin Benli**

* Corresponding author. Social Sciences University of Ankara, Faculty of Law; erman.benli@asbu.edu.tr

** Ph.D. Atılım University, Political Economy; handeemin@hotmail.com

Abstract

Cheapest cost avoider principle (CCAP) is applicable not only to accidents or damages but also to cases for all potential Cheapest Cost Avoiders (CCAs) including multiple parties such as third parties and government. In this context, we tried to implement the CCAP to the electricity loss and theft problem in Turkey. In the particular case, electricity loss and theft should not be considered within the limits of contracting parties. It is a social cost problem. However, higher transaction costs in real life prevent contracting parties from internalizing the harmful effects of the problem and regulation is needed for solution. In practice, Joint Civil Chambers of the Court of Cassation decided in 2014 that electricity companies have to bear the aforementioned costs. This decision increased the costs of electricity companies so that they started to lobby for passing a new regulation contrary to the court decision. The Turkish Parliament passed a new legal provision (Article 17/6-ç) in 2016 including liability of consumers for the relevant costs. Both court decision and legal provision are inefficient and wealth destroying because they disregard the reciprocal nature of the harm. Optimal regulation should allocate the loss and theft costs to the potential CCAs. It should also be redesigned to foster electricity companies to take efficient due care in the extent of current technology and technical capability. In other words, it is not economically efficient to make only consumers or companies liable.

1. Introduction

Electricity is not just an economic but also a political good in developing countries and Turkey (Oguz et al. 2014: 382). Therefore, legislative and judicial process in the electricity loss and theft issue turns into a strategic game between politicians, bureaucrats and judges in Turkey (Cetin and Oguz 2007: 1763). Electricity loss and theft is a social cost problem. It creates harmful effects. It is not efficient to make one party liable for the aforementioned costs because of the reciprocal nature of the harm (Coase 1960: 2). The ruling case of the Joint Civil Chambers of the Court of Cassation and the Article 17/6-ç of the Electricity Market Law No. 6446 are inefficient because they make one party liable for the costs.

CCAP was derived from the Coase Theorem. According to the CCAP, liability should be imposed on the party who solves the problem with a minimum cost (Calabresi and Hirschoff 1972, p. 1060). For the particular case in this paper, we try to apply CCAP to the electricity loss and theft issue which should be described as a social cost problem. Loss and theft costs should be allocated to the parties who solves the problem with a minimum cost. Therefore, electricity distribution companies should be liable for the costs to the optimum level. How do we determine the optimum level? It means technological limitations (highest level of technology) and technical capabilities. Consumers should also be liable for the rest of the costs exceeding optimum level. CCAP solution to the social cost problem minimizes the negative externality of court decision and the legal provision.

The remaining part of the paper is organized as follows. In the next section, we briefly explain the legal history of the issue. Section three provides CCAP analysis of the legal provision and court decisions for the efficient distribution of liability. Section four presents overall conclusions.

2. A Brief Legal History of the Issue

The Energy Market Regulatory Authority (EMRA) decided in 2010 that consumers should be liable for loss and theft costs. Consumers applied to the Consumer Arbitration Committees (CAC) so as to annul the EMRA’s decision. The CAC decided in favor of consumers in 2011. Electricity distribution companies appealled the decision of CAC and the 3rd Civil Chamber of the Court of Cassation took decisions[1] in favor of companies. After a year the Joint Civil Chambers of the Court of Cassation decided[2] against the 3rd Civil Chamber of the Court of Cassation. EMRA disagreed with the decision of the Joint Civil Chambers. In order to eliminate the ruling case of Joint Civil Chambers of the Court of Cassation, Turkish Parliament passed a new legal provision (Article 17/6-ç)[3] in 2016. It was designed to make consumers liable for loss and theft costs.

After the effective date of the Article 17/6-ç, EMRA prepared by-laws[4] concerning measures to reduce electricity loss. The Board of EMRA then took decisions[5] about target loss rate in 2015 and 2016. An opposition party in the Turkish Grand National Assembly (TGNA) brought an action for annulment of temporary Article 18 of the Electricity Market Law No. 6446. This Article delegates power to EMRA in order to reduce loss and theft. Plaintiff alleged that delegating power to the EMRA is not concrete and this rule was designed to protect producers contrary to public interest and Turkish Constitution. Constitutional Court of Turkey denied the claims that reducing loss and theft costs is an expert issue so that delegating power to the EMRA is consistent with public interest[6]. Constitutional Court of Turkey also added that even if temporary Article 18 delegates discretion to EMRA, it must use its discretionary power according to Article 125 of the Turkish Constitution. In this context, temporary Article 18 does not impose additional financial liability for consumers according to Constitutional Court of Turkey.

The legal history of the particular issue shows us that politicians, bureaucrats and judges read the notion of public interest differently. They all use public interest as an elusive, abstract and fictional concept to hide the wealth transfers through interest group politics.

3. CCAP is an Efficient Measure for Public Interest

3.1. Theoretical Background

From the law and economics perspective, public interest should be measurable. In legal debates over the benefits of rule making or court decisions, the meaning of public interest is usually assumed, rather than explicitly stated. Judges usually abstain from providing a clear definition of public interest. In academic circles, most scholars tend to start from market failure and establish a bridge to public interest (Ogus 1994; Weigel 2008, p. 17)

The link between economic inefficiency and its political-legal remedy gets overlooked in the process. While public interest is connected to imperfect markets, the concept of market failure does not necessarily indicate acting in the name of public interest. In the economic theory of regulation, public interest is broadly related to the protection of the public welfare. In this process, the theoretical connection between maximizing social welfare and its being in the public interest is taken for granted. However, the notion of public interest as maximizing social welfare does not find many allies among judges.

In addition to “economic” motives, some non-economic ones also drive the legal behavior. Distributional justice and paternalism play some role in rulemaking, regulation and court decisions. These considerations usually assume that there is no public choice and knowledge issues relevant to legislation and legal decisions. The analysis gets more complicated with the addition of government failure and epistemic ignorance in the legal decision and rule making.[7]

In most cases, it is possible to remedy market failures on the basis of private law (Ogus 1994; Shleifer 2005, p. 444). For example, internalization of externalities or compensating breaches of contract can be dealt with using the tools of the market system and do not necessarily require government intervention. When private law cannot solve the tension between private and public interests, public intervention to increase social welfare becomes the “preferable” remedy. The implicit connection between market failure and public remedy assumes that there is no feasible private law alternative. It is usually assumed that even if there were private law alternatives, they would fail to address the existing market failure.

The market failure argument goes hand in hand with ‘private law failure’. In order to have government intervention to market activities, not only economic behaviors but also the remedies of the private law should be deficient. While the theory takes the balanced view that a comparison of market failure plus private law failure with government failure, courts usually focus on private law failures and neglect the government failure. It is implicitly assumed that the cost of public law involvement is lower than any other options including resolving the market failure by using private law remedies.

During the 1970s, public interest became the reason for regulation. The public interest theory of economic regulation rose to ascendancy and then was criticized extensively by the Chicago school economists (Hertog 1999). However, the literature remained silent on the theoretical connection between public interest and market failure.[8]

The market failure approach takes a narrow conception of public interest. The goal of collective action, in this view, is the efficient use of resources.[9] However, political literature uses public interest in a wider sense. Social justice, paternalism, redistribution and participation in the political process become reasons for regulation (Sunstein 1990). In this view, the scope of public action expands and becomes ambiguous.[10]

The use of cost-benefit analysis on regulatory decisions opened the door to more comparative and quantifiable legal and political decision-making in many countries. Thus the public interest approach has also begun to use the tools of cost-benefit analysis. Developments in regulatory impact assessment methods provide more concrete analyses of public interest decisions and regulations. In this way, it becomes possible to have a more clear definition of public interest.

The reluctance to define public interest explicitly leaves plenty of room for political and legal maneuvering (Feintuck 2004). This is one of the reasons why we do not find any clear description of what is public interest in court decisions. The decisions discussed below also follow this trend. Judges cite the elusive concept of public interest without giving a clear definition of what is in the public’s interest, or how they make decisions following the criterion of public interest.

A major component of the public interest concept depends on the explanation about decisions that reduce social welfare. The public interest theory assumes that institutions are created for public purposes, but then mismanaged or get out of hand (Posner 1974, p. 337). This view accepts that there is no fundamental flaw with the theory, yet the implementation of public interest through bureaucracy is flawed. Thus, the concept of human error is used as a theoretical explanation. The theory is based on a lofty but naïve ideal of law-based administration.

In this view, the lack of expertise, human errors and enforcement problems create poor policy. These explanations easily turn into an excuse for budget expansions and increases in pecuniary gains (Mueller 2003).

This view does not stand well against empirical evidence. The literature on regulatory issues shows that public decisions of bureaucrats support specific groups consistently, and create systematic wealth transfers.[11] So there must be some conceptual misrepresentations of the public interest notion. While our goal is not to delve into these issues, there are two categorically different problems with the misrepresentation: knowledge problems and private interests. Friedrich Hayek elaborates on the knowledge problem (Hayek 1973). Neither regulators nor courts have all the necessary information to make decisions that maximize public interest in any empirically feasible way. Courts use crude proxies and rules of thumb to find public interest. The absence of any control mechanism for the interpretation of public interest and the vagueness of the definition leave room for less diligence and irresponsibility. In this vein Offe (1984) emphasizes the incompatibility between the generality of public control and the necessity of private solutions.

The second problem has given way to the public choice approach and the theory of interest group politics (Mueller 2003). This theory starts from transactions between politicians who supply policy promises and voters who seek particular policies. While the rational goals of politicians, namely election and re-election, are well accepted, the reasons for voting are still controversial.[12] In the literature, both altruism and self-interest carry some weight. Candidates should offer something to the electorate in exchange for votes. The range of voter demands forces politicians to offer “packages” rather than specific promises to voters.

Political parties reduce information costs of promise packages. There is an entrepreneurial aspect to politicians. They search for best packages of legislative benefits to persuade likely voters. The lack of continuous interaction between politicians and voters allows politicians to shirk in their promise packages more easily, as they are modeled within the principal-agent framework.[13]

An important participant in the political market is the bureaucracy. For public choice theory, bureaucrats are also self-interested. They tend to be policy advocates rather than simply implementers (Mises 1996). Bureaucrats have some control over the flow of information between politicians and voters and use their control to influence political decisions. In the public choice models, bureaucracy maximizes a number of separate variables, including income, reputation, power, and other non-pecuniary benefits. This description highlights differences between private managers, politicians and bureaucrats. The absence of any clear cost and benefit calculation allows bureaucrats to increase output and overlook costs. Bureaucracy creates another channel for wealth transfers between interest groups and politicians (Maggetti 2007, p. 273). In this process, public interest may be used to conceal distributional interventions.

The same argument is sometimes put forward for judiciary as well. In this view, judges behave rationally like everyone else. According to Richard Posner, public interest does not take a pivotal place in judicial utility (Posner, 1993). After all, they have limited time and more cases than they can handle. Especially, in countries such as Turkey, where the caseload is too much to bear, subjective preferences become more predominant.[14]

The concept of public interest has long been a rhetorical tool to sustain judiciary decisions. In the United States, the Supreme Court used it extensively (Peritz 1996). Similarly, the Constitutional Court of Turkey had recourse to it largely on economic matters, as discussed below. In this process, public interest becomes a controversial concept. For politicians and the judiciary, the goal of the state is to pursue public interest. For critics, it is a fictional concept to hide the wealth transfers through interest group politics.

Public interest is understood quite differently in the economics literature and legal writings. Economics literature refers to a dynamic process where the society moves from a lower level of welfare to a higher one.[15] The legal interpretation uses it in a static manner by focusing on providing basic services. This also reflects the tension between these two realms.

3.2. Implementation for Turkey

CCAP was developed by Calabresi in his study of “The Cost of Accidents” based upon Coase (1960) and Demsetz (1967). The aim of this principle is to provide effective and optimal point of deterrence or due care. CCAP was developed to determine optimal liability rules in the field of tort law (Dari-Mattiacci and Garoupa 2007, p.4). However, it can also be applicable “to externality problems involving large numbers of parties.” (Schmidtchen et.al. 2015, p. 3). Electricity loss and theft issue is one of them in addition to environmental cases. Although CCAP has some deficiencies (Sinai and Shmueli 2014, p. 67), it works well in the particular Turkish case.

We apply the CCAP to the particular issue more broadly than bilateral damages. Thus, CCAP can be used for all potential CCA actors including multiple parties such as third parties and government (Schmidtchen et.al. 2015, p. 11). For instance, electricity consumers and government are third parties in the electricity loss and theft case. In this paper, both electricity distribution companies and consumers are CCAP but the extent is different.

Electricity loss and theft externality should be regulated because of high transaction costs. The legal rule should be designed to decrease transaction costs and allocate rights efficiently. So how do we allocate liability in an efficient way in the loss and theft case? Technology and technical capability of companies determine the allocation of costs. Companies should take efficient due care in order to maximize it. The other part of the cost that companies are not technically capable to take efficient due care should be charged to consumers as potential CCA. Thus, Article 17/6-ç should be redesigned to foster companies to take efficient due care in the extent of current technology and technical capability. The limit of efficient due care determines the ultimate allocation of rights or obligations. The percentage of loss and theft costs charged to consumers will be reduced in parallel with advanced technology and lower transaction costs in the course of time.

4. Conclusion

Electricity loss and theft should not be considered within the limits of contracting parties. It should be recognized as a social cost problem. However, higher transaction cost prevents contracting parties from internalizing the harmful effects through bargaining. Regulation is needed to solve the social cost problem. In practice, Joint Civil Chambers of the Court of Cassation decided in 2014 that electricity companies have to bear the aforementioned costs. This decision increased the costs of companies so that they started to lobby for passing a new regulation contrary to the court decision. Turkish Parliament has passed a new legal provision (Article 17/6-ç) in 2016 including liability of consumers for the all costs. Both court decision and legal provision are inefficient and destroy wealth because they disregard the reciprocal nature of the harm. Regulation should allocate the loss and theft costs to the potential CCAs. It should also be redesigned to foster companies to take efficient due care in the extent of current technology and technical capability. In other words, it is not economically efficient to make liable only consumers or companies.

References

Barzel Y. and Silberberg E. (1973). Is the act of voting rational? Public Choice 16, pp. 51–58.

Belge C. (2006). Friends of the Court: The Republican Alliance and Selective Activism of the Constitutional Court of Turkey. Law and Society Review, 40 (3), pp. 653-692.

Buchanan J.M. and Tullock G. (1962) The Calculus of Consent, Logical Foundations of Constitutional-Democracy. Ann Arbor, University of Michigan Press.

Calabresi, G. and Hirschoff J.T. (1972). Toward a Test for Strict Liability in Tort. Yale Law Journal 81(6), pp. 1055-1085.

Caplan B. (2009). The Myth of Rational Voter, Princeton, NJ: Princeton University Press.

Cetin, T. and Oguz, F. (2007). The politics of regulation in the Turkish electricity market. Energy Policy 35, pp. 1761-1770.

Coase, R. (1960). The Problem of Social Cost. Journal of Law & Economics 3(1), pp. 1-44.

Croley S.P. (2008). Regulation and Public Interests: The Possibility of Good Regulatory Government, New York: Princeton University Press.

Dari-Mattiaci, G. and Garoupa N. (2009). Least-Cost Avoidance: The Tragedy of Common Safety. Journal of Law, Economics and Organization 25(1), pp. 235-261.

Demsetz, H. (1967). Toward a theory of property rights. The American Economic Review, Papers and Proceedings 57, pp. 347-359.

Feintuck M. (2004). The Public Interest in Regulation. Oxford: Oxford University Press.

Hayek F.A. (1973). Law, Legislation and Liberty: Rules and Order. Chicago: University of Chicago Press.

Hertog J. (1999). General Theories of Regulation. In Bouedewijn Bouckaert and Gerrit De Geest (eds.), Encyclopedia of Law and Economics. Edward Elgar, Cheltenham and University of Ghent, pp. 223-270.

Joskow P.L. and Noll R.G. (1981). Regulation in Theory and Practice: An Overview, In: Gary Fromm (eds) Studies in Public Regulation, Cambridge, MA: MIT Press, pp. 1-65.

Maggetti M. (2007). De facto independence after delegation: A fuzzy-set analysis. Regulation and Governance 1, pp. 271-294.

Miller G.J. (2005). Political Evolution of Principal Agent Problems. Annual Review of Political Science, 8, pp. 203-225.

Mises L. (1996). Human Action. 4th edition, revised. San Francisco: Fox and Wilkes.

Morgan B. and Yeung K. (2007). An Introduction to Law and Regulation: Text and Materials. London: Cambridge University Press.

Mueller D.C. (2003). Public Choice III. Cambridge University Press.

Offe C. (1984). Contradictions of the Welfare State. London: Hutchinson.

Ogus A. (1994). Regulation: Legal Form and Economic Theory, Clarendon Press.

Oguz, F., Akkemik, A.K. and Goksal, K. (2014). Can law impose competition? a critical discussion and evidence from the Turkish electricity generation market. Renew. Sustain. Energy Rev. 30, pp. 381-387.

Peritz R.J.R. (1996). Competition policy in America: History. Rhetoric, Law, New York: Oxford University Press.

Posner R.A. (1993). What do Judges and Justices Maximize (The Same Thing Everybody Else Does). Supreme Court Economic Review, 3, pp. 1-41.

Posner R.A. (1974). Theories of Economic Regulation. Bell Journal of Economics and Management Science, 5, pp. 335-58.

Prosser T. (1986). Nationalized Industries and Public Control. Oxford: Clarendon Press.

Rizzo M. (2009). The Knowledge Problem of the New Paternalism. Brigham Young University Law Review, pp. 103-161.

Rizzo M. (2005). The Problem of Moral Dirigisme: A New Argument Against Moralistic Legislation. NYU Journal of Law & Liberty 1 (2), pp. 790-844.

Rose-Ackerman, S. (1988). Progressive Law and Economics – and the New Administrative Law. Yale Law Journal 98, pp. 341-368.

Schmidtchen, D. et al. (2015). Replacing the Polluter Pays Principle by the Cheapest Cost Avoider Principle: On the Efficient Treatment of External Costs. http://www.beta-umr7522.fr/productions/publications/2015/2015-08.pdf (Last access: 15.04.2017), pp. 1-31.

Shleifer A. (2005). Understanding Regulation. European Financial Management 11(4), pp. 439-451.

Sinai, Y. and Shmueli B. (2014). Calabresi’s and Maimonide’s Tort Law Theories: A Comparative Analysis and a Preliminary Sketch of a Modern Model of Differential Pluralistic Tort Liability Based on Two Theories. Yale Journal of Law and Humanities 26, pp. 101-175.

Sunstein C. (1990). After the Rights Revolution: Reconceiving the Regulatory State. Harvard University Press.

Weigel W. (2008). Economics of the Law: a primer. New York: Routledge.

Zerbe R.O. (2001). Economic Efficiency in Law and Economics. Northampton, MA: Edward Elgar.

Endnotes

* Corresponding author. Social Sciences University of Ankara, Faculty of Law; erman.benli@asbu.edu.tr

** Ph.D. Atılım University, Political Economy; handeemin@hotmail.com

[1] See decisions of 3. Civil Chamber of the Court of Cassation dated 24.06.2013 and no. 2013/10841 and dated 11.11.2013 and no. 2013/15632.

[2] See decision of Joint Civil Chambers of the Court of Cassation dated 21.05.2014 and no. 2014/679.

[3] See Amendment Act of Electricity Market Law and Other Laws dated 04.06.2016 and no. 6719 Article 21.

[4] See Official Gazette dated 31.12.2015 and no. 29579.

[5] EMRA decisions dated 26.11.2015 and no. 5890; dated 10.03.2016 and no. 6148-5; dated 07.12.2016 and no. 6650.

[6] The Constitutional Court of the Republic of Turkey (CC) decision dated 2.11.2016 and no. 2016/172.

[7] On the relationship between knowledge problem and paternalism see Rizzo (2005) and Rizzo (2009).

[8] Market failure literature does not refer to public interest in discussions of the problems with imperfect markets. Joskow and Noll (1981), for example, do not establish a linkage between these concepts, but only assume it.

[9] Even the defenders of public interested regulation take the Kaldor-Hicks efficiency as the norm. See, for example, Croley (2008).

[10] The political approach may sometimes take two different paths. Some argue for a “substantive political approach”. Some others focus on procedural issues (Morgan and Yeung 2007, p. 41). Political approach and market failure approach overlap in some respects. In these approaches, law facilitates public‟s attempt to increase social welfare. However, procedural approach is not as goal-oriented as others. The establishment and improvement of institutions that improves participatory dialog takes the center place in this approach. See Prosser (1986) for a discussion.

[11] There is now a well-established literature on the subject, both theoretical and empirical. The public choice field provides extensive material. On the other hand, the public interest approach has also been revised taking into account the critique of the earlier public interest theory (Rose-Ackerman, 1988).

[12] See Buchanan and Tullock (1962) and Barzel and Silberberg (1973) for a classical discussion of voting motives. For a more recent critique, which also criticizes the public choice view, see Caplan (2009).

[13] For an analysis of political decision-making based on the principal-agent framework, see Miller (2005) and Waterman and Meier (1998).

[14] See Belge (2006) for an interesting analysis of the Constitutional Court of Turkey. Author finds that the court had a strong bias in favor of a specific party and ideology in cases of human rights and other fundamental democratic issues.

[15] A widely used economic concept to measure welfare improvements is the Kaldor-Hicks criterion. In the context of law and economics, Kaldor-Hicks criterion provides a tool to measure the improvement in social welfare. See Zerbe (2001) for a formal treatment of the relationship between law and efficiency.

[/accordion-item]

[/accordion]