Identifying impacts of COVID-19 on the Indian Power Sector

This article identifies the early impacts of the COVID-19 to create a basis for future discussion to aid in mitigating adverse effects and better preparing the power sector for such events in the future.

On March 25th, 2020, India began an unprecedented 21-day lockdown to fight the spread of COVID-19. In these troubling times of ‘social distancing’ and ‘working from home’, the centrality of electricity in powering our current and future societies is more evident than ever before. However, the power sector also is not immune to the adverse effects of the pandemic. The long-term impact of the current situation would only become apparent with time. Nevertheless, some early impacts of COVID-19 on the Indian power sector are already becoming evident. This article identifies these early impacts to create a basis for future discussion to aid in mitigating adverse effects and better preparing the power sector for such events in the future.

I know that history is going to be dominated by an improbable event, I just don’t know what that event will be.

Impact on the grid

In India, distribution utilities have a lower tariff for domestic and agricultural consumers, sometimes even below the average cost of supply, as compared to that for commercial and industrial consumers. Table 1 provides the electricity tariff rates in Delhi for selected consumer categories to highlight these differences. Thus, for several distribution companies, the lower tariff-paying consumers are cross-subsidized by commercial and industrial consumers.

| Category | Fixed Charge (₹ /KVA/Month) | Energy Charge (₹ /KWh) |

| Industrial | 250 | 7.75 |

| Single point delivery supply for Group Housing Societies | 150 | 4.50 |

| Agriculture | 125 | 1.50 |

Table 1: Electricity Tariff Schedule for FY(2019-20) – Delhi Electricity Regulatory Commission (DERC)

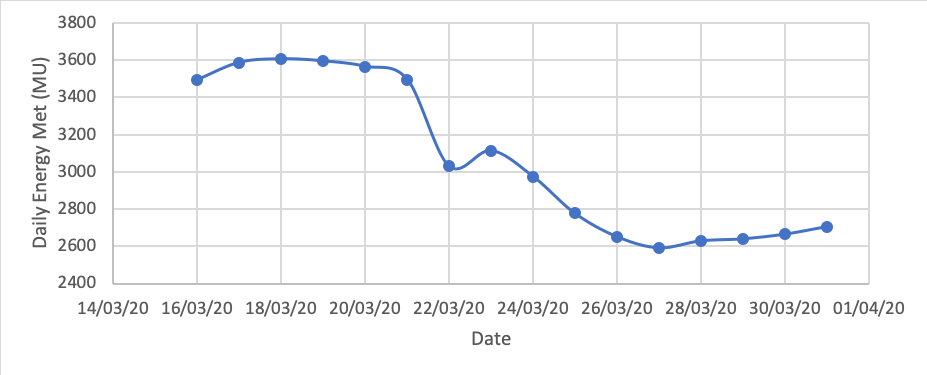

The COVID-19 lockdown has led to shut down of all but essential commercial activities across the country. Approximately 1.3 billion citizens are obliged to remain within the confines of their homes and, in many cases, only allowed to work from home. Consequently, the electricity demand from industrial and, commercial customers has reduced significantly while the residential demand is expected to have increased. According to the Power System Operation Corporation of India (POSOCO), The energy met on March 16th, 2020 – which can be considered as a business-as-usual scenario – was 3494 MU as compared to 3113 MU on March 23rd, 2020 a day of voluntary curfew. It further reduced to a range between 2600-2800 MU between March 25th to March 31st, 2020. This trend is illustrated in Figure 1.

Figure 1: Daily energy met (MU)

Thus, firstly, a key risk from the COVID-19 pandemic for the already struggling distribution companies in India arises from the loss of revenues due to reduction of demand from the commercial and industrial customers as well as the inability to cover the cross-subsidies provided to the lower-tariff paying consumer. Secondly, the utilities would also have to account for the expense to comply with any ‘must buy’ commitments that they have with generators with long-term power purchase agreements. The true and full extent of this risk would only be known once a quantitative analysis is conducted when this crises situation is contained. Thirdly, at an operational level, distribution companies would have to account for deviation in demand and supply patterns at a temporal and locational level. Finally, during this period, critical infrastructure such as electricity networks would have to be run with minimum employees.

COVID-19 impact on the power market

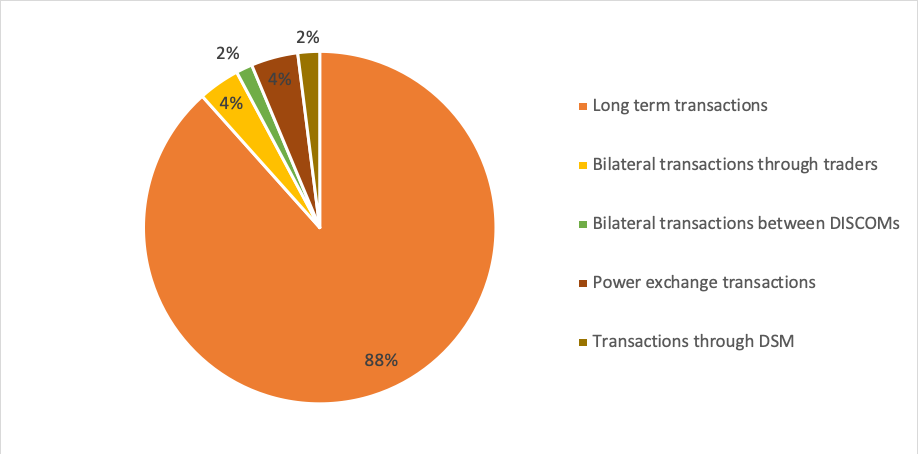

As seen in Figure 1, the trade on the wholesale power market comprises just 4.3 per cent of the total electricity transactions. However, the transactions through the power exchanges have grown over the last decade. The Indian Energy Exchange (IEX)[1] has seen a growth from 2616 MU in FY 2009 to 52,241 in FY 2019.

Figure 2: Share of market segments in total electricity generation 2018-19 (Source: CERC)

Until now, the trade in the wholesale market is in four market segments 1) Day-Ahead Market 2) Term Ahead Market and 3) Renewable Energy Certificates 4) Energy-saving certificates. Recently, the Central Electricity Regulatory Commission (CERC) finalized the regulations for implementing real-time markets. This half-hourly market will enable intra-day trade of electricity, allowing adjustment of generation and consumption profile during the day. Before the COVID-19 pandemic, it was announced by CERC that the real-time market would be operational from April 1st, 2020. However, the starting date has now been delayed by two months to June 1st, 2020. According to media reports, due to the COVID-19 pandemic, some required trials could not be completed. This delay in the real-time market implementation is likely to have a serious, adverse impact on the Indian power market.

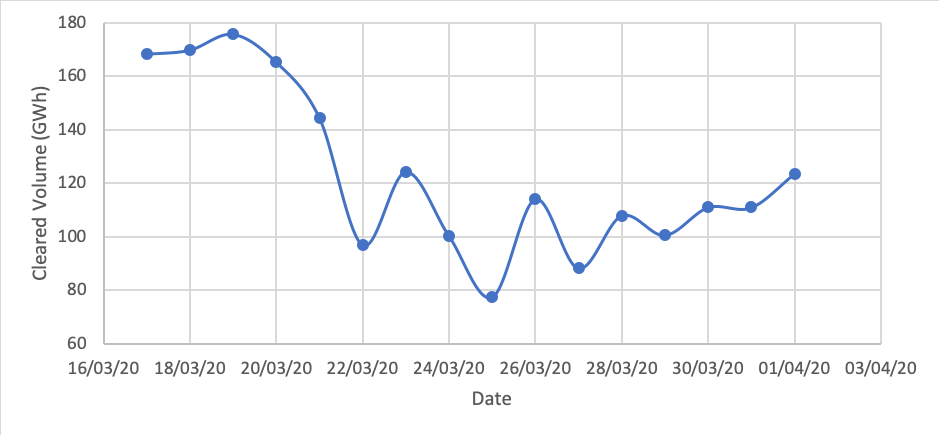

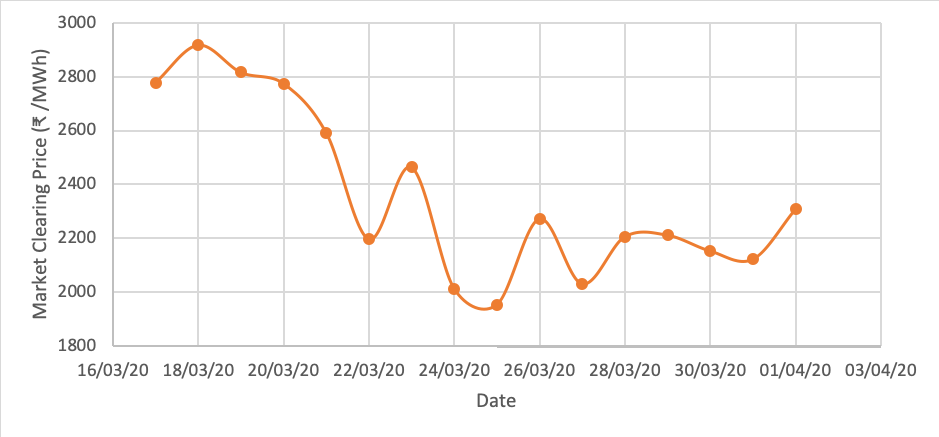

Another impact of the COVID-19 pandemic on the power markets is in terms of the market dynamic. It can be observed that there is a dip in the clearing volume and the market-clearing price, which coincides with the gradually increasing shutdown measures taken by the government as a response to COVID-19 (See Figure 2). Thus, the reduction in demand due to the lockdown is reflected in the volumes traded on the electricity market and the clearing price.

Another point of reference is the price and clearing volume in 2019. On March 22nd, 2020, the day of voluntary lockdown, the clearing volume was 97.05 GWh, and the clearing price was 2195.48 ₹ /MWh. In comparison, on the same day in 2019, the clearing volume was 107.98 GWh, and the clearing price was 2816.18 ₹ /MWh. From the start of the lockdown, on March 25nd to April 1st 2020, the average clearing volume was 104.27 GWh compared to 130.24 GWh in 2019 during the same period. Similarly, the average market clearing price was 2155.93 ₹ /MWh in 2020 as compared to 3371.025 ₹ /MWh in 2019 for the same period.

Figure 3: Cleared Volume (above) and Market Clearing price (below) for IEX between March 17th – April 1st, 2020.

Future Steps

Currently, we are at an early stage of discussion on the impacts of COVID-19 on the Indian power system. This article takes steps in identifying and documenting the early impacts that are evident for the grids as well as the markets. As more data becomes available, a quantitative analysis needs to be done to understand the severity of the issues identified. Furthermore, more discussion needs to take place on: firstly, mitigation of any long term risk to the Indian power sector and secondly on making Indian power sector better prepared for such crisis in the future.

[1] There are two power exchanges operational in India: 1) Indian Energy Exchange (IEX) and 3) Power Exchange India Limited (PXIL)

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights