First edition of the REMIT training: more is yet to come

This is the second installment of the Topic of the Month on REMIT

The idea behind the REMIT Training

On November 28th and 29th, 2023, the first edition of the two-day residential training course on the EU Regulation on Wholesale Energy Market Integrity and Transparency (REMIT) and its implementation, co-organised by the European Union Agency for the Cooperation of Energy Regulators (ACER) and the FSR, took place in Bruges. With this course, ACER and the FSR intended to fill a gap in training on REMIT, combining the theory related to the main concepts of the Regulation (e.g., market manipulation, insider trading) with the challenges of the practical implementation of the related prohibitions and obligations (e.g., prohibition of market manipulation and insider trading, registration and reporting obligations).

The unique value of the course was the combination of the experience in executive education of the FSR, the hands-on practice provided by instructors from ACER and the testimonials from professionals from financial conduct authorities (Consob and BaFin), energy exchanges (NordPool) and financial markets (Nasdaq). Moreover, the course could not have been more timely considering the revision of REMIT, proposed by the European Commission in March 2023, reaching its final stages in the legislative process.

This is not the first time the FSR engages in research and training activities related to REMIT: in the framework of the Evolution of electricity markets course, the legal week also covers REMIT topics and a REMIT Cover the basics article with a short podcast was published on the FSR website in December 2022.

Goals and target audience

As already indicated, the objective of the course was to illustrate how the prohibitions and obligations introduced by REMIT are applied in practice and how market participants and other relevant stakeholders might comply with them. In order to do this, attention was paid to the logic of the Regulation and its interaction with similar provisions in the financial services sector (MAR and MIFID). The definitions of market abuse, in the forms of market manipulation, attempted market manipulation and insider trading and the related obligations and prohibitions (e.g., the obligation to disclose inside information) were examined in detail. Finally, the multi-layered monitoring and enforcement system involving National Regulatory Authorities (NRAs), and the ACER was described in all its complexity.

The course was designed to be of interest for professionals involved in energy markets or in the regulation of the energy sector, including officials in government agencies and regulatory bodies, staff of energy companies dealing with regulatory matters and market surveillance officers, but also academic researchers.

The actual participants matched the target audience: the course was attended by 46 participants from 14 different countries, mostly from the private sector, but with a significant component of staff of regulatory agencies. Half of them had more than five years of work experience in the energy sector, the other half was divided between junior and mid-level professionals. Therefore, instructors were able to use the expertise of the more senior participants to add elements of complexity and of practice to foster the discussion. Furthermore, when considering the background, the course attracted participants with a comprehensive range of expertise: most of them had a legal background, but there were also several economists and engineers.

The several dimensions of the course

The training benefitted from a wide variety of instructors, coming from different entities and companies dealing with the implementation of REMIT. Therefore, various points of view of the topic were provided, including a legal perspective (e.g. on the differences between REMIT and competition law concepts and the case law on market manipulation of the European Courts) and the perspective of the financial market surveillance authorities (lessons on insider trading from the financial markets, the experience of the Italian and German financial conduct authorities).

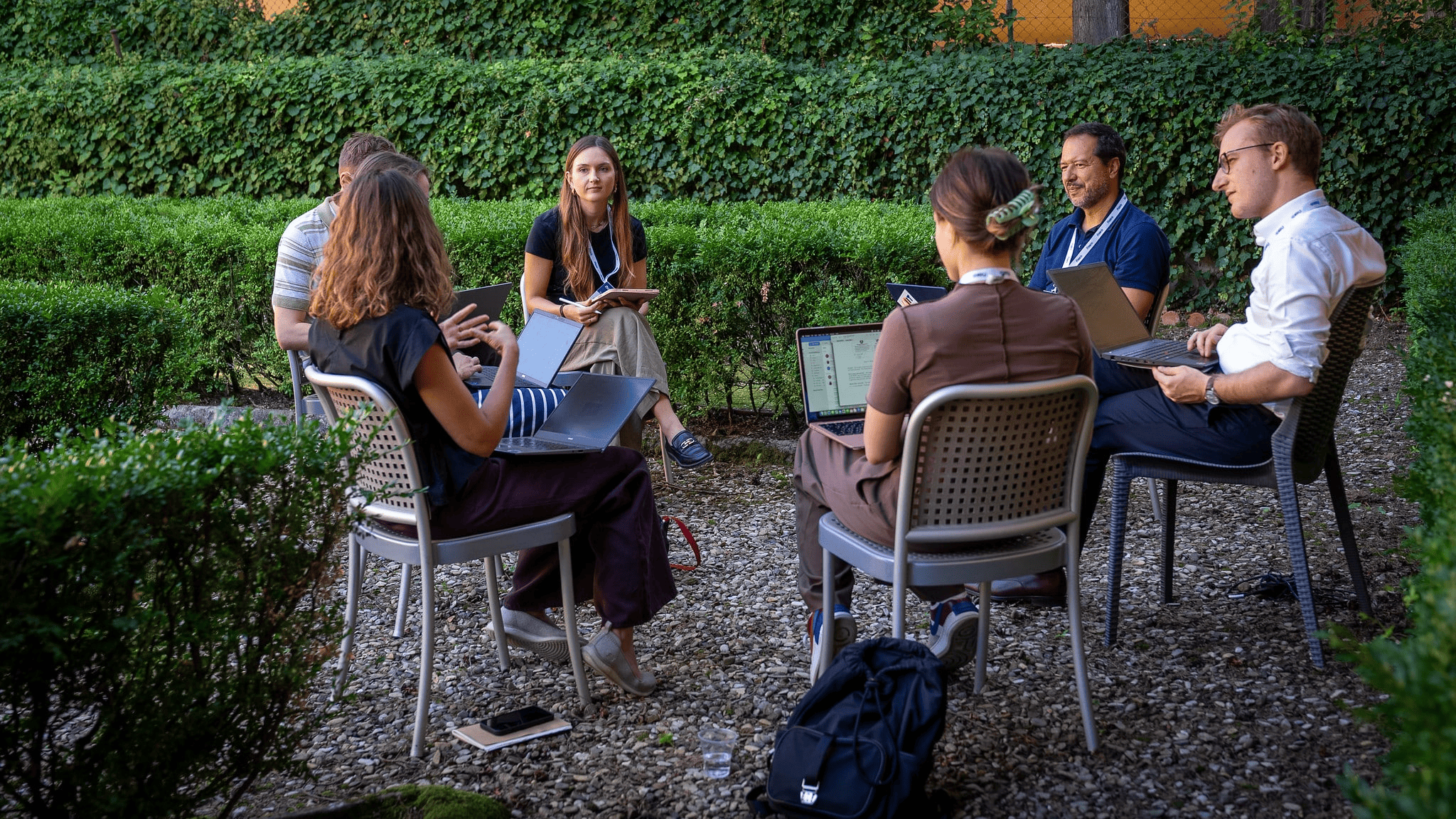

During the two days in Bruges, participants were able to listen to instructors, answer quizzes and use the dedicated Q&A sessions to obtain further clarifications. To ensure a level playing field, some reading material was provided in advance: both basic materials to allow the more junior participant to prepare for the course and digging-deeper readings for those who wanted to know more.

From theory to practice: the role of the case studies

The course included two case studies, one on the perspective of organised marketplaces, the other on market manipulation.

Furthermore, a mock market abuse case was proposed: participants were guided through a group work with a final discussion of the practical case they had to stage. They were divided into several teams and received evidence of a potential REMIT breach; they then identified the next steps in terms of additional information to look into or collect and, at the end, each group formed and presented its assessment. This exercise was particularly important to let participants use, in a practical example, all the information provided during the course.

What’s yet to come: the second edition of the course and REMIT II

Given the interest received by the course, a second edition is foreseen in the second half of 2024. Due to the limited capacity of the venue where the first edition of the course was held, not all applicants could be admitted. Those who were not admitted will be given priority access to the second edition.

This second edition will also cover the revision of REMIT recently agreed by the co-legislators and soon to enter into force.

The changes introduced by the revision of REMIT will also be the focus of a webinar offered to the participants in the first edition of the course.

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights