EU electromobility at crossroads: What does it mean for the electricity system?

This is the fourth and final installment of the Topic of the Month "Electrification of final uses: updates from the FSR"

Electrification is advancing across Europe’s economy, with electric vehicles (EVs) as one of the main technologies at the forefront of this transition. As EV adoption grows, their integration into the electricity system offers a unique opportunity to support grid flexibility and accelerate decarbonization. Indeed, recent EU legislation has started to create a clearer framework for enabling EVs not only to manage their charging smartly but also to discharge electricity back to the grid, thereby contributing to a reduction of both system costs and emissions. However, recent developments in the automotive sector, including a slowdown in electrification efforts by car manufacturers, could place this emerging trajectory at risk of misalignment.

Against this evolving context, we outline two potential scenarios to assess how future policy choices could influence the role of electromobility in the power system and highlight the actions most critical to realising its full value.

An EU framework for a smart EV integration

The revised Renewable Energy Directive (RED III)—formally Directive (EU) 2023/2413—explicitly recognises EVs as decentralised energy assets, establishing a foundational regulatory framework to promote their integration into energy systems[1]. This regulatory acknowledgement builds upon several years of foundational work from more than 1,000 academic papers that introduced and built on the Vehicle‑to‑Grid (V2G) concept. V2G envisages EVs as bi‑directional power assets capable of intelligently charging during periods of excess renewable generation and discharging during peak demand, thereby mitigating fossil-fuel-based electricity production, alleviating grid congestion, and balancing electricity systems.

In practice, five key conditions must be met for V2G to operate at scale: (1) both the EV and the charging infrastructure must be bi-directional and compatible; (2) the EV must support remote control of its charging and discharging processes; (3) a coordinator or aggregator must group hundreds or thousands of EVs to participate meaningfully in electricity markets, which typically require tens or hundreds of megawatts of capacity; (4) regulatory frameworks and network codes must enable EVs to interconnect with the grid and access energy and balancing markets; and (5) any V2G operation must safeguard the primary mobility needs of EV owners and minimize battery degradation.

These conditions imply that if EU policies seek EVs integration to reduce the burden of net-zero grid investments, policymakers must build on EVs’ private investments and face the challenge of EVs having many potential alternative uses depending on where they are connected and who is managing them (Thompson and Perez, 2020). A clear perspective would help to shape the future on a cooperative ground.

Although meeting the technical and regulatory conditions required to make a conventional EV and its charging system V2G-ready costs only about one-tenth (Kempton and Tomic, 2005) as much as installing a dedicated battery energy storage system (BESS)—its closest technological counterpart—the deployment of V2G remains limited. As of 2024, Europe has installed 61.1 GWh of BESS capacity (Solar Power Europe, 2024), whereas commercial-scale V2G deployments are still largely absent. Until recently, real-world implementations have remained limited to small-scale pilot projects, often aggregating only a handful of vehicles.

However, since the publication of RED III, there has been a meaningful shift: three early-stage commercial V2G programs[2] have been launched in Europe and the United Kingdom, enabling EV owners to participate in markets for energy and grid services. Although these business model attempts are in their early stage—typically constrained to specific EV models with bidirectional capabilities and often reliant on bespoke regulatory exemptions or sandbox frameworks—they represent a critical inflection point, signalling the transition of V2G from a theoretical promise to major market experimentations.

Slower than expected

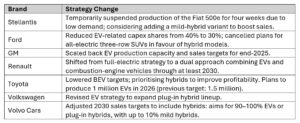

Nevertheless, two recent developments, one in the European policy landscape and one in the automotive industry, may impact the trajectory toward large-scale V2G implementation. First, the upcoming Industrial Action Plan for the European Automotive Sector (expected in 2025) proposes adjustments that would reduce the stringency of the EU’s CO₂ emission performance standards, allowing car manufacturers more flexibility to continue selling vehicles with thermal engines. Second, several automakers have scaled back their electrification commitments in response to a cooling EV market, as summarised in Table 1.

Table 1: Main car brands that have declared to scale back on their EV ambition[3]

These two developments reduce the regulatory and market pressure on car manufacturers to accelerate their fleet electrification. Nevertheless, it also creates an opportunity to reflect on the systemic requirements for V2G and address persistent barriers, particularly those that are characterised by long lead times, such as vehicle hardware capabilities and alignment with EU network codes.

Two scenarios in front of us

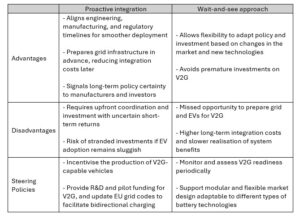

From a policy perspective, a slower pace of EV deployment can lead to two plausible pathways. The first is a proactive integration scenario, where the delay is used to get prepared: car manufacturers advance toward V2G-ready models, and regulators update grid codes to support integration. The second is a wait-and-see approach, where efforts focus on other decarbonization strategies, and V2G remains marginal until EV uptake is much higher or other solutions fall short. Table 2 summarises the advantages and disadvantages of each pathway. Policies that can steer industry evolution towards one of the two scenarios are also listed.

Table 2: Advantages, disadvantages and policy options of each scenario

The trajectory of electromobility’s contribution to the electricity system remains uncertain. While EU policy has laid essential groundwork for V2G integration, aligning industry timelines with regulatory frameworks will be key to unlocking its full potential.

The assertiveness of regulators in the choice between steering the industry towards a proactive integration or a wait-and-see path will determine whether EVs remain an underused asset from the electricity system perspective or not.

If you want to know more about how to transform electric vehicles into flexible energy assets through smart integration strategies that support Europe’s clean energy goals, you may consider our course Smart integration of EVs in Europe.

[1] Article 20a(5) of the Directive says that: “In addition to the requirements laid down in Regulation (EU) 2019/943 and Directive (EU) 2019/944, Member States shall ensure that the national regulatory framework allows small or mobile systems such as domestic batteries and electric vehicles and other small, decentralized energy sources to participate in the electricity markets, including congestion management and the provision of flexibility and balancing services, including through aggregation.”

[2] As of 2024, to our knowledge there are three notable early-stage commercial Vehicle-to-Grid (V2G) programs are underway in Europe and the UK: Mobilize V2G (Renault, France), which relies on a ‘regulatory sandbox’; Octopus Energy V2G Tariff (Octopus Energy, UK), which offers a commercial V2G tariff for UK customers with specific compatible vehicles; We Drive Solar (Netherlands), which provides shared EVs with bidirectional charging capabilities and integrates them into a local smart grid in Utrecht.

[3] Stellantis: https://www.reuters.com/business/autos-transportation/stellantis-pauses-production-electric-fiat-500-due-poor-demand-2024-09-12/

Ford: https://www.reuters.com/business/autos-transportation/carmakers-adjust-electrification-plans-ev-demand-slows-2024-09-06/

GM: https://www.reuters.com/business/autos-transportation/gm-not-reiterating-2025-1-million-ev-production-capacity-forecast-2024-07-15/

Renault: https://www.reuters.com/business/autos-transportation/renault-ceo-calls-flexibility-european-ev-transition-timeline-2024-07-22/

Toyota, Volkswagen, Volvo cars: https://www.reuters.com/business/autos-transportation/carmakers-adjust-electrification-plans-ev-demand-slows-2024-09-06/