Engaging consumers in the energy retail market

Highlights from the event: Promoting Competition in the Retail Energy Market

Despite the energy retail market having been fully open to competition, also for residential consumers, for more than fifteen years, it has proven extremely difficult to engage these energy consumers in this market.

This FSRDebate discussed the results of the retail auctions run by the Italian regulatory authority (ARERA) and assessed whether the Italian experience could serve as a reference for other countries also characterised by a low degree of energy consumers’ market engagement and what the results of the Italian auctions could suggest in terms of expected future behaviour of consumers.

Background

Concerned with the slow pace at which electricity consumers were leaving the regulated markets and opting for alternative offers available in the free market, ARERA, the Italian Regulatory Authority for Energy, Networks and Environment, organised a set of auctions through which bundles of consumers still in the regulated (‘maggior tutela’) market were allocated to competing suppliers which bid discounts with respect to the cost-reflective benchmark defined by the regulator, which they offered to apply for a period of three years.

The results of the last auctions, for residential customers, which were held at the beginning of the year imply substantial savings for consumers who are still in the regulated market, in the order of €130 per connection point per year[1].

Discussion

More specifically, based on a reasonable cost assessment, it can be estimated that the suppliers participating in the auctions will lose approx. € 100/year for each acquired customer. Overall, if all consumers that were allocated to the completing suppliers through the auctions were to remain in the new regime for the full 3-year period, total savings would be in the order of 1.8 billion compared to previous regulated tariffs.

The auctions also resulted in a somewhat less concentrated retail market, where the share of the largest supplier (ENEL) was reduced from 55% to 45%, and the total share of the largest three suppliers (Enel, Eni and Hera) was reduced from 68% to 62%.

The large savings emerging from the auctions raise interesting questions regarding the expected future behaviour of consumers as assessed by suppliers.

During the FSRDebate, the reasons behind the results of the retail auctions in Italy were discussed. It is clear that the results of the auctions signal the expectations of the suppliers to be able to extract much value from the acquired customers in the coming years.

Panellists conjectured that suppliers competing in the auctions valued the possibility of acquiring customers who are typically inactive and therefore would be difficult to attract otherwise. Once acquired, these customers could be offered options in the free market or other services by the same suppliers which are more profitable for the latter. The panellists therefore concluded that the Italian retail auctions were a success for the involved customers, but also that the regulator should keep an eye on the behaviour of suppliers which have acquired customers through the auctions to ensure that no unfair commercial practice is used to obtain higher revenues from these customers.

The Italian experience could also be of relevance for other Member States characterised by significant shares of consumers who have remained inactive despite the possibilities offered by retail market liberalisation. In fact, once some experience is gained on the behaviour of the consumers and suppliers involved in the Italian auctions is available, guidelines might be issued by the Commission on the way in which a similar approach might be used more widely.

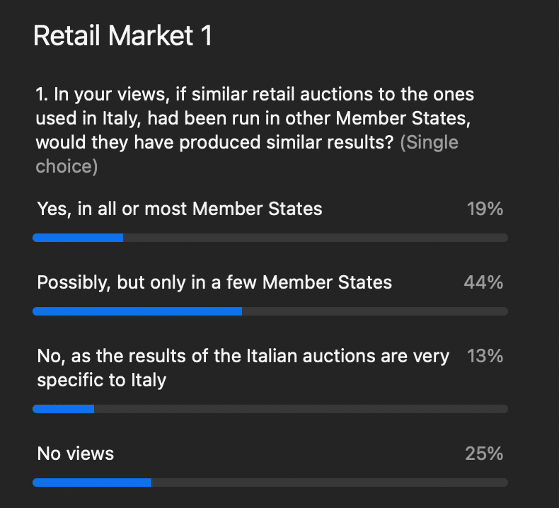

During the FSRDebate the audience was invited to participate in three polls. In the first one, the audience was asked whether, in case similar retail auctions to the ones used in Italy were run in other Member States, they would produce similar results. Almost two thirds of the respondents indicated that similar results could likely emerge in at least some Member States.

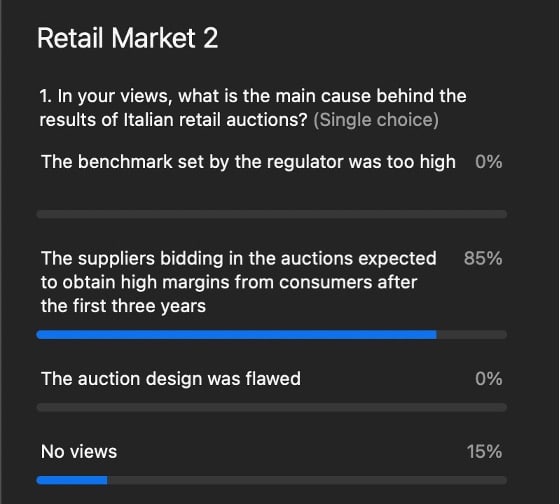

In the second poll, the audience was asked about the main cause behind the results of Italian retail auctions. A large majority of respondent felt that suppliers acquiring customer through the auctions expect to obtain high margins from consumers after the first three years. No respondent believed that the large savings resulting from the auctions were due to too high a benchmark set by the regulator or to a flawed auction design.

Finally, the third poll asked the audience about the main message emerging from the results of the Italian retail auctions. Respondents were almost equally split among three possible messages: (i) collective switching should be promoted, (ii) greater competition is needed in the retail market, and (iii) consumers should be provided with more reliable information on the available tariff plans. No respondent claimed that regulated prices should be reintroduced for household consumers.

[1] The full results are available at: https://www.acquirenteunico.it/sites/default/files/documenti/Esiti%20definitivi%20STG%20domestici.pdf.

Don’t miss any update on this topic

Sign up for free and access the latest publications and insights