A ‘no-regrets’ network for EU hydrogen?

Highlights from the event: Which hydrogen for Europe?

Despite the fact that renewable and low-carbon hydrogen represents one of the pillars of the EU decarbonisation and system integration strategies, there is still significant uncertainty regarding how the hydrogen sector will develop in the years to come and what this implies for the hydrogen transport infrastructure. In 2020 and again in 2022 the EU set goals for the production and import of renewable hydrogen. However, an agreed ‘target model’ for the nascent hydrogen sector is still to emerge. The uncertainty that this creates might impact the development of the hydrogen transport infrastructure. Reference is often made to a ‘no-regrets’ network. But what would this be?

Against this background, this FSR Debate aimed at comparing two visions - one mostly based on ‘hydrogen valleys’, similar to the current setting of the sector, and another one based on the development of an EU-wide hydrogen backbone network- and discuss how they could contribute to a ‘no-regrets’ approach to the hydrogen network and what this implies for the development of the renewable/low carbon hydrogen sector.

Setting the context: the EU Hydrogen Strategy

Renewable and low carbon hydrogen is currently considered one of the pillars for the decarbonisation of energy demand. However, in 2022, hydrogen still accounted for less than 2% of Europe’s energy consumption and was primarily used to produce chemical products; 96% of this hydrogen was produced from natural gas, resulting in significant amounts of CO2 emissions.

The 2020 EU Hydrogen Strategy[1] defined a roadmap for the development of renewable and low-carbon hydrogen. The Strategy set the priority for the EU to develop renewable hydrogen, while recognising that in the short and medium term other forms of low-carbon hydrogen are needed.

Two visions for the development of the renewable/low-carbon hydrogen market and the supporting network are possible:

- One based on hydrogen valleys, i.e. local hydrogen clusters bringing together decentralised renewable hydrogen production and local demand, therefore with hydrogen transported over short distances. This is the model currently prevailing.

- One based on a EU-wide hydrogen market, with “unhindered cross-border trade and efficient allocation of hydrogen supply among sectors”[2].

The Hydrogen Strategy seemed to favour the second vision, at least for the 2030 horizon and beyond.

In order to support this vision, a suitable infrastructure is required:

- In the REPowerEU, the Commission indicated its intention to support the development of three major hydrogen import corridors via the Mediterranean, the North Sea area and, as soon as conditions allow, from Ukraine.

- An increasing group of energy infrastructure operators, under the European Hydrogen Backbone (EHB) initiative, have been looking at and proposing how a EU-wide hydrogen network could be developed, mostly by repurposing gas infrastructure no longer used in the future. The latest (EHB) report highlights a set of 40 projects managed by the EHB’s TSO members, representing 31.500 km of hydrogen pipelines with expected commissioning prior to 2030. By 2040, the backbone network should extend to close to 40,000 km. Two thirds of this network will consist of repurposed infrastructure.

Moreover, the 6th List of Project of Common Interest in 2023 included 65 hydrogen and electrolyser projects. However, so far the hydrogen sector seems to be developing at the local level. All seven projects which were allocated support at the first auction of the European Hydrogen Bank earlier this year envisage the production of renewable hydrogen for local consumption (possibly for the production of ammonia), including in the same industrial complex[3].

The regulators are also taking a cautious approach to the hydrogen network in Europe. Both at the 38th European Gas Regulatory Forum in Madrid in April and at the 10th Energy Infrastructure Forum in Copenhagen in June different views were expressed regarding which hydrogen network will be needed and by when. It seems that the sector is looking for a ‘no-regrets’ approach to the hydrogen network, which however risks of pushing the debate into a vicious circle. What such an approach will be depends on how much and where (renewable and low-carbon) hydrogen will be produced and consumed, or imported into the EU. This partially depend on the cost of producing such hydrogen. However, until it is clear which infrastructure will be available, it is unlikely that projects beyond those with a local footprint will emerge.

During this FSR Debate, different views regarding the future of the hydrogen sector and therefore the network implications were confronted.

In the introductory part of the event, Mr Wernert, from the European Commission, outlined the progress made in implementing policies and measures to promote the development of hydrogen projects, mentioning their inclusion among the Projects of Common Interest and the first European Hydrogen Bank auctions. After the Commission, Ms Bartok, from the EU Agency for the Cooperation of Energy Regulators, highlighted two aspects related to hydrogen networks which are particularly relevant from a regulatory perspective: (i) the allocation of the network costs across time, borders and sectors; and (ii) the allocation of the risk of cost under-recovery or of stranded assets.

The panellists then presented different perspectives related to the future hydrogen network. The benefits of a EU-wide backbone network were highlighted in terms of supporting the production of hydrogen where this could be done at least costs and supporting imports. Industrial intensive energy consumers stressed the need to clarify what will be the role of hydrogen in the decarbonisation of energy demand, to provide the background for their investment decisions to decarbonise their processes. Gas infrastructure operators may play a major role in enabling the hydrogen network, as a large part of it could be developed by repurposing gas network elements.

During the FSRDebate the audience was invited to participate in four polls. In the first two polls, the audience was asked about their views on the role of renewable/low-carbon hydrogen in Europe by 2030 and 2040, respectively.

With regard to the 2030 horizon, more than 60% of the respondents believe that there will not be sufficient volumes of renewable/low-carbon hydrogen even significantly to substitute the fossil-based hydrogen currently used as a feedstock. However, almost 20% of the respondents showed a more positive view regarding the increase in renewable/low-carbon hydrogen production, expecting it also to have started to replace other fossil-based fuels as energy carriers in hard-to-abate sectors.

.

.

With regard to the 2040 horizon, almost 60% of the respondents think that, by then, hydrogen will have substituted other fossil-based energy carriers in ‘hard-to-abate’ sectors and processes, but most of these will have been already electrified, while almost 30% of the respondents believe that It will play a major role in substituting substantial volumes of other fossil-based energy carriers in ‘hard-to-abate’ sectors and processes.

The third poll asked participants about their view regarding imports of hydrogen, either as such or in the form of hydrogen-based energy carriers (such as ammonia) by 2035. In this case, more than 60% of the respondents indicated that they think that imports of hydrogen, as such or as hydrogen-based energy carriers (such as ammonia), will play a significant role by 2035, while a third of the respondents think that Imports of renewable hydrogen will still only play a marginal role ten years from now.

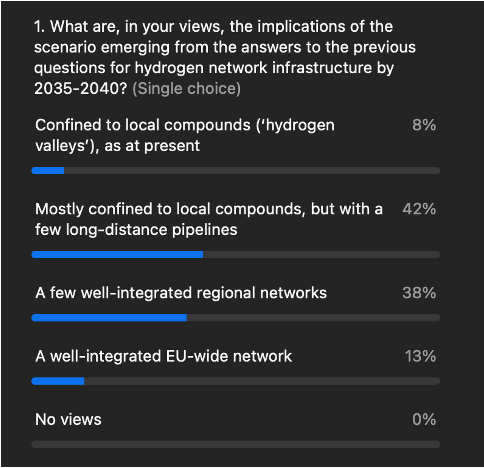

In the final poll the audience was asked about the implications of the scenario emerging from the answers to the previous questions for hydrogen network infrastructure by 2035-2040. More than 40% of the respondents believe that such a network will be confined to local compounds but with a few long-distance pipelines, while a slightly lower share of respondents think that there will be a few well-integrated regional networks. Only 13% of the respondent believe that a EU-wide well integrated hydrogen network will emerge by the end of the next decade.

[1] Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions, A hydrogen strategy for a climate-neutral Europe, Brussels, 8.7.2020, COM(2020) 301 final.

[2] Hydrogen Strategy, page 7.

[3] The only project with envisages the transport of hydrogen beyond the local area is the Renato P2X’s 480MW Catalina project in Spain, planning to connect the electrolyser plant to a green ammonia conversion facility through a dedicated 221km hydrogen pipeline.

Cover the basics: Hydrogen in the Energy Transition

In this article, we answer some frequently asked questions about hydrogen and we explore how it contributes to the energy transition. Read