FSR Topic of the Month:

Raising public awareness and trust in electricity transmission infrastructure development

Written by Pradyumna Bhagwat

Quantifying the impact of stakeholder engagement

Despite the abundance of qualitative evidence of TSOs undertaking diverse public engagement initiatives, there is little quantitative assessment of the impact of these activities on the project developers’ business.

An econometric analysis would aid both TSOs and NRAs in dealing with economic incentives to raise public awareness and trust. Such an analysis would give greater confidence to regulators for incentivising such activities as they would now have a better understanding of the costs and benefits of various stakeholder engagement activities.

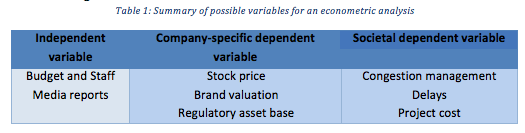

However, any robust econometric analysis requires the identification of the relevant independent and dependent variables. Table 1 summarises some possible variables. In the next section, we discuss these variables further. Indeed, it should be noted that such an evaluation would also entail monitoring of relevant data and use of the highest methodological standards.

1. Independent variables

The following two possible independent variables to be used as inputs for an econometric analysis are discussed.

- Staff and Budget

A firm requires expending of resources to conduct any activity. The resources may be a combination of person-hours that employees dedicate towards the task and the monetary cost incurred over and above the employee costs. The same holds true for stakeholder engagement. This variable can be measured in a disaggregated manner by logging the number of manhours that employees spent on specific stakeholder engagement activities and monetary overheads from such beyond the employee time or in an aggregated way as the total cost to the company of an activity ex-post. In case the company has set a budget ex-ante, this budget too can be considered as the value of the variable

- Media reports

The impact of favourable and adverse media reports on the dependent variables used for the analysis has been applied by Henisz et al. (2014)[1] in the context of the gold mining industry. According to the authors, the opinions and actions reported by media may give a better representation of the relationship between the stakeholders and the company compared to a third-party evaluation. Furthermore, media reports would also provide a clear view of how the stakeholders perceive the company.

2. Dependent variables

In this section, six possible dependent variables are discussed. The dependent variables are further classified based on their relevance to a company or societal benefit.

- Company-specific dependent variables

An econometric analysis that is conducted from a firm’s perspective requires dependent variables that measure the impact on the firm’s performance. Such quantification would help the investors and the management while deciding on the allocation of resources for stakeholder engagement activities.

- Company stock prices

External investors use several criteria including the stock market value of the company under consideration while making their investment decisions. Thus, an inter-relationship between stakeholder engagement and company stock prices could prove to be an important indicator for project developers. However, this variable would be applicable only to TSOs listed on the stock market. For companies listed on a sustainability index[2], the company’s sustainability index ranking as the proxy for gauging the impact of stakeholder engagement. This variation is applicable for stock-market listed as well as unlisted companies

- Brand valuation

A positive impact on brand valuation[3] would be indicative of a positive company perception by the public and vice versa for adverse effects on brand valuation. Brand valuation too can impact the access to finance from external investors as this may form part of the investors’ assessment criteria.

- Regulatory asset base

The regulated asset base is a key determining factor for a TSO’s annual revenue and consequently the performance of the firm. An essential element in calculating the value of RAB is the investment in new projects that are to be included. Therefore, RAB can be considered as a dependent variable to assess the impact of stakeholder engagement on the company’s performance.

- Societal benefit

An econometric analysis can also be conducted from a regulator’s perspective to evaluate the need for and the level of incentive required to enable stakeholder engagement activities. In such a case, the assessment requires dependent variables that provide insight into societal benefit.

- Congestion management costs

A key dependent variable from the societal benefit perspective for assessing the impact of stakeholder engagement is the congestion management cost. When the capacity of the grid to carry electricity is constrained, the TSO is required to carry out congestion management by taking steps such as re-dispatching. The avoided costs of re-dispatching may be a benefit of timely implementation of infrastructure projects.

- Project delays

Suboptimal stakeholder engagement by project developers may be a cause for delays in project implementation[4]. Although there is no (publicly available) quantitative data on the matter, it may be cautiously presumed that there are financial and societal costs attached to these delays. Thus, evaluating the impact of stakeholder engagement activities on the timelines for completion of the project is relevant.

- Project costs

Any savings that may occur due to a reduction in the project costs is a societal benefit and vice versa. Therefore, the use of project costs as an output for an econometric analysis can provide useful insights about the societal impact of stakeholder engagement activities.

3. Limitations of the quantification approach

The first limitation is that a statistical correlation is not necessarily indicative of causality. This is due to the presence of what literature refers to as disturbance variables that may not be accounted for in the analysis but have a strong effect on the dependent variable. Secondly, even if the same methodology is applied for conducting the econometric analysis for all TSOs, the results may not be easily comparable. This is because most TSOs operate in different institutional settings. This would reflect several aspects of project development such as project delays and project cost. The third limitation is the difficulty in the monitoring of the data.

4. Hypothetical example for understanding the utility of quantification

To better understand the utility of this quantification, consider the hypothetical example of a project developer building a transmission line with an estimated cost of € 100 million to alleviate congestion. The project is expected to be commissioned in ‘n’ months

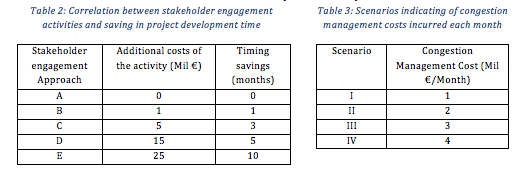

An econometric analysis provides a correlation between stakeholder engagement activities and saving in project development time (see Table 2). It can be assumed that cost of the activities increases depending upon the required resources, skills as well as the comprehensiveness of the activity and innovation. Note that any additional stakeholder engagement activity would impact the project cost. The other dependent variables used is congestion management cost. The analysis considers four different scenarios of congestion management costs that are incurred in the absence of the line (see Table 3).

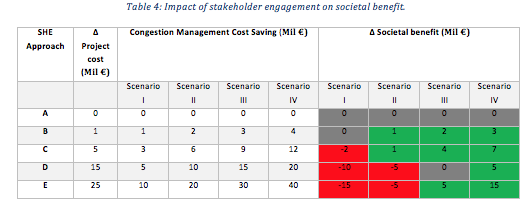

Table 4 provides insight into the change in societal benefit in the four congestion management cost scenarios for the five approaches to stakeholder engagement. Such quantification would give the NRA greater insight while deliberating the trade-off between higher project costs due to stakeholder engagement vis-à-vis improvement in societal benefit.

With this article, we come to the end of this topic of the month. For a deeper insight into our research on “Enlarging incentive regulation to improve public awareness and trust in electricity transmission infrastructure development”, please read the latest

FSR Research Report

[1]For more details see: Henisz, W.J., Dorobantu, S., Nartey, L.J., 2014. Spinning gold: The financial returns to stakeholder engagement. Strateg. Manag. J. 35, 1727–1748. doi:10.1002/smj.2180

[2] For more details see: RobecoSAM, 2016. CSA Guide – RobecoSAM’s Corporate Sustainability Assessment Methodology.

[3] For more detail see: Jones, R., 2005. Finding sources of brand value: Developing a stakeholder model of brand equity. J. Brand Manag. 13, 10–32. doi:http://dx.doi.org/10.1057/palgrave.bm.2540243

[4] Note that the causes for delays go beyond stakeholder engagement.