Last week, I discussed how the advent of the “prosumer” is challenging the status quo in distribution tariff design. The main conclusion was that the use of volumetric network charges with net-metering becomes problematic both from an efficiency and equity perspective when consumers start installing PV panels on their rooftops. As an alternative, net-metering could be suspended, or capacity-based charges could be introduced. But how future-proof would such a move be if batteries become affordable for households? In other words:

How should distribution network charges be redesigned in a world where residential PV and batteries are cheap?

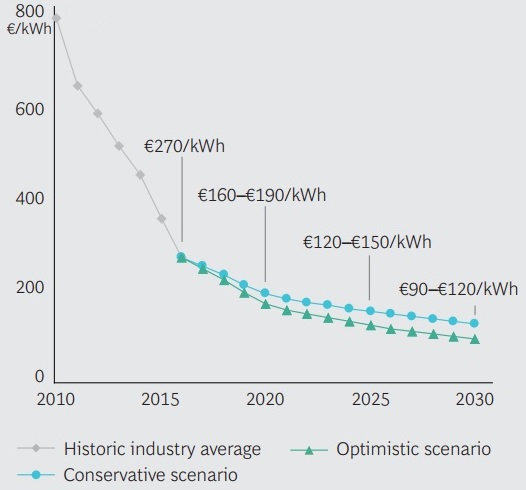

PV enables consumers to lower their total electricity supplied from the grid (in kWh), but it does not allow consumers to control when they exactly need the grid to provide them with electricity. The adoption of decentralised electricity storage, in the form of battery packs, can bring change to this and gives consumers more means to react to the way the network tariff is designed. The investment cost of batteries continues to decline rapidly as can be seen figure 1.[1]

Figure 1: Residential battery pack costs: realised and forecasted (BCG, 2017)[2]

I again assess the performance of four tariff designs described in my earlier article, namely:

- Volumetric network charges with net-metering (€/kWh);

- Volumetric network charges without net-metering, based on electricity withdrawn (€/kWh);

- Volumetric network charges without net-metering, bi-directional (€/kWh);

- Capacity based charges (€/kW), based on the observed peak demand of a consumer.

I split the analysis up into two extreme cases:

- Case ‘’sunk network costs’’: a network that is over-dimensioned combined with low expected demand growth in the short/medium term. In this case, the network costs are characterised by high sunk costs, i.e. costs made in the past which are not affected by how much the network is utilised;

- Case ‘’high prospective network costs’’: a network that has a high level of utilisation combined with demand growth in the short/medium term. In this case, future network investments can be avoided or deferred by intelligently steering the behaviour of consumers.

As in the previous article, a game-theoretical model is applied to quantify the impact of a tariff design on an efficiency and equity metric.[3],[4] For the efficiency metric, the results for the four different tariff designs are compared to the theoretical optimal tariff. In the case where all network costs are sunk, network charges have a pure allocative function. The optimal network tariff design from an efficiency point of view will be fixed network charges as fixed charges do not distort the consumer decisions.

If the objective of the network tariff is also to avoid or defer future network investment cost, network charges will not only have an allocative function but should also steer consumer behaviour to an overall efficient outcome. As described in the MIT Utility of the Future Report, from a theoretical perspective, the ideal network tariff will be capacity-based charge combined with a fixed charge.[5] However, the capacity-based charge should not be based on the observed maximum capacity utilisation of an individual consumer, but on the contribution of the consumer to the coincident peak capacity observed for a network. The magnitude of the ‘’forward-looking-peak-coincident’’ capacity charge (in €/kW) should be set equal to the cost of incremental network investment divided by the expected load growth, to steer consumer behaviour in a way which is most optimal from a social welfare point of view.[6] Typically, not all network costs can be recovered by such capacity-based charge; therefore, the remaining residual costs are recovered with non-distortive fixed network charges. To apply such an advanced tariff, not only smart meters at residential level are needed, but also a smart grid needs to be in place to be able to provide information on the real-time status of the network. Additionally, good knowledge of the cost of incremental network investment and expected load growth is a prerequisite, which is not so evident in practice.

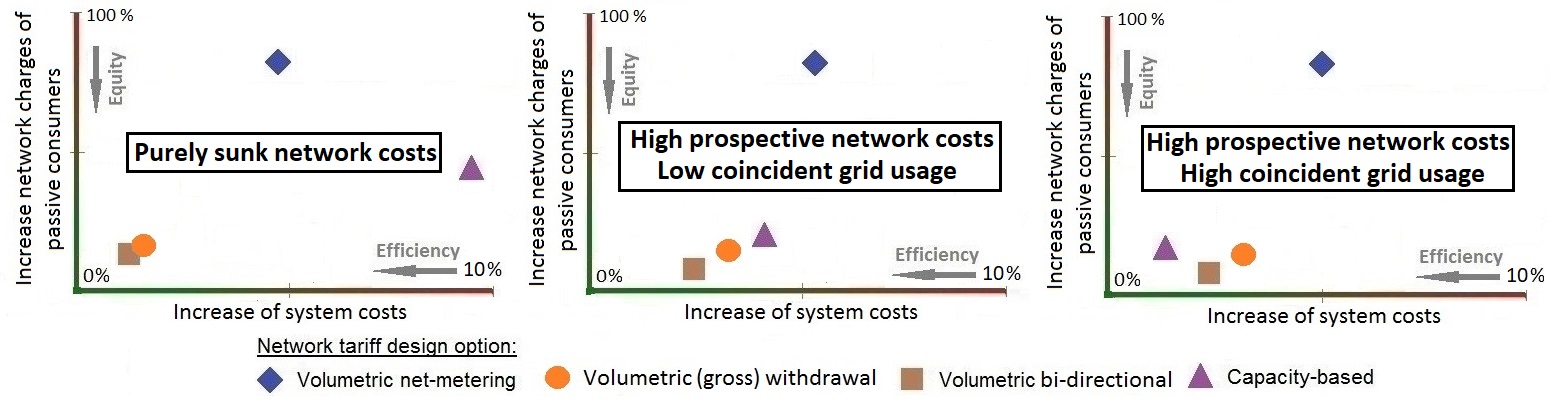

Again, in the mathematical modelling, I assume for simplicity that 50% of the consumers are active. Being active implies that these (rational) consumers install PV and/or batteries if by doing so they minimise their total electricity supply costs. The other 50% of consumers remain passive. The results for the four tariff designs in terms of the efficiency and equity metric for the two different cases are shown in Figure 2. In the case of high prospective costs, it is assumed that the network cost is driven by the coincident peak withdrawal or injection from the network. The ‘’prospective costs’’ case is split up into two scenarios, one with low coincident grid usage by consumers and another one with high coincident grid usage connected to the network. A situation of low coincident grid usage can be thought of as a scenario with high heterogeneity among consumers (e.g. shops, students, retirement home, families, …) all connected to one (local) network.

Figure 2: Results for different network tariff design options in a world with cheap PV and batteries. The increase of system costs is shown relative to the ideal tariff design under these assumptions.

Three key results emerge from our modelling analysis. Firstly, volumetric network charges with net-metering create severe equity issues and inefficiencies in all cases. Active consumers are overly incentivised to install PV as by doing so they can not only avoid paying electricity commodity costs but also network charges. The network charges paid by the passive consumers, who do not have the option to install PV, increase significantly to allow the DSO to recover all its costs. With volumetric charges with net-metering in place, consumers have no incentive to invest in batteries.[7] Additionally, high penetration of PV connected to the distribution network could in some cases lead to an increase in network costs due to costs for replacing electronics/protection to cope with reverse flows, voltage issues etc. [8] This cost is not reflected in this tariff design. If there are sustainability goals, e.g. a certain capacity of decentralized PV to be installed, explicit subsidies should be favoured.

Secondly, in the case of volumetric network charges without net-metering, the inefficiencies and equity concerns are limited. Active consumers install PV when it is inexpensive because they can avoid paying network charges for withdrawing electricity from the grid. However, electricity demand does not always coincide with PV production and vice-versa. Hence, volumetric network charges without net-metering incentivise to invest in batteries to increase self-consumption of PV production. The incentive with bi-directional charges is slightly stronger than charges solely based on gross consumption. In the case of high prospective grid costs, this tariff design is not the most efficient; however, inefficiencies are limited as increased self-consumption can indirectly have a positive impact on network costs.

Thirdly, depending on whether we are in a ‘’sunk network costs’’ or ‘’high prospective network costs’’ scenario, severe inefficiencies and equity issues may arise under capacity-based charges. Active consumers will invest strongly in synergetic cheap PV and cheap batteries to lower their individual peak demand from the network and thus their network charges. In the case where all network costs are sunk, a lower individual peak demand does not result in lower total network costs to be recovered by the DSO. Consumers invest in an uncoordinated manner in batteries and PV and can end up strongly competing against each other to allocate sunk grid costs, while this does not result in any system benefit. An increase in total system costs and consequent equity issues occur.

In the case where network costs can be avoided or deferred by steering consumer behaviour, a lower individual peak demand can result in lower total network costs to be recovered by the DSO. However, this will only be the case when the grid use by consumers is sufficiently coincidental or homogenous.[9] Conversely, consumers will overly try to lower their peak consumption with little system benefit, i.e. the decrease in the individual electricity bill active consumers can obtain by lowering their peak demand is higher than the cost for them to do so (e.g. by installing a large battery pack) but in its turn, this incurred cost is higher than the total network costs that can be avoided by this action. Overall, the total system cost increases. Further, the results show that if grid use is highly coincident, capacity charges based on the individually observed peak can be of good use. Limited equity issues arise, i.e. passive consumers see their grid cost only slightly increase because of the actions of active consumers.

To summarize, in this topic of the month I argue that robust distribution network tariff design is a function its context, i.e. technology costs and the state of the network. I applied a game-theoretical model to test the implication of four tariff structures for efficiency and equity. It was shown that the relative performance of different implementations changes with the context. In general, the more consumers have options to play with their electricity volume and capacity needed from the network and the more our society gets electrified (e.g. electrical vehicles and heat pumps), the more critical it will become to let distribution tariff converge to the ‘’theoretical ideal tariff’’. If a suboptimal grid tariff is in place, active consumers will also react to the network tariff but not in ways that would benefit us all.

Extra: Adding EV and heat pumps to the equation

I focussed on PV and batteries. In the case electrical vehicles (EVs) and heat pumps would be added to the game, results could be affected. Applying a volumetric charge (with or without net-metering) for the use of the network, while the network costs are not driven by the total volume withdrawn, would make EVs unnecessarily less competitive when compared to cars fuelled by gasoline or diesel. This reasoning also holds for heat pumps versus traditional domestic heating by e.g. burning gas. In case capacity charges based on individual peak usage are applied, (domestic) charging at times when this does not inflict any cost on the network (e.g. during the night) of an EV or heat pump would be discouraged without any economic rationale. Again, making these novel technologies unnecessary less competitive when compared with more traditional alternatives.

[1] On the increase of sales of residential batteries.

[2] Source: Boston Consulting Group, 2017. How batteries and solar power are disrupting electricity markets.

[3] For more information about the assessment criteria for distribution network tariff design, please take a look at my previous article.

[4] The model and parameter settings, in case network costs are sunk, are described in detail in: Schittekatte, T. et al. (2017). Future-proof tariff design: recovering sunk grid costs in a world where consumers are pushing back. RSCAS Working paper 2017/22. Academic work using a similar model for which the network costs are not assumed sunk but are (partly) a function of grid usage has not been formally published yet, but is expected in the beginning of 2018.

[5] See e.g. box 4.6. on p. 115-116 of the MIT Utility of the Future Report

[6] By applying such tariff, a consumer will be incentivised to change its consumption at times the network is stressed and, the consumer will do so at those times if he can change his consumption in a way that is cheaper than the cost of reinforcing the network (e.g. by installing a battery or curtailing PV).

[7] Consumers can have several complementary reasons why to install a battery pack at home next to network tariff design which are not discussed here. An important reason could be to be protected against supply disruptions due to extreme weather conditions. Also, if a consumer would be enabled to see time-varying electricity commodity prices, he could use the battery to arbitrage, i.e. withdraw electricity from the grid when it is cheap and inject it when it is expensive.

[8] For more information please take a look at Chapter 7 of the MIT Utility of Solar Energy Report (2015). Especially Figure 7.5 on page 162 is very insightful.

[9] On the relationship between individual peak demand and coincident peak demand of low voltage consumers see e.g. Passey, R., et al. 2017. Designing more cost reflective electricity network tariffs with demand charges Energy Policy 109: 642-649.